GBP/USD outlook: Omicron concerns limit recovery and keep the downside at risk

GBP/USD

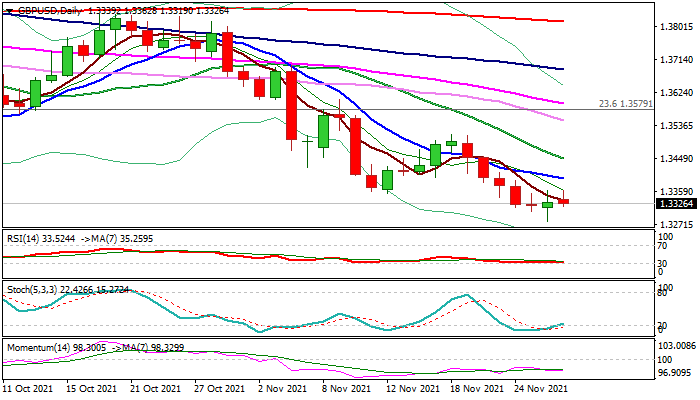

Recovery attempts from new 2021 low (1.3278), posted after Omicron shock last Friday, were so far limited and unable break above Friday’s high (1.3362).

Risk-sensitive pound remains influenced by fears of the impact of new coronavirus variant, keeping the downside at risk, as daily techs remain in bearish configuration, but sideways-moving momentum studies suggest the action may hold in extended consolidation before larger bears resume.

Solid offers are seen at 1.3400 zone, which is expected to limit extended upticks and keep bearish bias.

Violation of 1.3278 low would risk drop towards key Fibo support at 1.3164 (38.2% of 1.1409/1.4249).

Conversely, lift above pivotal 1.3400 zone (10DMA / former low of Sep 29) would ease downside pressure for extended correction, but larger bears are expected to remain in play while the price action holds below 1.3513 (Nov 18 lower top).

Res: 1.3362; 1.3400; 1.3447; 1.3513.

Sup: 1.3319; 1.3278; 1.3187; 1.3164.

Interested in GBP/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.