GBP/USD

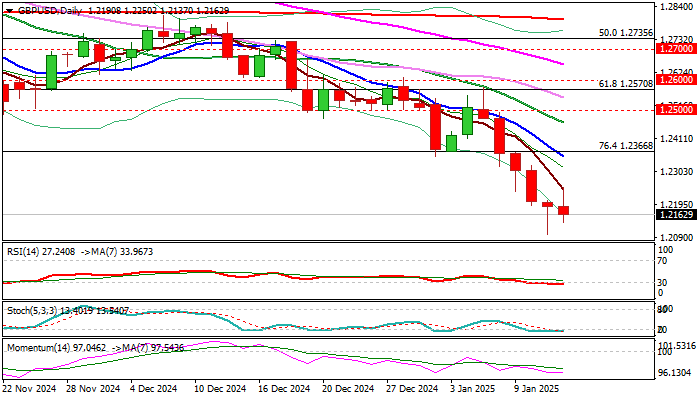

Cable came under fresh pressure on Tuesday and looks for retest of new multi-month low (1.2099) after recovery from Monday’s strong downside rejection failed repeatedly at 1.2250 zone.

Bears regained control after a mild correction, with loss of 1.2099 low (also monthly cloud base) to open way for test of 1.2037/00 targets (4 Oct 2023 low / psychological).

Daily studies remain in full bearish setup, though oversold conditions may keep near term action on hold for some time.

Upticks are likely to be limited and ideally capped under 1.2350/60 zone falling 10DMA / broken Fibo 76.4% support) as fundamentals are dollar positive.

US Dec PPI missed expectations but came above previous month’s figure (y/y), which signals that inflation remains elevated and to further soften Fed’s rate cut outlook for 2025.

Markets focus on UK and US December inflation reports (due on Wednesday) which would further pressure pound, as price pressure is expected to rise, and UK economy remains on fragile legs.

The dollar would benefit more from the anticipated implementation of tariffs, proposed by Trump’s administration, even on the latest comments that tariff implementation might be gradual at the beginning.

Res: 1.2250; 1.2299; 1.2360; 1.2400.

Sup: 1.2099; 1.2069; 1.2037; 1.2000.

Interested in GBP/USD technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD eases to daily lows near 1.0260

Better-than-expected results from the US docket on Friday lend wings to the US Dollar and spark a corrective decline in EUR/USD to the area of daily lows near 1.0260.

GBP/USD remains under pressure on strong Dollar, data

GBP/USD remains on track to close another week of losses on Friday, hovering around the 1.2190 zone against the backdrop of the bullish bias in the Greenback and poor results from the UK calendar.

Gold recedes from tops, retests $2,700

The daily improvement in the Greenback motivates Gold prices to give away part of the weekly strong advance and slip back to the vicinity of the $2,700 region per troy ounce at the end of the week.

Five keys to trading Trump 2.0 with Gold, Stocks and the US Dollar Premium

Donald Trump returns to the White House, which impacts the trading environment. An immediate impact on market reaction functions, tariff talk and regulation will be seen. Tax cuts and the fate of the Federal Reserve will be in the background.

Hedara bulls aim for all-time highs

Hedara’s price extends its gains, trading at $0.384 on Friday after rallying more than 38% this week. Hedara announces partnership with Vaultik and World Gemological Institute to tokenize $3 billion in diamonds and gemstones

Trusted Broker Reviews for Smarter Trading

VERIFIED Discover in-depth reviews of reliable brokers. Compare features like spreads, leverage, and platforms. Find the perfect fit for your trading style, from CFDs to Forex pairs like EUR/USD and Gold.