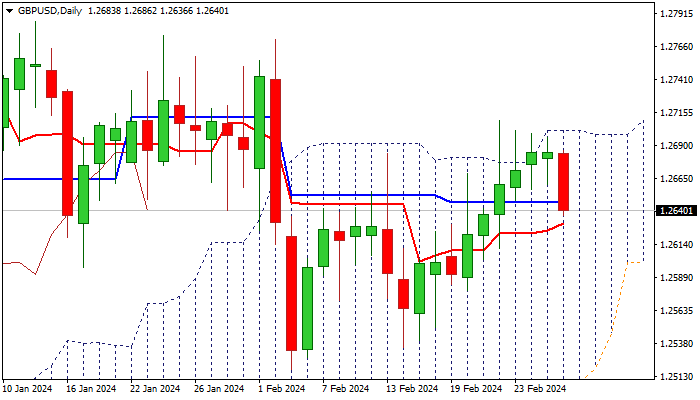

GBP/USD outlook: Drops after repeated rejections at daily cloud top

GBP/USD

Cable dips 0.3% in Asian/early European trading on Wednesday after a multiple failures to clear the top of daily Ichimoku cloud.

Long upper shadows on daily candles and narrowing ranges in past few sessions, confirmed significance of cloud top barrier, while diverging RSI added to early signals that bulls were running out of steam and warned of pullback.

Fresh bears cracked Fibo support at 1.2643 (38.2% of 1.2535/1.2709 upleg, reinforced by 10DMA), loss of which to signal further weakness and expose targets at 1.2600 (Fibo 61.8%) and 1.2570 (200DMA).

Daily indicators are heading south, and 14-d momentum is approaching the centreline, with break into negative territory to further weaken near-term structure.

Res: 1.2668; 1.2686; 1.2709; 1.2772.

Sup: 1.2622; 1.2600; 1.2570; 1.2535.

Interested in GBP/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.