GBP/USD outlook: Pound receives fresh support from hawkish shift in rate expectations as inflation rises

GBP/USD

Cable jumped to a seven-week high in European trading on Wednesday, after UK inflation report showed unexpected rise in consumer prices, causing a hawkish shift in rate expectations, one day ahead of BOE policy meeting.

Markets now expect a 25 basis points hike to 4.25%, fueling fresh rise of the pound, though Fed policy decision, due later today, will be also closely watched.

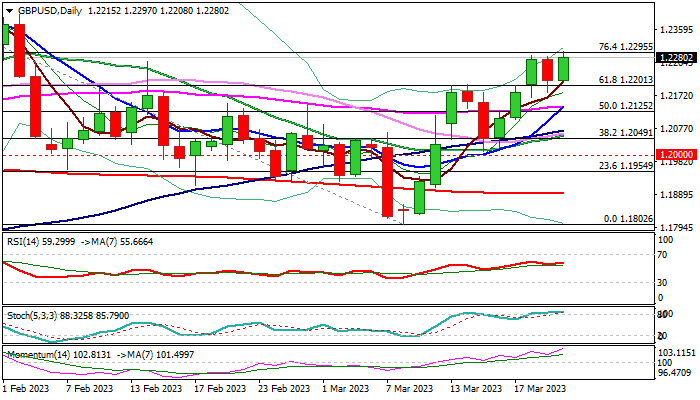

Fresh rise generates an initial signal of bullish continuation as the price action remains above broken pivotal Fibo level at 1.2201 (61.8% retracement of 1.2447/1.1802, also former tops of Mar 13/14) for the third straight day, adding to improved outlook.

Bulls cracked next Fibo level at 1.2295 (76.4% retracement) and pressure round-figure barrier (1.2300), with close above these levels to further firm the structure and expose targets at 1.2402/47 (Feb 2 high / 2023 peak, posted on Jan 23).

Strengthening positive momentum on daily chart and moving averages in full bullish setup, support the action, but overbought stochastic warns that bulls might be running out of steam.

Failure to clear 1.2300 zone would signal that the action may hold in extended consolidation, with bullish bias to remain intact while the price action stays above strong 1.2200 support zone.

Res: 1.2300; 1.2370; 1.2402; 1.2447.

Sup: 1.2244; 1.2200; 1.2141; 1.2152.

Interested in GBP/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.