GBP/USD outlook: Lifted further by better than expected UK PMI data

GBP/USD

Cable advances for the second consecutive day, underpinned by better than expected UK services PMI (dominant sector of the economy) released earlier today.

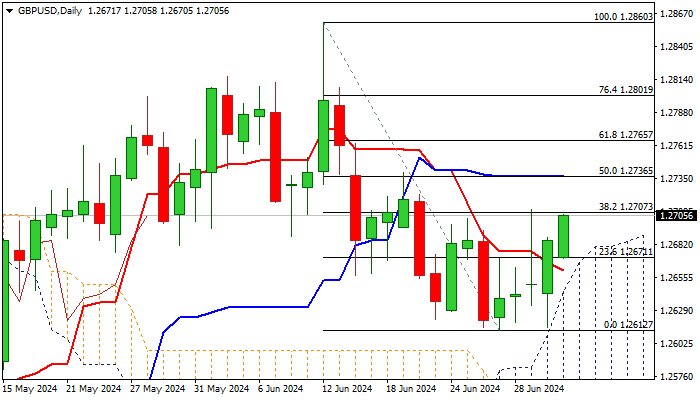

Fresh bulls cracked psychological 1.2700 barrier and nearby pivotal Fibo resistance at 1.2707 (38.2% of 1.2860/1.2612 bear-leg) with bounce from 1.2612 higher base being underpinned by rising and thickening daily Ichimoku cloud.

Sustained break of 1.2700/07 barriers to generate bullish signal for extension towards next targets at 1.2736 and 1.2765 (Fibo 50% and 61.8% retracement).

On the other hand, 14-d momentum is still in the negative territory and requires caution, though near-term bullish bias to remain in play as long as price action stays above daily cloud top, reinforced by daily Tenkan-sen (1.2661).

Res: 1.2670; 1.2715; 1.2736; 1.2765.

Sup: 1.2687; 1.2661; 1.2638; 1.2612.

Interested in GBP/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.