GBP/USD Outlook: Sustained break below 1.3800 mark awaited for bearish confirmation

- GBP/USD struggled to capitalize on the overnight bounce from the 1.3800 neighbourhood.

- The upbeat US economic outlook continued benefitting the USD and exerted some pressure.

- Investors now eye UK jobs report, BoE Governor Bailey’s speech for a fresh trading impetus.

The GBP/USD pair opened with a modest bearish gap and dropped to multi-day lows during the early part of the trading action on Monday. Worries that events in Turkey will cause disruptions in other asset classes drove some haven flows towards the US dollar, which, in turn, exerted some pressure on the major. However, retreating US Treasury bond yields capped the upside for the USD and assisted the pair to attract some dip-buying at lower levels.

The pair recovered around 60 pips from daily swing lows, albeit lacked any strong follow-through. Reports that the European Union is set to block exports of Oxford-AstraZeneca vaccines to the UK held bulls from placing aggressive bets around the British pound. Investors remain concerned that a significant shortage in vaccine supplies could derail the UK government's plan to exit the current lockdown and dampen prospects for a swift economic recovery.

On the other hand, the optimistic US economic outlook continued underpinning the greenback. The Fed Chair Jerome Powell and US Treasury Secretary Janet Yellen's prepared remarks for testimony before the House Financial Services Committee on Tuesday added to the narrative of a strong US economic recovery from the pandemic. This was seen as another factor that further collaborated towards keeping a lid on any strong gains for the major.

Apart from this, a slight deterioration in the global risk sentiment provided a fresh lift to the safe-haven USD and prompted some selling around the major during the Asian session on Tuesday. The US, the EU, UK and Canada – in a rare coordinated action – imposed sanctions on Chinese officials for human rights abuses in Xinjiang. China hit back immediately with punitive measures against the EU and further escalated diplomatic tensions.

The pair was last seen hovering near session lows, around the 1.3835 region as market participants now look forward to the UK monthly employment details for a fresh impetus. Apart from this, scheduled speeches by the BoE Governor Andrew Bailey and Deputy Governor Jon Cunliffe will play a key role in influencing the sterling. Later during the early North American session, Fed Chair Jerome Powell and US Treasury Secretary Janet Yellen will testify before the House Financial Services Committee. This might further contribute to produce some meaningful trading opportunities around the major.

Short-term technical outlook

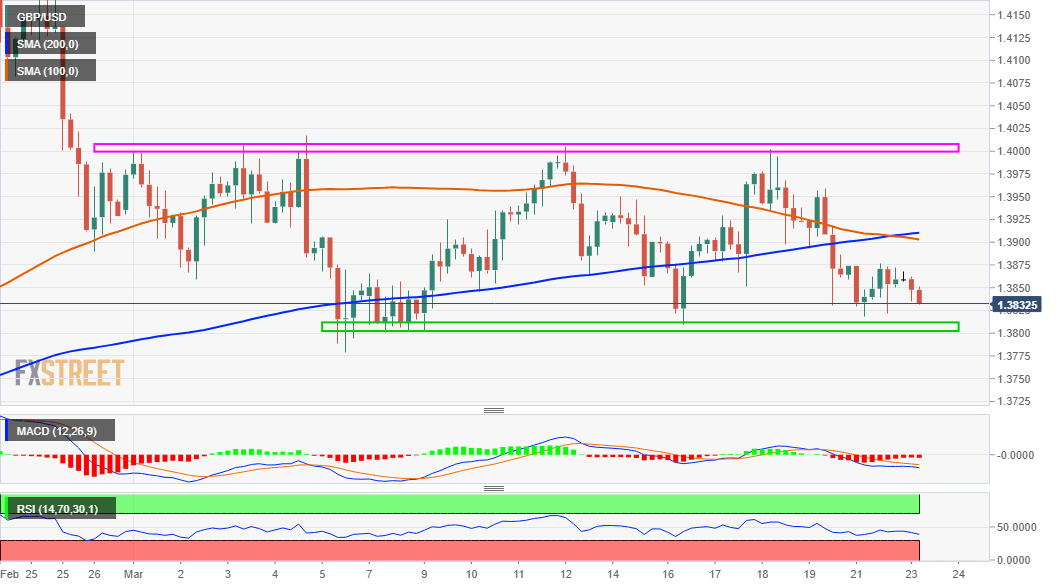

From a technical perspective, repeated failures near the key 1.4000 psychological mark constituted the formation of a bearish double-top pattern on short-term charts. However, the lack of any strong follow-through selling warrants some caution for aggressive traders. Hence, it will be prudent to wait for sustained weakness below the 1.3800 mark before positioning for any further depreciating move. The pair might then accelerate the slide towards testing a strong horizontal resistance breakpoint, now turned support near the 1.3730-25 region. This is closely followed by the 1.3700 mark, which if broken will set the stage for a slide towards testing the next relevant support near the 1.3655-50 region.

On the flip side, the overnight swing highs, around the 1.3875-80 region now seems to act as an immediate resistance ahead of the 1.3900 mark. Some follow-through might trigger a short-covering bounce and push the pair back towards the 1.3965-70 supply zone. However, any further move up might continue to confront stiff resistance near the 1.4000 mark. Only a convincing break through the double-top resistance will negate any near-term negative bias and set the stage for the resumption of the prior/well-established upward trajectory.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.