GBP/USD targets with persistent downtrend

Market overview

On Thursday, US Treasury yields advanced, reflecting a resurgence in global demand for bonds following a recent decline driven by concerns over elevated inflation and mounting government debt. Concurrently, the sell-off in UK assets persisted, as investors grappled with a precarious mix of entrenched inflation and weak economic growth. These factors continue to weigh heavily on the British pound, exacerbating its decline against the US dollar.

Technical analysis

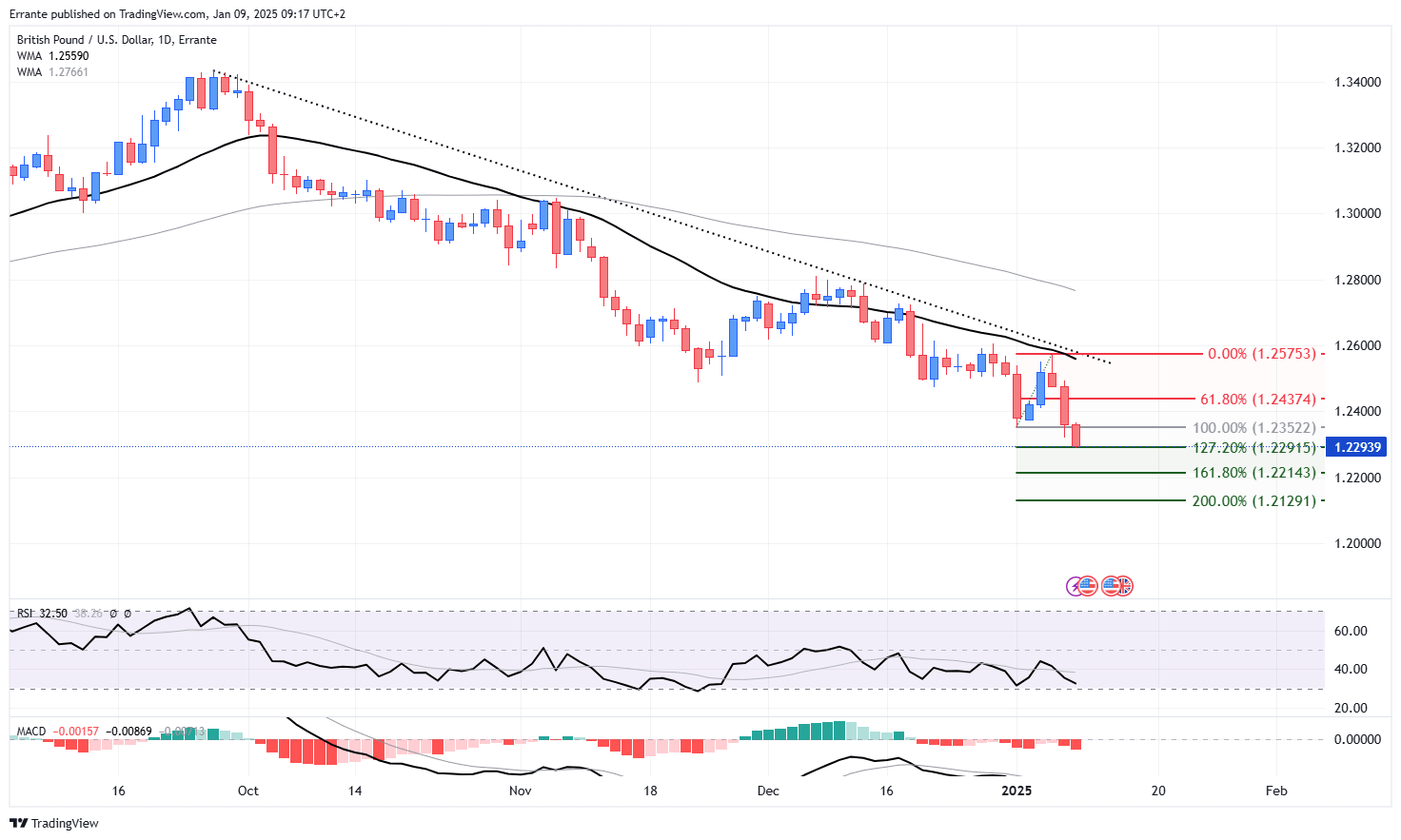

The GBP/USD pair remains firmly entrenched in a four-month downtrend, having broken below the key support level at 1.23522 on the daily chart. Sellers are currently testing the immediate support at 1.22915, and a sustained breach of this level could extend the decline toward subsequent targets at 1.22143 and 1.21291.

Momentum indicators further validate the bearish sentiment. The 34-period and 100-period moving averages display a pronounced bearish divergence, underscoring the strengthening downtrend. Simultaneously, the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) oscillators remain entrenched in bearish territory, reinforcing the likelihood of continued selling pressure.

Conversely, for a meaningful reversal, buyers must reclaim the upper resistance at 1.25753. Such a breakout would signal a shift in momentum and invalidate the prevailing bearish outlook.

Key levels to watch

-

Resistance levels: 1.23522, 1.24374, 1.25753.

-

Support levels: 1.22915, 1.22143, 1.21291.

Fundamental drivers

Investor sentiment toward the British pound remains fragile, with concerns over the UK's economic resilience compounding its challenges. Persistent inflationary pressures and a slowing economy have led to heightened apprehension about the Bank of England’s ability to manage policy effectively.

Meanwhile, in the US, attention is centered on upcoming speeches from Federal Reserve officials and the release of the central bank's balance sheet data. These events may offer further insight into the Fed's monetary policy trajectory. Looking ahead, Friday’s non-farm payrolls report is expected to be a pivotal event, potentially triggering significant volatility across currency markets.

Conclusion

GBP/USD continues to face bearish pressure, with the pair eyeing support levels at 1.22143 and 1.21291. A break above 1.25753 would be required to alter the bearish trajectory.

Author

Ali Mortazavi

Errante

BEc, CMSA, Member of IFTA - International Federation of Technical Analysis, Associate Member of STA - Society of Technical Analysis (UK).