GBP/USD Outlook: Bulls seem non-committed, remain at the mercy of USD price dynamics

- GBP/USD sticks to modest gains for the third straight day on Thursday, though lacks follow-through.

- The uncertainty over the Fed’s rate-hike path keeps the USD bulls on the defensive and lends support.

- The upside potential seems limited amid expectations that the BoE rate-hike cycle is nearing the end.

The GBP/USD pair edges higher for the third successive day on Thursday, though remains below the 1.2100 mark through the Asian session. The uptick is sponsored by subdued US Dollar demand, which has been struggling to capitalize on the upbeat NFP-inspired rally to a one-month low amid the uncertainty over the Fed's rate-hike path. Fed Chair Jerome Powell Fed Chair Jerome Powell struck a balanced tone on inflation and reiterated on Tuesday that the process of disinflation was underway. This, in turn, fuels speculations that interest rates may not rise much further, exerting some pressure on the US Treasury bond yields and keeping the USD bulls on the defensive. Powell, however, acknowledged that rates might need to move higher than expected if the economy remained strong.

Moreover, a slew of FOMC members stressed the need for further rate hikes to control inflation amid a stronger labor market. In fact, Fed Governor Christopher Waller noted that it could require higher interest rates for longer than some are currently expecting to get inflation down to the target. Adding to this, New York Fed president John Williams, in an interview with the Wall Street Journal, said that the Fed funds rate to a range of 5% to 5.25% still seems a very reasonable view. Meanwhile, Minneapolis Fed President Neel Kashkari said that explosive job growth is evidence that the central bank has more work to do to tame inflation. This, along with a softer risk tone, should continue to lend support to the safe-haven buck and cap the upside for the GBP/USD pair.

Traders might also refrain from placing aggressive bullish bets around the British Pound amid a dovish assessment of the Bank of England's policy decision last week. In fact, the UK central bank removed the phrase that they would "respond forcefully, as necessary". Furthermore, BoE Governor Andrew Bailey said that inflation will fall more rapidly during the second half of 2023. This suggested that the BoE was becoming increasingly unsure as to whether further policy tightening is warranted and that the current rate-hiking cycle might be nearing the end. Hence, investors will look to the BoE's monetary policy report hearing for clues about future rate hikes, which might influence the Sterling. This, along with the USD price dynamics, should provide some impetus to the GBP/USD pair.

Technical Outlook

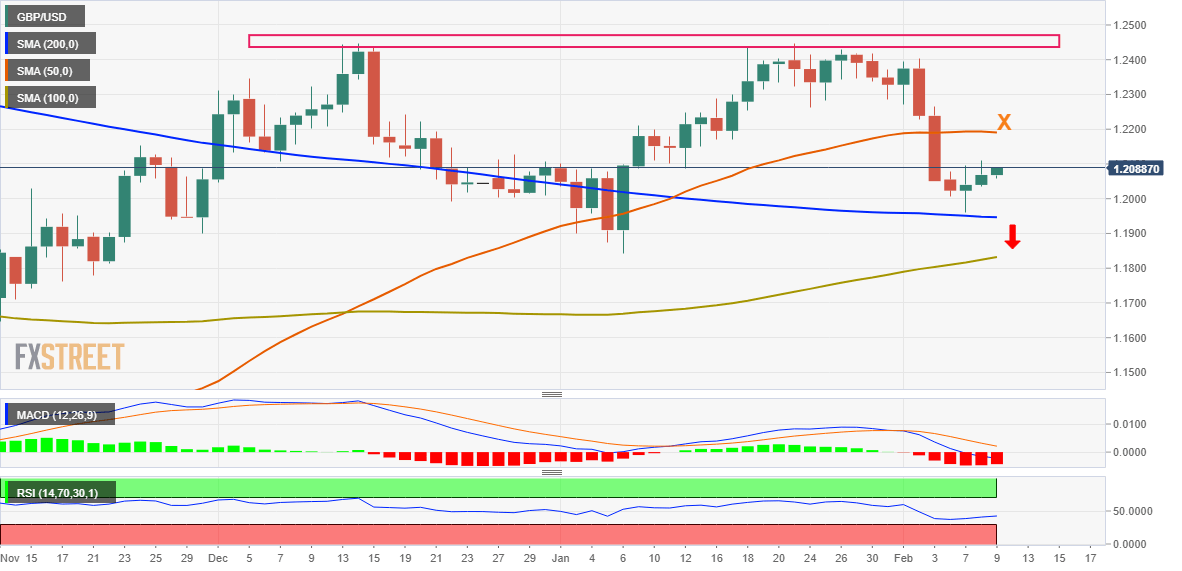

From a technical perspective, the emergence of some buying near the very important 200-day SMA warrants some caution for bearish traders. That said, the formation of a bearish multiple-top near the 1.2450 supply zone, along with the lack of any meaningful buying, suggests that the path of least resistance for the GBP/USD pair is to the downside. Meanwhile, the 1.2000 psychological mark is likely to act as immediate support ahead of the weekly low, around the 1.1960 area, nearing the 200 DMA.

Some follow-through selling below the latter will reaffirm the negative bias and make the GBP/USD pair turn vulnerable to accelerate the fall towards the 1.1900 round figure. The downward trajectory could get extended towards the YTD low, around the 1.1840 region touched on January 6, en route to the 100-day SMA, currently near the 1.1815-1.1810 area.

On the flip side, any meaningful rally beyond the 1.2100 mark is likely to confront stiff resistance ahead of the 1.2200 round figure. The latter coincides with the 50-day SMA, which if cleared might negate the bearish outlook and prompt some short-covering. The GBP/USD pair could then climb to the 1.2235-1.2280 barrier before aiming to reclaim the 1.2300 mark.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.