GBP/USD

Cable bounces on Thursday and probes levels above 1.20, after regaining traction on UK political news.

The top news of the day was a resignation of British Prime Minister Boris Johnson, who decided to step down after most of the ministers from his cabinet already resigned.

Pound’s recent drop was fueled by strong demand for safe-haven dollar, on growing fears that major economies are sliding into recession.

Cable hit the lowest in over two years on Wednesday (1.1875), with profit-taking and political news offering fresh support to British pound.

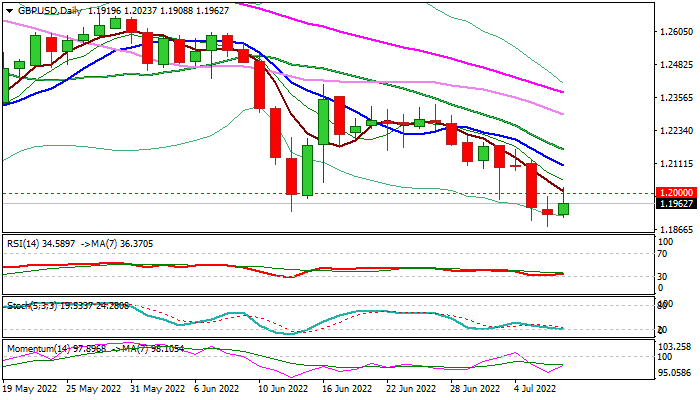

Reversal pattern is forming on daily chart, with north-heading 14-d momentum and RSI turning up from oversold zone border line, supporting the action, which sees daily close above 1.20 handle as minimum requirement for generating initial reversal signal, while extension above 1.2105 (falling 10DMA / 50% retracement of 1.2325/1..1875 bear-leg) would confirm signal and put bears on hold.

On the other side, larger structure is firmly bearish and fundamentals remain generally negative, with failure to clearly break 1.20 barrier (weekly close above this level) to signal that current action would be likely short-lasting consolidation before bears resume.

Confirmation of such scenario would require a clear break of longer-term key supports at 1.1958/30 (Sep 2021 / Oct 2016) to open way towards critical support at 1.1409 (2020 low).

Res: 1.2000; 1.2037; 1.2104; 1.2158.

Sup: 1.1908; 1.1875; 1.1822; 1.1751.

Interested in GBP/USD technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD stays near 1.0800 after US data, eyes on Trump's tariff decisions

EUR/USD continues to trade at around 1.0800 on Wednesday as investors refrain from taking large positions ahead of US President Donald Trump's tariff announcements. Meanwhile, the data from the US showed that employment in the private sector rose by 155K in March.

GBP/USD trades with caution above 1.2900, awaits Trump’s tariffs reveal

GBP/USD trades marginally higher on the day above 1.2900 as the US Dollar fails to benefit from the upbeat employment data. Traders remain wary and refrain from placing fresh bets on the major, anticipating the US 'reciprocal tariffs' announcement on "Liberation Day' at 20:00 GMT.

Gold stabilizes above $3,110 ahead of Trump's tariffs announcement on “Liberation Day”

Gold fluctuates in a narrow channel above $3,110 after correcting from the record-high it set near $3,150 on Tuesday. XAU/USD struggles to find direction before US President Donald Trump officially announces the reciprocal tariff implementation at the White House later this Wednesday.

Liberation day arrives, the fight back begins

Investors have been waiting for the announcement of Trump’s reciprocal tariffs, and today it will arrive. The President is set to announce the tariff arrangement at 2000 GMT, after US stock markets have closed.

Is the US economy headed for a recession?

Leading economists say a recession is more likely than originally expected. With new tariffs set to be launched on April 2, investors and economists are growing more concerned about an economic slowdown or recession.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.