GBP/USD: Initial resistance at $1.2420 is preventing a test of the $1.2485 range high [Video]

![GBP/USD: Initial resistance at $1.2420 is preventing a test of the $1.2485 range high [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/GBPUSD/british-banknotes-14144912_XtraLarge.jpg)

GBP/USD

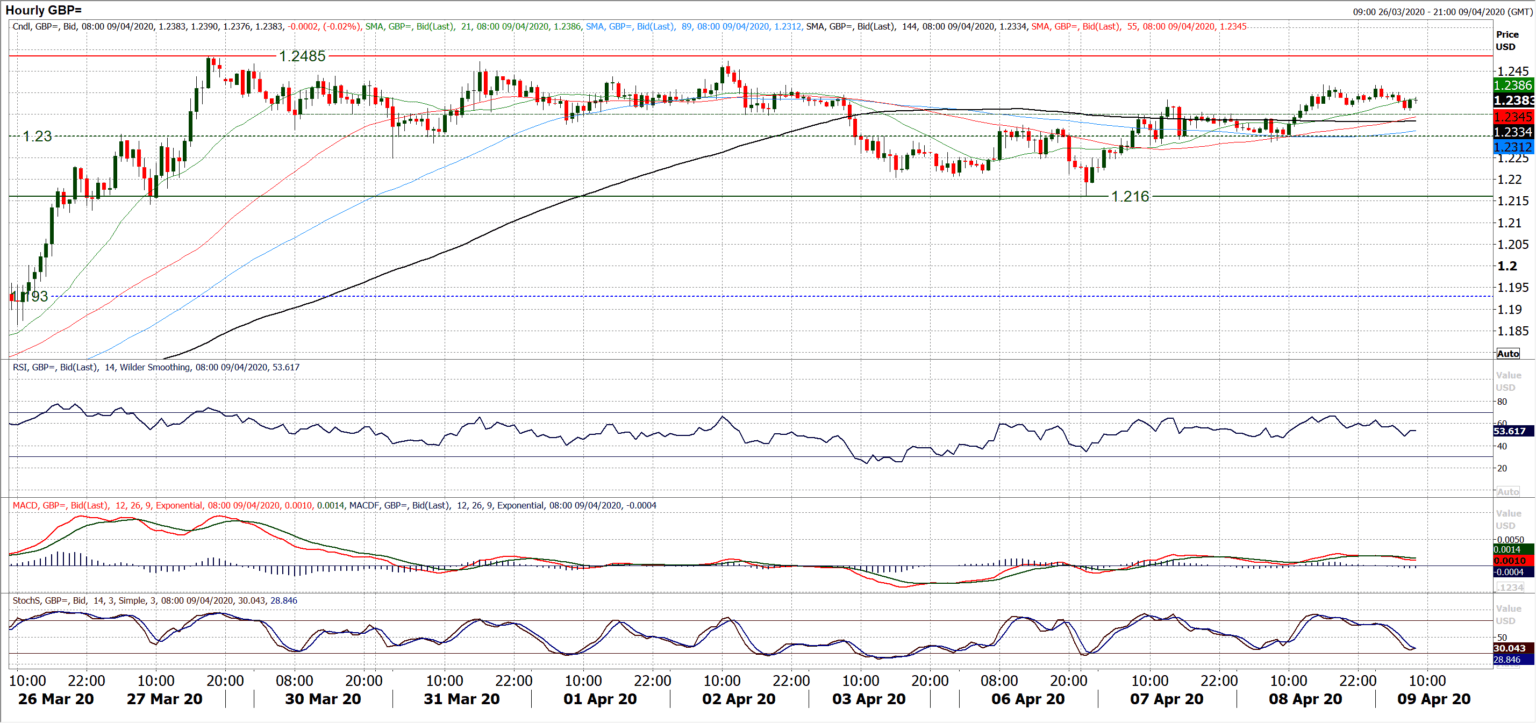

We have been seeing an increasingly settled outlook on Cable for over a week now. The negative aspects of last Friday’s breakdown below $1.2300 have been neutralised by a couple of recovery candles in the past two sessions. The move has also formed good support now at $1.2160 and we see Cable as a range play between $1.2160/$1.2485. This comes with momentum indicators mixed to slightly positive still. Stochastics and MACD lines are strengthening, whilst RSI is now hovering bang on 50. The hourly chart now reflects this very mild positive bias within the consolidation as the market trades slightly above what is effectively a mid-range pivot band of support $1.2300/$1.2350. As we move into the European session, there is a slight rolling over and how the market reacts to $1.2300 will determine whether this positive bias turns to a near term mild negative bias. Hourly momentum oscillating calmly between 35/65 throughout this week reflects the ranging conditions. Initial resistance at $1.2420 is preventing a test of the $1.2485 range high.

Author

Richard Perry

Independent Analyst