GBP/USD

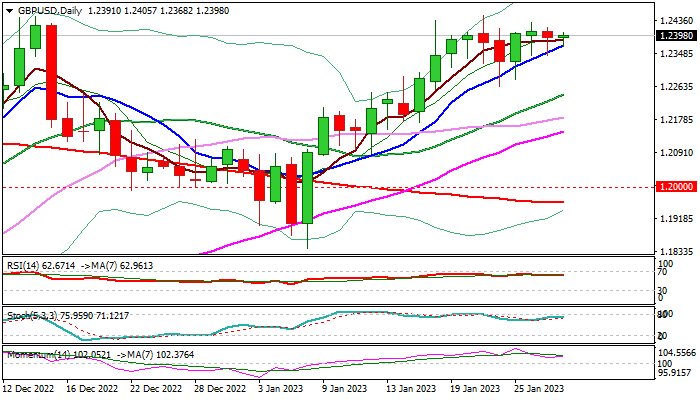

Cable is trading within a narrow range around 1.24 handle in European session on Monday, extending near-term directionless mode.

Bulls were capped by the base of descending weekly cloud (1.2455) and so far unable to register a clear break above 1.2400, but hold grip, as the price continues to move above ascending 10DMA (currently at 1.2371), which tracks the action since Jan 6 and marks solid support.

January action is on track to end in another long bullish candle (fourth straight month of gains), which is a bullish signal, though offset by weekly bearish Doji, overbought conditions and fading bullish momentum on weekly chart.

Daily techs remain in full bullish setup, but the action lacks strength for final push higher, awaiting fresh signals.

Traders eye key events this week – Fed and BOE rate decisions, which could provide direction signals.

The US central bank is widely expected to further slow the pace of tightening and raise its interest rate by 25 basis points, while the Bank of England would likely go for 50 basis points hike and push interest rate to 4%.

More hawkish stance from the BOE, compared to Fed, could be supportive for sterling, as this week’s hikes would also further narrow the gap between their monetary policies.

Res: 1.2446; 1.2455; 1.2500; 1.2544.

Sup: 1.2371; 1.2304; 1.2263; 1.2216.

Interested in GBP/USD technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD clings to recovery gains near 1.0850 ahead of Fedspeak

EUR/USD trades in positive territory near 1.0850 on Friday following a four-day slide. China's stimulus optimism and a broad US Dollar correction help the pair retrace the dovish ECB decision-induced decline. All eyes remain on the Fedspeak.

GBP/USD pares UK data-led gains at around 1.3050

GBP/USD is trading at around 1.3050 in the second half of the day on Friday, supported by upbeat UK Retail Sales data and a pullback seen in the US Dollar. Later in the day, comments from Federal Reserve officials will be scrutinized by market participants.

Gold at new record peaks above $2,700 on increased prospects of global easing

Gold (XAU/USD) establishes a foothold above the $2,700 psychological level on Friday after piercing through above this level on the previous day, setting yet another fresh all-time high. Growing prospects of a globally low interest rate environment boost the yellow metal.

Crypto ETF adoption should pick up pace despite slow start, analysts say

Big institutional investors are still wary of allocating funds in Bitcoin spot ETFs, delaying adoption by traditional investors. Demand is expected to increase in the mid-term once institutions open the gates to the crypto asset class.

Canada debates whether to supersize rate cuts

A fourth consecutive Bank of Canada rate cut is expected, but the market senses it will accelerate the move towards neutral policy rates with a 50bp step change. Inflation is finally below target and unemployment is trending higher, but the economy is still growing.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.