GBP/USD outlook: Cable loses traction as European stocks extend weakness

GBP/USD

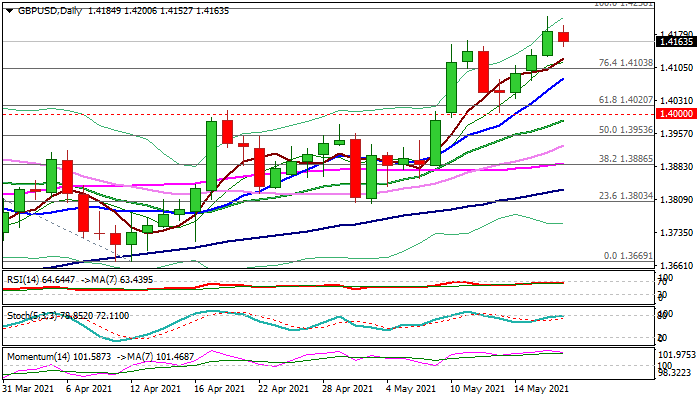

Cable is losing traction in European trading on Wednesday, failing to capitalize from upbeat April’s UK inflation figures.

Pound faced strong headwinds at 1.4200 zones that was shown by long upper shadow of Tuesday’s daily candle.

Drop of European equities on Wednesday weighed on risk sentiment and pushed the sterling lower, adding to signals that bulls are running out of steam.

Initial support lays at 1.4130 (Tuesday’s low, reinforced by rising 5DMA, guarding more significant levels at 1.4103/1.4080 (broken Fibo 76.4% / rising 10 DMA).

Near-term bias is expected to remain with bulls while the action remains above these supports, with extended consolidation to precede fresh probe through 1.4200 barrier and final attack at 1.4238 (2021 high).

Caution on daily close below 10DMA that would generate initial reversal signal and allow for deeper pullback.

Larger uptrend from 1.3670 (Mar/Apr higher base) is expected to stay intact as long as key support at 1.40 zone holds.

Res: 1.4200; 1.4220; 1.4238; 1.4265.

Sup: 1.4130; 1.4100; 1.4080; 1.4036.

Interested in GBP/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.