GBP/USD outlook: Cable is consolidating under new one-month high

GBP/USD

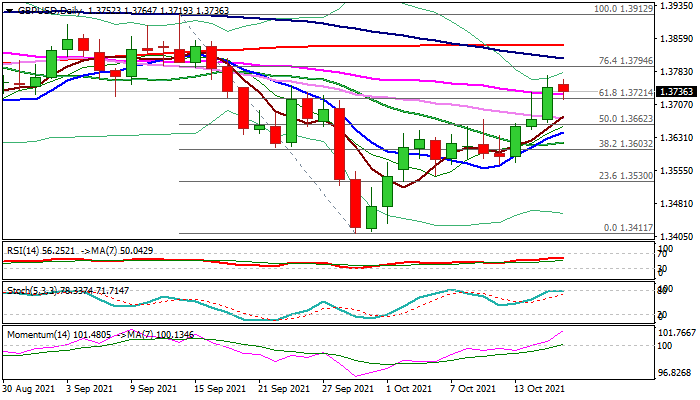

Cable is consolidating under new one-month high (1.3773) in early Monday, following last week’s 0.55% advance and weekly close above double-Fibo barriers at 1.3721 (61.8% of 1.3912/1.3411) and 1.3731 (61.8% of 1.4249/1.3411) that generated bullish signal.

The sentiment remains strong as hopes for BoE rate hike as early as November were boosted by hawkish comments from Governor Bailey, who said that the central bank is gearing up for the first rate hike after pandemic on mounting inflation risk.

Although Bailey sees the recent jump in inflation as temporary, worries that surge in energy prices would push inflation higher and for a longer period, would prompt BoE to act.

Fresh bullish acceleration is facing headwinds from thin daily cloud, which looks like minor obstacle, as the price emerged above thick ascending weekly cloud that underpins.

Rising bullish momentum and double bull- cross of 5/20 and 10/20DMA’s supports the action, but sideways-moving stochastic and RSI suggest bulls may take a breather before resuming.

Broken Fibo barrier offers immediate support at 1.3721 with extended dips expected to find ground above 1.3675 (5/30DMA bull-cross) to keep bulls intact.

Res: 1.3777; 1.3794; 1.3812; 1.3844.

Sup: 1.3721; 1.3675; 1.3662; 1.3643.

Interested in GBP/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.