GBP/USD Forecast: Which way out of the wedge? Fundamentals and technicals battle it out

- GBP/USD has been pressured by Brexit uncertainty and the BOE's dovishness.

- Brexit developments, UK inflation figures, and US consumer data are set to move markets.

- Early January's daily chart is painting a bullish picture.

- The FX Poll is pointing to gains in the medium and long terms.

The Bank of England is back – it has had the most significant impact on the pound – leaving politics behind. Will sterling continue sliding? A mix of notable figures from both sides of the Atlantic and also Brexit are set to drive GBP/USD.

This week in GBP/USD: Carney carnage beats Mid-East, Brexit

Mark Carney, the outgoing Governor of the Bank of England, has weighed heavily on the pound. After months of trying not to rock the boat, the central banker said that the BOE's response to a slowdown may be prompt and that it has ample room to move.

To be fair to the governor, pound/dollar had already been pressured beforehand. The heightened tensions between the US and Iran sent traders to the safety of the US dollar, among other assets. America's killing of top Iranian general Qassem Suleimani and the consequent Iranian attack US bases – all happening in Iraq – grabbed the headlines. Later on, when both countries backed down from the brink of broader military confrontation, the greenback remained bid.

US economic figures were initially supportive of the dollar. The ISM Non-Manufacturing Purchasing Managers' Index for December beat expectations with 55 points – showing that America's services sector is doing well despite the manufacturing slump. Concerns if a recession has eased.

Friday's Non-Farm Payrolls changed the picture, as the figures missed expectations with only 145,000 jobs gained and wage growth at 2.9%. However, the greenback's retreat was limited.

Also, in the UK, Markit's final Services PMI for December exceeded estimates and hit 50 points – precisely the threshold separating expansion from contraction. Nevertheless, Carney's words and Brexit uncertainty carried a greater weight – to the downside.

Ursula von der Leyen, President of the European Commission, and Michel Barnier, the EU's top Brexit negotiator, visited Prime Minister Boris Johnson – and reaffirmed their pessimistic stance. Brussels remains skeptical about reaching a new trade deal by the end of the year – when the transition period ends.

Britain is on course to leave the bloc at the end of the month, but the UK retains most rights and obligations as a de-facto member during the transition period. Johnson has ruled out extending this implementations phase, and the tight deadline poses a "huge challenge" – as Barnier stated.

UK events: GDP, inflation, retail sales, and also Brexit

Speculation about the UK-EU relations after Brexit will likely remain a key driver of sterling. Any reports of progress could push the pound higher, while acrimony may weigh on it.

The significant volatility that Carney triggered raises expectations that economic indicators also have room to rock the pound.

The UK publishes monthly Gross Domestic Product figures for November on Monday. The economy stagnated in October, and a repeat of 0% growth is on the cards for November. Industrial output is also of interest. Britain escaped a recession by returning to expansion in the third quarter.

The BOE will watch inflation figures for December on Tuesday. The headline Consumer Price Index disappointed by decelerating to 1.5% in November, falling further away from the bank's 2% target. A small bump up may be seen now, given higher energy prices.

The final top-tier publication is of retail sales for December on Thursday. The statistics for November probably missed the late Black Friday shopping festivity and showed a drop of 0.6% in both headline and core sales. Data for December will likely show a rebound in the lead to Christmas.

Here is the list of UK events from the FXStreet calendar:

US events: Trade, the Fed, and consumer data

While the Mid-East will likely return to the back burner, Sino-American relations return to center-stage. Chinese Vice Premier Liu He will lead a delegation to Washington to sign Phase One of the trade deal. The world's largest economies clinched an accord in mid-December – but refrained from releasing the full document. Investors will pore over the details of the 86-page document.

If investors see the agreement only as a temporary detente, markets may suffer, and the safe-haven dollar may find demand. If markets are content with the deal and foresee Phase Two as feasible, the greenback may give ground.

The US economic calendar focuses on the consumer. Annual Core CPI – the most significant figure – will likely remain around 2.3%. Any increase may boost the dollar as the Federal Reserve has low expectations for inflation.

After meager increases in November, economists expect more significant rises in US retail sales in December – for the same reason as in the UK, Black Friday.

The US economy is centered around consumption, and apart from past sales, markets are interested in future activity. The University of Michigan's first Consumer Sentiment release for 2020 is set to show ongoing upbeat confidence with a score close to 100. These preliminary figures for January will have the last word of the week.

Here the upcoming top US events this week:

GBP/USD Technical Analysis

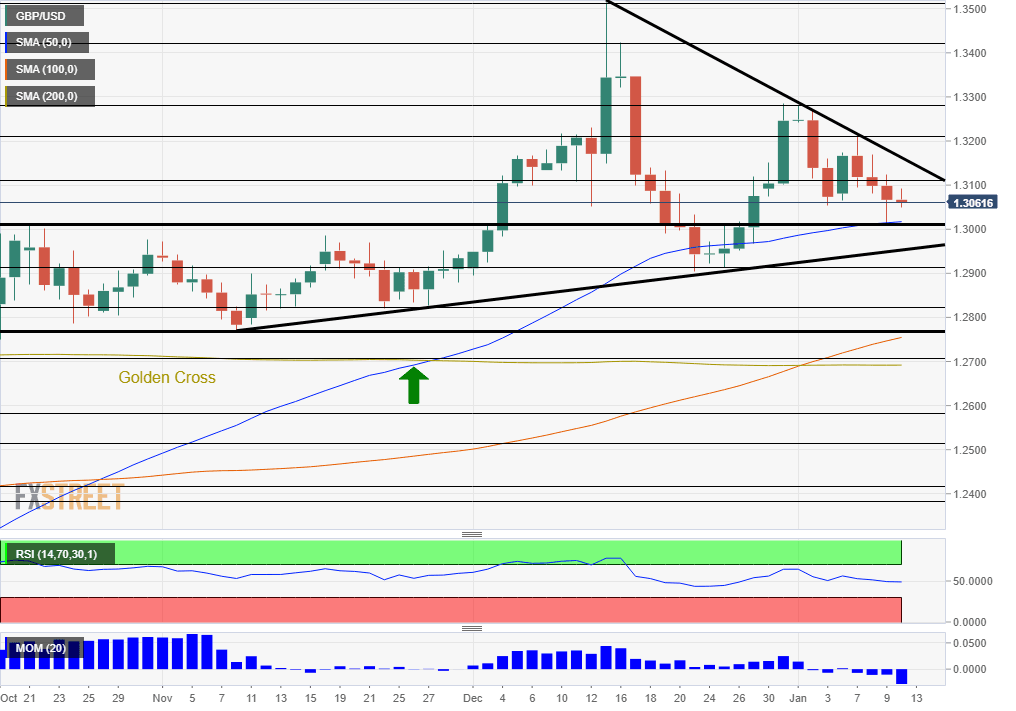

Pound/dollar is trading within a narrowing triangle or wedge. Uptrend support is more moderate and began in November. Downtrend resistance is steeper and kicked off at the peak of 1.3510 around the elections. Overall, support is stronger.

While momentum is to the downside, GBP/USD is trading above the 50, 100, and 200-day Simple Moving Averages – a bullish sign. The recent drop found support exactly at the 50-day SMA.

All in all, the picture is bullish.

Critical support awaits at 1.3010, which capped cable in October and also in January. It is followed by 1.2920, which was a swing low around Christmas. Next, we find 1.2820, which provided support in November. Another critical line is 1.2775, which worked as support in November and also converges with the 100-day SMA.

Resistance awaits at 1.31, which worked as support in early December. It is followed by 1.32 and 1.3285, which were swing highs in early January. 1.3410 and 1.3510 were the mid-December election highs.

GBP/USD Sentiment

After the Christmas elections rollercoaster, it is time for a reality check – and UK data may be the next trigger for a sell-off.

The FX Poll is showing that experts see the pound recovering and rising over the medium and long terms. However, average targets have been left mostly unchanged in the past week.

Related Forecasts

- GBP/USD Price Forecast 2020: Pound may continue to fall on hard Brexit deadline

- USD/JPY Forecast: Has it gone too far? Top-tier consumer data, trade headlines

- EUR/USD Forecast: Dollar rules in a messy world

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.