GBP/USD

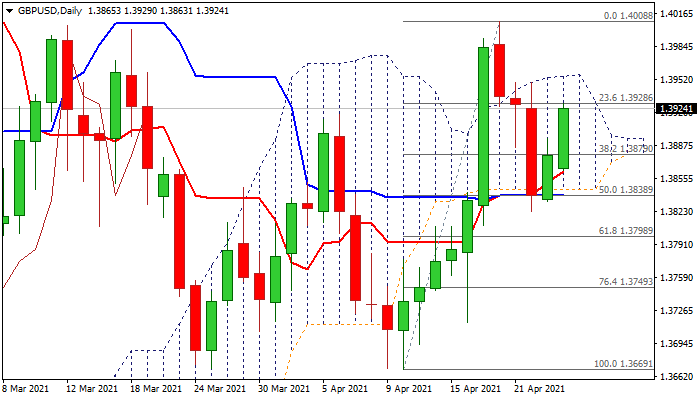

Cable extended Friday’s bounce and rose above 1.39 mark in early European trading on Monday but continues to trade within daily cloud (1.3844/1.3957) which started to narrow and will twist later this week.

Break of cloud top would generate bullish signal for renewed attack at psychological 1.40 barrier, above which the pound last traded two months ago.

Revived bullish momentum and daily moving averages in positive setup underpin fresh advance, but mixed fundamentals sour the sentiment.

British minister denied media report that PM Boris Johnson said he would rather let bodies pile high in thousands than order a third economic and social lockdown.

On the other side, BoE’s Deputy Governor Broadbent said he expects very rapid UK growth next couple of quarters.

Res: 1.3928; 1.3949; 1.3957; 1.4000.

Sup: 1.3900; 1.3879; 1.3862; 1.3844.

Interested in GBP/USD technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

AUD/USD recovers above 0.6200 after an early dip

Wall Street shrugged off fears ahead of the close and trimmed Trump-inspired losses, helping AUD in its way up. Australia will release in the Asian session November Retail Sales and Exports and Import figures for the same month.

EUR/USD hovers around 1.0320 after another moved American session

The EUR/USD pair trades around 1.0320 after falling to 1.0275. Employment data, a cautious Federal Reserve, and President-elect Donald Trump tariffs shook financial boards and kept investors in cautious mode.

XAU/USD holds on to gains around $2,660

Gold price retains risk-inspired gains. The benchmark 10-year US Treasury bond yield holds at its highest level since late April near 4.7%, limiting XAU/USD directional strength. US markets will remain closed on Thursday.

Crypto Today: BTC drops 3% despite $52M ETF inflows as Chainlink launches Ripple’s RLUSD

Mega-cap assets like XRP and exchange tokens BNB and BGB showcased resilience, defying broader market weakness spurred by an ongoing liquidation event that wiped over $150 billion from global crypto market capitalization in the past 24 hours.

Bitcoin edges below $96,000, wiping over leveraged traders

Bitcoin's price continues to edge lower, trading below the $96,000 level on Wednesday after declining more than 5% the previous day. The recent price decline has triggered a wave of liquidations across the crypto market, resulting in $694.11 million in total liquidations in the last 24 hours.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.