GBPUSD

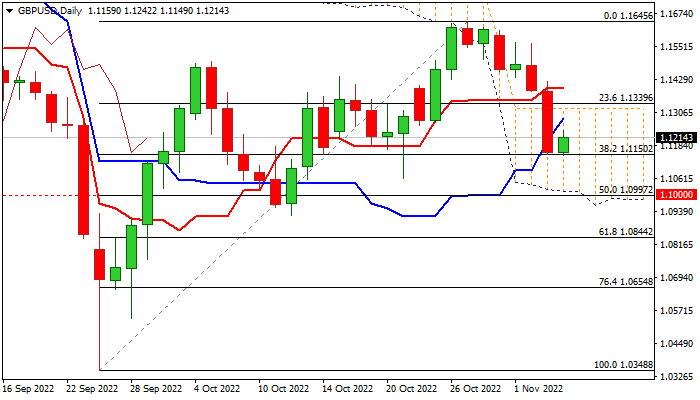

Cable edges higher in early Friday as traders collect profits after bearish acceleration below 1.15 handle in past two days found footstep at solid Fibo support at 1.1150 (38.2% of 1.0348/1.1645).

The pound is weighed by BoE’s gloomy outlook for the economy, while the most recent hawkish tones from Fed suggest that the US central bank will remain in aggressive mode in policy tightening.

A brief optimism that the Fed may slow the pace in hiking rates was dampened by the remarks from Chair Powell, who said that it was still premature to discuss the possible pause in rate increases.

Markets focus on the US October job report, which is expected to show the lowest hiring in nearly two years and a moderate increase in wages, suggesting some loosening in labor market that may add to hopes of Fed’s smaller rate hike in December and cause increased volatility.

Weakened daily studies (MA’s in bearish setup and rising negative momentum), add to bearish near-term bias, though bears still look for confirmation on clear break of 1.1150 pivot that would risk drop towards key supports at 1.10 zone (daily cloud base / psychological) and 1.0922 (Oct 12 trough) in extension.

Upticks should stay capped under 20DMA / daily cloud top (1.1314/21) to keep near-term bears in play.

Res: 1.1242; 1.1321; 1.1376; 1.1412.

Sup: 1.1150; 1.1060; 1.1000; 1.0922.

Interested in GBPUSD technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD regains traction and bounces off daily lows

After bottoming out near 1.0450, EUR/USD managed to regain some balance and revisit the 1.0470 zone on the back of alternating risk appetite trends in the FX world and amid investors' assessment of the German elections.

GBP/USD hovers around 1.2630 amid a vacillating Dollar

GBP/USD alternates gains with losses in the low-1.2600s in response to the lack of a clear direction in the global markets and a lacklustre price action surrounding the Greenback.

Gold extends consolidative phase near record highs

Prices of Gold glimmered higher on Monday, hitting an all-time high around $2,955 per ounce troy on the back of the US Dollar's inconclusive price action as investors are warming up for a key inflation report due toward the end of the week.

Bitcoin Price Forecast: BTC standoff continues

Bitcoin has been consolidating between $94,000 and $100,000 since early February. Amid this consolidation, investor sentiment remains indecisive, with US spot ETFs recording a $540 million net outflow last week, signaling institutional demand weakness.

Money market outlook 2025: Trends and dynamics in the Eurozone, US, and UK

We delve into the world of money market funds. Distinct dynamics are at play in the US, eurozone, and UK. In the US, repo rates are more attractive, and bills are expected to appreciate. It's also worth noting that the Fed might cut rates more than anticipated, similar to the UK. In the eurozone, unsecured rates remain elevated.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.