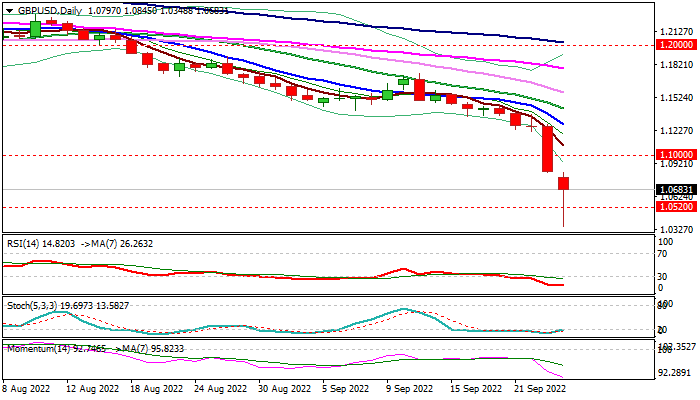

GBP/USD

British pound fell to a record low vs dollar in Asian session on Monday, in extension of last Friday’s sharp fall, when the pair was down 3.6% for the day in the biggest daily drop since 10 Nov 2021.

Cable spiked through 1985 low at 1.0520 to hit new all-time low at 1.0348, deflated by strong risk aversion on growing uncertainty and signals that the Fed will remain in strong hawkish mode, while confidence in Britain’s plan to stabilize the economy by lowering taxes and increasing borrowing, started to fade, adding to prevailing negative sentiment.

Although the cable bounced back to 1.07 zone in early European trading, as traders collected some profits on signals from deeply oversold daily studies, overall structure remains bearish, as the pair is pressured by deteriorating fundamentals and negative technical studies.

Cable fell 5% last week and is on track for another strong monthly fall (the biggest monthly loss since June 2016 – the post-Brexit fall).

We look for sustained break below 1985 low to signal bearish continuation, as p parity level already came in focus.

Broken psychological 1.10 support reverted to solid resistance, reinforced by falling daily Tenkan-sen, which should ideally cap extended upticks.

Res: 1.0845; 1.0914; 1.1000; 1.1211.

Sup: 1.0600; 1.0520; 1.0348; 1.0200.

Interested in GBP/USD technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

AUD/USD: The hunt for the 0.7000 hurdle

AUD/USD quickly left behind Wednesday’s strong pullback and rose markedly past the 0.6900 barrier on Thursday, boosted by news of fresh stimulus in China as well as renewed weakness in the US Dollar.

EUR/USD refocuses its attention to 1.1200 and above

Rising appetite for the risk-associated assets, the offered stance in the Greenback and Chinese stimulus all contributed to the resurgence of the upside momentum in EUR/USD, which managed to retest the 1.1190 zone on Thursday.

Gold holding at higher ground at around $2,670

Gold breaks to new high of $2,673 on Thursday. Falling interest rates globally, intensifying geopolitical conflicts and heightened Fed easing bets are the main factors.

Bitcoin displays bullish signals amid supportive macroeconomic developments and growing institutional demand

Bitcoin (BTC) trades slightly up, around $64,000 on Thursday, following a rejection from the upper consolidation level of $64,700 the previous day. BTC’s price has been consolidating between $62,000 and $64,700 for the past week.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.