GBP/USD outlook: Stronger than expected UK GDP numbers lift cable to four-month high

GBP/USD

Cable hit new four-month high in European trading on Thursday, lifted by better than expected UK May GDP numbers, which poured cold water on expectations for BoE rate cut next month.

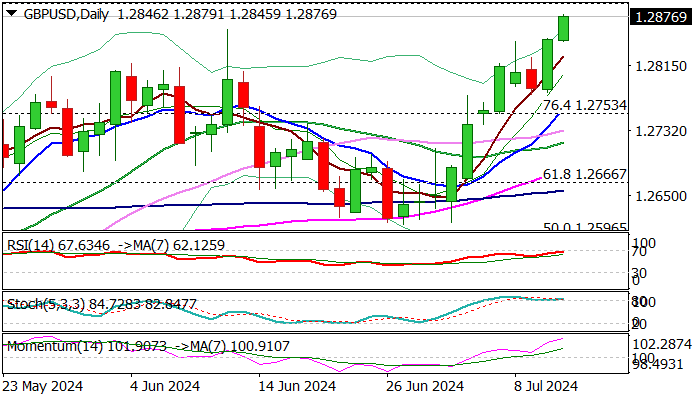

Fresh strength broke through pivotal barriers at 1.2846/60 (200WMA/former top June 12) and pressuring key barrier at 1.2893 (2024 high, posted on March 8).

Firmly bullish technical picture on daily chart (Tenkan/Kijun-sen forming a bull-cross and bullish momentum is strengthening) support the action, though headwinds on approach to 1.2893 could be expected, due to overbought conditions and significance of barrier.

Markets shift focus towards release of US June inflation report which is expected to provide fresh signals.

Weaker than expected US CPI numbers would further boost pound as further easing in consumer prices would bring the Fed one step closer to rate cut and subsequently deflate dollar.

Cable could accelerate through 1.2900 and probably challenge psychological 1.30 barrier, in case of stronger CPI downside miss.

Conversely, bulls may lose traction if US price pressures rise in June.

Session low (1.2845) offer initial support, followed by 1.2800/1.2780 (psychological / daily higher base and 1.2760/53 (rising 10DMA / broken Fibo 76.4% of 1.2893/1.2299).

Res: 1.2893; 1.2900; 1.2950; 1.3000.

Sup: 1.2845; 1.2800; 1.2780; 1.2753.

Interested in GBP/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.