GBP/USD outlook: Bulls regain traction and generate initial signal that correction has bottomed

GBP/USD

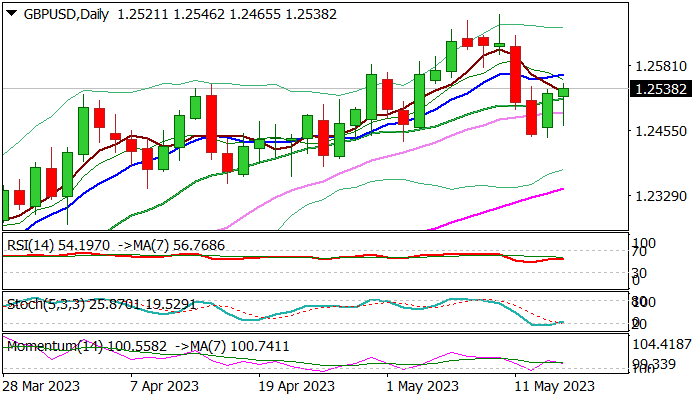

Cable quickly regained ground after post-UK jobs data dip below 1.25 handle, following short-lived negative impact from higher unemployment and jobless claims, as prevailing expectations that the BoE would deliver another rate hike in June continue to underpin pound.

Fresh advance, if sustained, would generate an initial signal that correction from 1.2679 peak (May 10) might be over.

Look for signal on close above cracked Fibo barrier at 1.2534 (38.2% of 1.2679/1.2444), which will require verification on lift and close above 1.2562 (10DMA/50% retracement) and open way for further recovery towards targets at 1.2590 and 1.2624 (Fibo 61.8% and 76.4% respectively) in extension).

This would bring daily MA’s into full bullish setup and contribute to existing signals from bullish momentum and Stochastic reversing from oversold territory.

Today’s long tailed daily candle also signals strong bids, though close above broken 20DMA (1.2517) is needed to keep near-term bias with bulls.

Res: 1.2562; 1.2590; 1.2624; 1.2640.

Sup: 1.2518; 1.2472; 1.2444; 1.2402.

Interested in GBP/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.