GBP/USD outlook: Extended consolidation likely to precede fresh push higher

GBP/USD

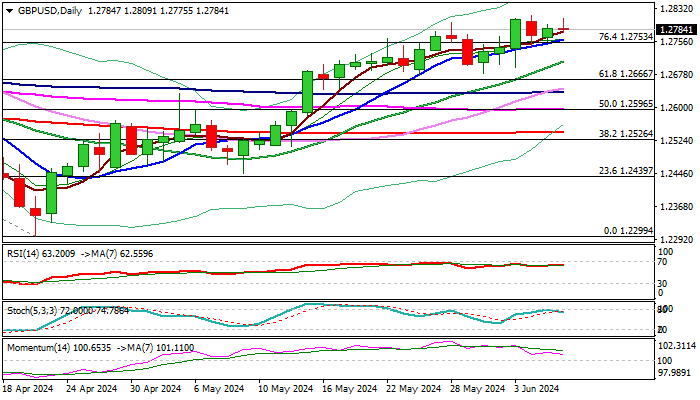

Cable is consolidating under new multi-week high (1.2817), with near-term action underpinned by rising 10DMA (1.2758) and looking for fresh push higher and attack at 2024 high (1.2893).

Daily moving averages in full bullish configuration and with multiple bull-crosses maintain bullish structure, though fading positive momentum suggests that near-term action may hold in extended consolidation before larger bulls regain full control.

Dips should be ideally contained by 10DMA (also broken Fibo 76.4% of 1.2893/1.2299) and extended pullback not to exceed 1.2707/1.2680 zone (rising 20DMA (May 30 higher low) to keep larger bulls in play.

Res: 1.2803; 1.2817; 1.2853; 1.2893.

Sup: 1.2758; 1.2707; 1.2680; 1.2666.

Interested in GBP/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.