GBP/USD Forecast: Under pressure, more slides ahead

GBP/USD Current Price: 1.3055

- BOE policymakers reinforcing Carney’s hints about coming rate cuts.

- UK data to be out this Monday expected to show the economy deteriorating further.

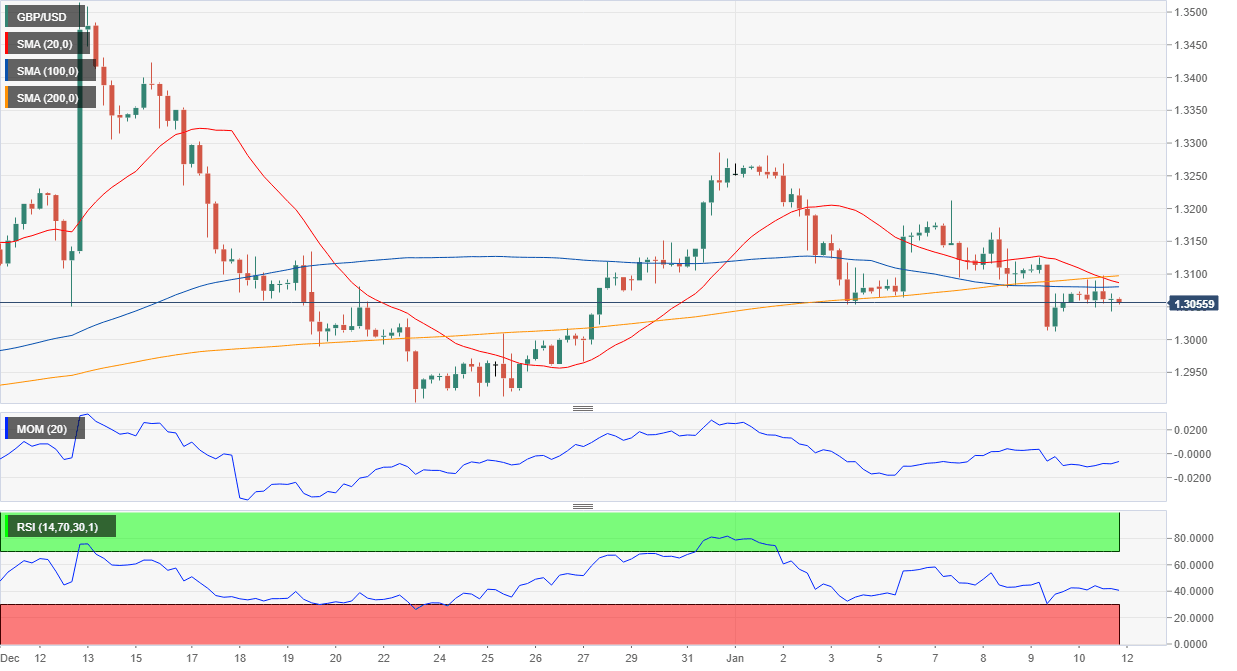

- The GBP/USD pair is neutral-to-bearish, could resume slide once below 1.3015.

The GBP/USD pair finished Friday pretty much unchanged at 1.3055, down for the week amid dollar’s persistent strength. Late Thursday, the UK House of Commons approved PM Johnson’s Withdrawal Agreement Bill, as expected. The event had no impact on GBP crosses, although it kept the Pound subdued, amid concerns the UK could crash out of the EU without a proper deal. Comments from BOE’s Governor, Mark Carney, added weight on the currency, as he hinted that the central bank might need to cut rates.

During the weekend, BOE’s member, Gertjan Vlieghe said that he would vote in favour of a looser monetary policy when the Monetary Policy Committee meets later this month, which will probably keep Sterling in the losing side.

This Monday, the UK will release November Industrial Production and Manufacturing Production, both seen falling further yearly basis. The kingdom will also release its Trade Balance for the same month, and monthly GDP estimates. In general, the economy is seen deteriorating further, amid Brexit uncertainty.

GBP/USD short-term technical outlook

The GBP/USD pair is stuck around the 23.6% retracement of its latest daily slump and gaining bearish potential according to technical readings. In the daily chart, a mild-bearish 20 DMA capped the upside by the end of the week, providing dynamic resistance at around 1.3100. Technical indicators hover around their midlines without clear directional strength. In the 4-hour chart, the pair is neutral-to-bearish, developing below a congestion of moving averages, and as technical indicators head south below their midlines. The weekly low at 1.3012 is the immediate support, while a more relevant one comes at 1.2970.

Support levels: 1.3015 1.2970 1.2925

Resistance levels: 1.3100 1.3140 1.3185

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.