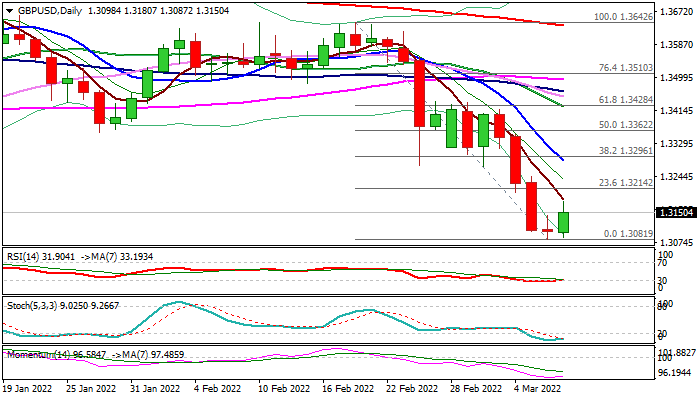

GBP/USD outlook: Formation of morning star pattern is positive signal

GBP/USD

Revived risk mode on fresh optimism over the crisis in Ukraine pushes sterling higher in European trading on Wednesday, with bounce from new multi-month low (1.3081), putting larger bears temporarily on hold.

Fresh advance interrupts steep fall of past four days, which ended with Doji candle on Tuesday and on track to form a morning star reversal pattern.

Daily techs show that strong bearish momentum is starting to fade and deeply oversold stochastic turning north that fuels hopes for stronger correction.

Overall picture remains bearish and current rebound needs more work to the upside to generate firmer bullish signal.

Initial resistance at 1.3214 (Fibo 23.6% of 1.3642/1.3081) is still intact, with break here needed to soften larger bears and open way for recovery extension towards key barriers at 1.3300 zone (double-Fibo /falling 10DMA.

However, daily close above broken former low at 1.3161 is seen as a minimum requirement to keep fresh bulls in play.

Res: 1.3161; 1.3187; 1.3214; 1.3245.

Sup: 1.3144; 1.3120; 1.3081; 1.3000.

Interested in GBP/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.