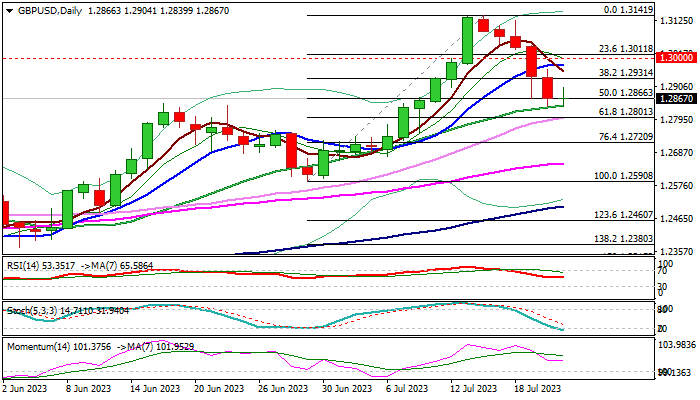

GBP/USD

Pullback from new 2023 peak extends into sixth straight day, although bears face headwinds at important support zone at 1.2866/43 (50% retracement of 1.2590/1.3141 upleg / 20DMA) and consolidating above these levels in European session on Friday.

Oversold stochastic contributes to scenario, however, consolidation is likely to be narrow and short, as dollar continues to strengthen and weighs on sterling.

Firm break of 1.2866/43 pivots is needed to generate fresh bearish signal for test of immediate support at 1.2801 (Fibo 61.8% / 30DMA) and possible stronger acceleration.

The pair is on track for bearish weekly close and the biggest weekly drop since the last week of January, with potential formation of bearish engulfing pattern on weekly chart, to add to negative signals.

Broken Fibo 38.2% (1.2931) should cap extended upticks and keep bears in play.

Res: 1.2904; 1.2931; 1.3000; 1.3041.

Sup: 1.2843; 1.2801; 1.2750; 1.2720.

Interested in GBP/USD technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD extends recovery beyond 1.0400 amid Wall Street's turnaround

EUR/USD extends its recovery beyond 1.0400, helped by the better performance of Wall Street and softer-than-anticipated United States PCE inflation. Profit-taking ahead of the winter holidays also takes its toll.

GBP/USD nears 1.2600 on renewed USD weakness

GBP/USD extends its rebound from multi-month lows and approaches 1.2600. The US Dollar stays on the back foot after softer-than-expected PCE inflation data, helping the pair edge higher. Nevertheless, GBP/USD remains on track to end the week in negative territory.

Gold rises above $2,620 as US yields edge lower

Gold extends its daily rebound and trades above $2,620 on Friday. The benchmark 10-year US Treasury bond yield declines toward 4.5% following the PCE inflation data for November, helping XAU/USD stretch higher in the American session.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.