GBP/USD Price Forecast 2023: Pound Sterling set to struggle amid Fed-BoE contrast, economic woes

- GBP/USD staged a late comeback in 2022 after plunging to a 37-year low at 1.0339.

- The US Dollar could regain the upper hand amid the Fed-BoE policy divergence.

- Economic challenges in the UK to keep downside risks intact for Pound Sterling.

- The monthly chart indicates a rocky road ahead for GBP/USD in 2023.

Will the recovery in the GBP/USD pair extend into 2023? Will the US Dollar re-accumulate safe-haven demand? Where is the Cable price headed next year? These questions are flooding my mind as I set out to analyze the GBP/USD price forecast for 2023. In order to understand how 2023 would shape up for the GBP/USD pair, it’s necessary to have a clear picture of how the currency pair fared in the past year.

Not something to boast about but the Pound Sterling managed to pull off an impressive 11% recovery against the US Dollar in the final quarter of 2022, having lost 25% of its value in the first nine months of the year. The Cable lost 15% alone in the month of September, in what turned out to be the worst nightmare for GBP markets in almost four decades.

What caused the GBP/USD downfall in 2022?

It was another down year for the GBP/USD pair but the severity of the decline was intense mainly due to the monetary policy divergence between the US Federal Reserve (Fed) and Bank of England (BoE) in the first half of 2022. Meanwhile, the failure of the United Kingdom (UK) political system collaborated with the collapse of the Pound Sterling against the United States Dollar (USD) in the second half of the year.

1. Russia-Ukraine war-led raging inflation

The British economy was badly hit by Russia’s invasion of Ukraine that took place in February last year. The West responded with harsh sanctions on Russia, as Moscow refused to stay quiet and cut the gas supplies to Europe and the United Kingdom among other restrictive measures. Surging energy prices spiraled into multi-decade-high inflation rates worldwide. With the United States having relatively less economic and trade exposure to Russia, the supply shock due to the protracted Russia-Ukraine war was unlikely to be big enough to derail the American economy when compared to that of the UK. In the third quarter, Britain’s energy regulator, Ofgem, warned that household energy bills could rise by 80% and, therefore, announced a raise in its main cap on consumer energy bills to an average of £3,549 ($4,197) from £1,971 a year.

According to the Office for National Statistics (ONS), the United Kingdom’s annual rate of inflation surged to a 41-year high of 11.1% in October when compared to 10.1% recorded in September. Meanwhile, the US Consumer Price Index (CPI) rose 7.7% YoY in October, a slower pace of increase than the 8.0% expected and the lowest annual inflation reading since January.

UK Oct CPI chart

Source: FXStreet.com

2. The UK political and market turmoil

Britain’s deepening cost-of-living crisis pressurized the ruling Conservatives Party to appoint a new leader, Liz Truss, replacing the controversial Prime Minister Boris Johnson. The new prime minister’s main agenda was to curb the running household energy bills in the UK and rework a sustainable fiscal framework. Just six weeks into the job, British PM Liz Truss resigned, as the ‘mini-budget’ unveiled by her Finance Minister Kwasi Kwarteng roiled financial markets. The new government had announced a swathe of tax cuts, taking the top rate of tax paid on incomes over £150,000 ($166,770) from 45% to 40%.

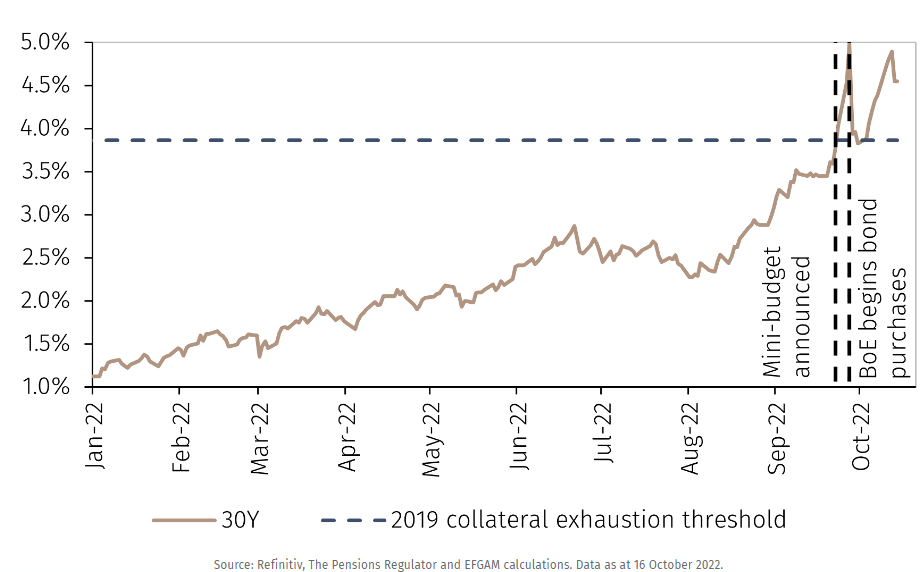

The new fiscal plan received public backlash and was soon reversed but the Truss government’s fiscal U-turn failed to quell the UK’s bond (gilt) market turbulence, which smashed the GBP/USD pair to its lowest level in 37 years at 1.0339 on September 26. Ten-year gilt yields – the interest rate paid on bonds, rose at a record rate in September, causing instability in pension funds and mortgage issuance, which prompted the Bank of England to intervene. Two-year and 30-year yields climbed at the highest rate since 1994. Investors lost confidence in the new UK PM Truss’s leadership and sought a new Prime Minister in the former Finance Minister, Rishi Sunak. Sunak became the fifth Prime Minister to assume power in six years.

UK 30-year Gilt Yield (%)

New PM Rishi Sunak and Finance Minister Jeremy Hunt unveiled the highly-anticipated Autumn Budget on November 17, outlining tax hikes and spending cuts worth £55 billion. Hunt’s budget somewhat reassured markets, helping the Cable pair to recover ground above the 1.2000 psychological barrier.

The turnaround in the currency pair from multi-decade troughs could be also attributed to the continued Bank of England intervention in the chaotic bond market to calm nerves. On September 28, the bank’s Financial Stability Committee announced a two-week emergency purchase program for long-dated UK gilts to restore order to the markets and protect liability-driven investment (LDI) funds from imminent collapse. Ahead of the planned end of the purchase scheme on October 14, the BoE increased the limit for its daily gilt purchases and also widened the scope to include index-linked gilts.

3. Fed-BoE policy divergence

With inflation stubbornly high on both sides of the Atlantic, the US Federal Reserve was relatively more aggressive in the fight against inflation while the United Kingdom faced imminent risks of a recession, which prompted the Bank of England (BoE) to adopt a cautious approach in its policy tightening path.

The Federal Reserve embarked on the most aggressive race to raise borrowing costs in four decades, hiking rates at seven straight meetings for the first time since 2005. Not since the 1980s has the Federal Reserve raised rates by 4.25 percentage points in a single year. The US central bank, at its December meeting, raised interest rates by 50 basis points (bps) officially bringing the benchmark rate up to a target range of 4.25-4.50%, the highest since early 2008.

On the other hand, the Bank of England has been brutally honest about the UK’s dire economic outlook. The central bank estimated a recession in the third quarter of 2022, which would last until the middle of 2024, causing the economy to shrink by 2.9%. Trying hard to maintain a balance between surging inflation and a slowing economy, the BoE resorted to a gradual approach to hiking rates in 2022. The central bank increased rates by 50 bps in December after delivering a 75 bps increment in November, its biggest hike in 33 years. That sums up to a total of 325 bps of rate increases.

Besides these key catalysts influencing the GBP/USD journey in 2022, looming Brexit issues surrounding the Northern Ireland protocol remained a noise in the background and played a second fiddle almost throughout the year. China’s Covid lockdowns also posed a threat to the UK economic outlook, as supply-side shocks failed to ease despite the gradual reopening of the Chinese economy at the turn of the year.

GBP/USD: What’s in store for 2023?

1. Fed and BoE policy outlooks will hold the key

Both central banks are likely to extend their rate hike trajectory into 2023, as inflation needs to be brought down on a sustained basis. That said, the BoE still remains behind the curve when compared to the Fed.

As the Fed projected an economic slowdown while dismissing recession risks, markets remain unconvinced, since higher rates are likely to remain for longer. The CME FedWatch Tool shows the market pricing less than a 15% chance for the Fed target rate to be above 4.75% at the end of December 2023. The uncertainty could likely build a ground for a turnaround in the bearish US Dollar trend.

However, if the bond market continues to "fight the Fed" and pushes yields lower, the US Dollar will probably bear the brunt, at least in the short term. But it could be only a temporary move. The bond market's belief in lower Treasury yields is partly attributed to rising recession risks amid a hawkish Fed outlook. Yet slowing global growth will negatively impact riskier assets, inevitably leading to bouts of dollar strength.

Therefore, the GBP/USD rebound witnessed in the final quarter of 2022 could lose momentum in the early part of 2023, in the face of continued widening monetary policy contrast. At the latest policy meeting, the BoE struck a dovish tone, as it revealed a three-way vote split. The Monetary Policy Committee (MPC) members voted by a majority of 6-3 to increase the bank rate by 50 bps, two members voted to keep the rates unchanged at 3%, while one member voted for a 75 bps lift-off to 3.75%. Meanwhile, the central bank projected a ‘prolonged period’ of recession for the UK economy, while the inflation is expected to remain sky-high until mid-2023. Both these concerns are likely to keep any optimism around Pound Sterling short-lived.

2. UK’s large current account deficit

The new UK government's austere fiscal policy and stabilizing bond market have calmed some nerves, but the Pound Sterling remains vulnerable as the economy battles a large current account deficit. This issue became critically acute in 2022 as the gas and oil import bill ballooned amidst the Russia-Ukraine crisis, further aggravated by the former Finance Minister’s ‘mini-budget’.

Britain’s current account deficit improved from a record 8.3% of GDP in the first quarter of 2022 to 5.5% of GDP in the second quarter. Still, it had the largest deficit relative to the size of its economy of any G7 country.

With the current account deep in the red, the UK will be less likely seen as an attractive destination for foreign loans or investments. Also, the ballooning deficit challenges the credibility of the UK government to manage public finances, which could keep the sentiment around the British Pound undermined.

It’s worth noting that the UK political environment could also pose a threat to the renewed GBP/USD upside, especially after the debacle seen through the year 2022. But as it remains an unknown, it’s wise not to dwell deeper into that subject in analyzing the British Pound’s potential directional move next year.

3. Risk trends to significantly impact GBP/USD

The ebb and flow of risk trends will emerge as another significant driver impacting the higher-yielding Pound Sterling, as well as, the safe-haven US Dollar in the coming year. With the UK economy enduring a protracted recession, followed by a potentially shallower one in the Eurozone while the United States recession is foreseen in the second half of next year, risk sentiment is expected to remain in a weak spot until the effect of global tightening wanes and green shoots are clearly visible.

In addition, investors are yet to see convincing signs of an economic recovery in China, courtesy of its pivotal shift from the zero-Covid policy, the rapid reopening and Beijing’s continued measures to easy policy to stimulate the economy. Bloomberg News reported in early December that senior Chinese officials debated an economic growth target for next year of around 5%. This appeared a welcoming development after the Political Bureau of the Communist Party of China Central Committee, chaired by Chinese President Xi Jinping, abandoned its growth target, insisting instead on the zero-Covid strategy.

A handful of leading banking giants, including Australia & New Zealand Banking Group Ltd., Nomura Holdings Inc. and Morgan Stanley, raised their China GDP forecasts for 2023 to between 4.8% to 5.4% on the reopening optimism. However, these institutions do not rule out some near-term pain as Covid cases continue surging, at least until the positive impact of the reopening is witnessed in the country’s production and consumption.

A turnaround in the global sentiment also depends on the dynamics surrounding energy prices and the protracted Russia-Ukraine war. The high-beta currency, the British Pound, remains exposed to downside risks amid structural weakness before it could embark on a sustained recovery path. The year 2023 promises to be a tougher ride for the GBP/USD pair.

How is GBP/USD positioned technically in 2023?

GBP/USD: One-month chart

Source: FXStreet.com

The monthly chart shows that the GBP/USD recovery momentum faltered above 1.2320, which is the 50% Fibonacci Retracement (Fibo) level of the entire downtrend, starting from the June 2021 peak of 1.4248 to the September 2022 low of 1.0339 – almost four-decade troughs.

The currency pair’s retracement from a six-month top at 1.2446 came after key technical indicators signaled a bearish pivot. The downward-sloping 21-month Simple Moving Average (SMA) cut the mildly bearish 50-month SMA from above, confirming a bear cross. Meanwhile, the Relative Strength Index (RSI) turned flattish, despite the late rebound in the Pound Sterling against the US Dollar. This pointed to a negative RSI-price divergence and turned the tide against the GBP/USD buyers.

The corrective decline could test the 1.1854 demand area if the sellers refuse to give up. That support is the 38.2% Fibo level of the same descent. The next relevant downside target is aligned at the 23.6% Fibo level at 1.1268. Further south, if GPB bulls fail to defend the October 2022 low (dashed horizontal line) of 1.0923, then a renewed sell-off toward the 37-year low could be in the offing.

Should GBP bulls defy the bearish signals and resume the ongoing rebound, GBP/USD could see a fresh upswing toward 1.2785, the golden ratio of the 61.8% Fibo level. Recapturing the above-mentioned 50% Fibo barrier is critical to sustaining any additional recovery attempts.

Acceptance above the 61.8% Fibo resistance could challenge bearish commitments at a powerful supply zone at around the 1.2950 region, where the falling (dashed) trendline, 21- and 50-month SMAs converge. That will be a tough nut to crack for Cable optimists. Up next, the descending 100-month SMA at 1.3452 will come into the picture if the GBP/USD pair seeks a monthly close above the confluence hurdle.

All in all, GBP/USD could likely emerge as a bearish trade for 2023, with investors resorting to a ‘sell the bounce’ strategy on every renewed upside.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.