GBP/USD

Cable dipped to the lowest in six months on Thursday after the Bank of England kept rates unchanged for the fist time since December 2021 and against consensus for 25 basis points hike.

The policymakers were split and voted by narrow 5-4 margin to stay on hold, arguing their decision by significant growth slowdown, caused by high borrowing cost, as the economy was already fragile after being hit by Brexit and Covid pandemic.

Although inflation in Britain fell more than expected in August, it remains the highest among the G7 group countries, which keeps the BoE policymakers alerted and ready to act further if necessary, as BoE Governor Bailey stressed that job with inflation was not done yet.

However, the policymakers must be very careful as weak economic indicators warn of further slowdown, which could deteriorate if the central bank continues to tighten its monetary policy.

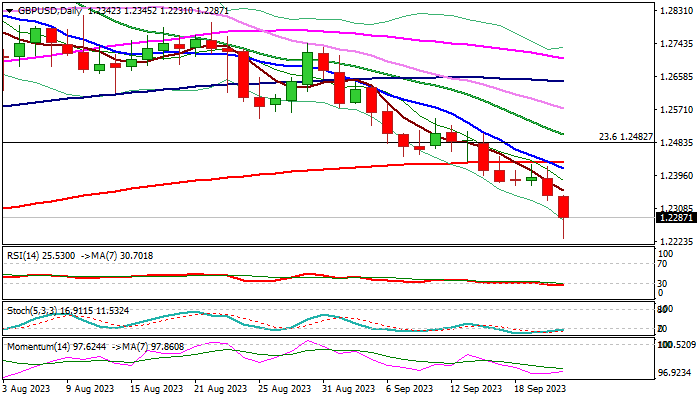

Fresh extension broke below key short-term support at 1.2307 (May 25 low) but needs to register a daily close below this level to confirm bearish signal and open way for further weakness.

Subsequent bounce from new multi-month low (1.2231) points to increased headwinds, mainly caused by oversold conditions on daily chart which prompted traders to collect some profits.

Limited corrective upticks should stay below falling 10DMA (1.2414) which formed a death-cross with 200DMA and reinforcing bearish structure, are likely to offer better selling opportunities, as pound was additionally weighed by stronger dollar after Fed’s hawkish hold on Wednesday.

Bears face immediate support at 1.2204 (55WMA) and eye targets at 1.2074/00 (Fibo 38.2% of 1.0348/1.3141 uptrend / psychological).

Res: 1.2307; 1.2345; 1.2414; 1.2432

Sup: 1.2231; 1.2204; 1.2074; 1.2000

Interested in GBP/USD technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD stays near 1.0400 in thin holiday trading

EUR/USD trades with mild losses near 1.0400 on Tuesday. The expectation that the US Federal Reserve will deliver fewer rate cuts in 2025 provides some support for the US Dollar. Trading volumes are likely to remain low heading into the Christmas break.

GBP/USD struggles to find direction, holds steady near 1.2550

GBP/USD consolidates in a range at around 1.2550 on Tuesday after closing in negative territory on Monday. The US Dollar preserves its strength and makes it difficult for the pair to gain traction as trading conditions thin out on Christmas Eve.

Gold holds above $2,600, bulls non-committed on hawkish Fed outlook

Gold trades in a narrow channel above $2,600 on Tuesday, albeit lacking strong follow-through buying. Geopolitical tensions and trade war fears lend support to the safe-haven XAU/USD, while the Fed’s hawkish shift acts as a tailwind for the USD and caps the precious metal.

IRS says crypto staking should be taxed in response to lawsuit

In a filing on Monday, the US International Revenue Service stated that the rewards gotten from staking cryptocurrencies should be taxed, responding to a lawsuit from couple Joshua and Jessica Jarrett.

2025 outlook: What is next for developed economies and currencies?

As the door closes in 2024, and while the year feels like it has passed in the blink of an eye, a lot has happened. If I had to summarise it all in four words, it would be: ‘a year of surprises’.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.