GBP/USD

Cable fell to intra-day low in European trading on Friday, deflated by disappointing UK GDP data.

The data show that British economy barely grew in October (m/m 0.1% vs 0.4% forecast) and sharply down from 0.6% growth in September.

The fact that the economy slowed even before the emergence of new Omicron variant of coronavirus and remains well below pre-pandemic, raise a question mark above wide expectations for the Bank of England’s first rate hike after pandemic on the policy meeting next week, as it is a harder job for the central bank to push the economy out of recession than to cool surging inflation.

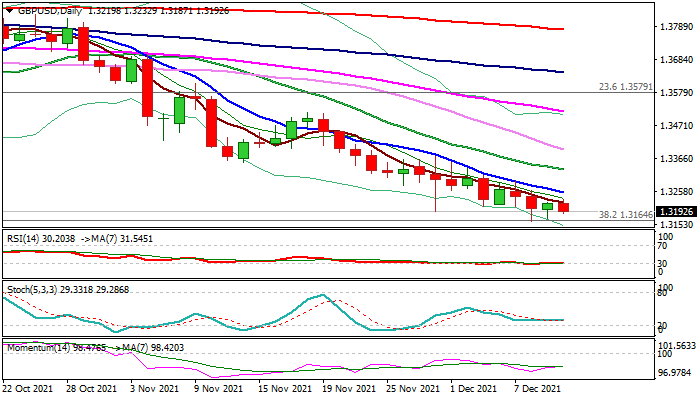

Fresh weakness pressures new one-year low (1.3161), pivotal Fibo support at 1.3164 (38.2% of 1.1409/1.4249) and 200WMA (1.3151) after last week’s action generated strong bearish signal on close below thick weekly cloud.

Break of these levels would expose psychological 1.30 support and risk stronger acceleration lower on violation. Daily studies remain in full bearish setup and supportive, while the markets await today’s key event – release of US CPI data, with November’s figure at/above, forecasted 6.8% (Sep was 6.2%) to inflate the greenback and further depress the pound.

Weekly cloud base (1.3250) marks solid resistance which is expected to cap and confirm bearish stance on repeated weekly close below it.

Res: 1.3232; 1.3250; 1.3300; 1.3328.

Sup: 1.3161; 1.3100; 1.3046; 1.3000.

Interested in GBP/USD technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD remains pressured below 1.0800 on renewed USD strength

EUR/USD stays under pressure and declines toward 1.0750 following Thursday's recovery. A renewed US Dollar uptick and a cautious mood weigh on the pair, as traders digest the Trump win and the Federal Reserve's monetary policy announcements.

GBP/USD holds lower ground near 1.2950 amid tepid risk sentiment

GBP/USD trades in negative territory at around 1.2950 in the second half of the day on Friday. The emergence of dip-buying in the US Dollar and a tepid risk tone undermine the pair. The BoE’s cautious rate cut could check the pair's downside as traders comments from central bankers.

Gold fluctuates below $2,700 amid stronger USD, positive risk tone

Gold trades below $2,700 in the early American session on Friday and is pressured by a combination of factors. Hopes that Trump's policies would spur economic growth and inflation, to a larger extent, overshadow the Fed's dovish outlook, which, in turn, helps revive the USD demand.

Week ahead – US CPI to shift market focus back to data after Trump shock

After Trump comeback, normality to return to markets with US CPI. GDP data from UK and Japan to also be important. But volatility to likely persist as markets assess impact of Trump.

October’s US CPI rates to be the next big test for the greenback

With the US elections being over, Trump getting elected and the Fed having released its interest rate decision, we take a look at what next week has in store for the markets. On the monetary front a number of policymakers from various central banks are scheduled to speak at some point or the other.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.