The British Pound flirted with its recent highs against the greenback, advancing up to 1.5670 in the European opening, and on broad dollar weakness. However, much worse-than-expected local retail sales figures, have sent the GBP/USD pair into negative territory, back below the 1.5600 level and to a daily low of 1.5586. UK retail sales unexpectedly declined 0.2% in June, dragging the annual reading lower to 4.0% from a previous revised 4.7% and expectations of a 4.9% advance.

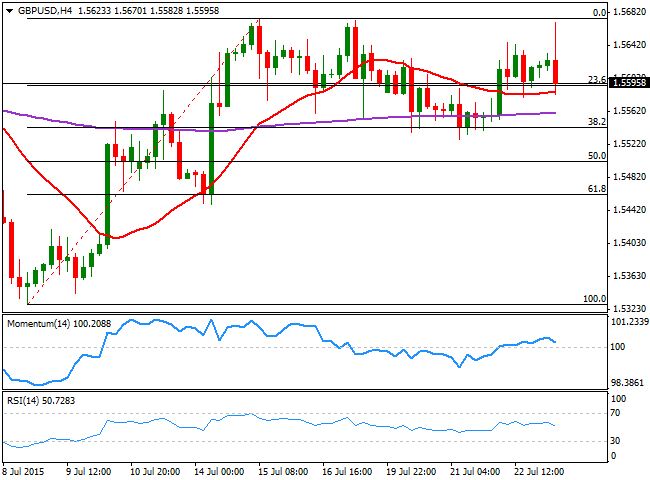

The GBP/USD pair trades around the 23.6% retracement of its latest bullish run around 1.5590, and the 4 hours chart shows that the price is pressuring its 20 SMA, a few pips below the mentioned Fibonacci level, whilst the technical indicators have turned lower in neutral territory, showing no directional strength at the time being. At this point the pair needs to accelerate below the 1.5580 support level to confirm additional declines towards the 1.5520/40 region, albeit further slides seem unlikely for today.

To the upside, some steady gains above 1.5620 are required may see the pair recovering the lost ground and return to its recent highs around 1.5670.

View live chart of the GBP/USD

Recommended Content

Editors’ Picks

AUD/USD: The hunt for the 0.7000 hurdle

AUD/USD quickly left behind Wednesday’s strong pullback and rose markedly past the 0.6900 barrier on Thursday, boosted by news of fresh stimulus in China as well as renewed weakness in the US Dollar.

EUR/USD refocuses its attention to 1.1200 and above

Rising appetite for the risk-associated assets, the offered stance in the Greenback and Chinese stimulus all contributed to the resurgence of the upside momentum in EUR/USD, which managed to retest the 1.1190 zone on Thursday.

Gold holding at higher ground at around $2,670

Gold breaks to new high of $2,673 on Thursday. Falling interest rates globally, intensifying geopolitical conflicts and heightened Fed easing bets are the main factors.

Bitcoin displays bullish signals amid supportive macroeconomic developments and growing institutional demand

Bitcoin (BTC) trades slightly up, around $64,000 on Thursday, following a rejection from the upper consolidation level of $64,700 the previous day. BTC’s price has been consolidating between $62,000 and $64,700 for the past week.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.