- A Brexit deal seems with reach – and the saga is nearing an end in any case.

- Sterling has room to rise amid Britain's robust covid vaccine preparedness.

- The central bank's readiness to fund the government generously is another factor

A picture of political chaos is a conclusion one could come to when reading British newspapers – and that would be unfavorable for the pound. Prime Minister Boris Johnson has been ceding ground to the opposition Labour Party, clashing with Conservative MPs, and losing top advisors.

Most recently, he was forced to isolate again, after being exposed to someone testing positive for COVID-19. However, politics is not everything There are three reasons to be bullish on GBP/USD.

1) Brexit will soon be over

Sterling has been jumping up and down in response to the daily see-saw of Brexit headlines. That has been the pattern in the past few weeks – and also the past four and a half years since the EU Referendum. GBP/USD is still below the June 23 2016 levels near 1.50 and it is unclear if it can attack that level. Nevertheless, the seemingly endless saga will soon be over.

The UK has formally left the bloc in January this year but is still in a transition period that expires at year-end. The 2019 Brexit Withdrawal Agreement – aka the "divorce deal" has settled the burning issues of financial settlements and citizens' rights.

What is discussed right now is the future of trade relations between the EU and the UK – undoubtedly important, yet without the "cliff-edge" risk. The difference is between agreeing on more favorable or less favorable commerce arrangements, not an economic paralysis.

Moreover, the economic risks of a no-trade-deal are unlikely to be fully felt as the economic damage from the pandemic is far more significant. Nevertheless, there are reasons to believe that London and Brussels will eventually strike a deal.

First, negotiators have made substantial progress on most topics, leaving only two main issues on the agenda – fisheries and state aid, where there have been reports about "bending red lines."

Second, the incoming Joe Biden administration in America has warned Britain that any risk to the peace agreement in Ireland would deny the UK a trade deal with the US.

Third, circling back to New Year's Eve – there is nothing like a deadline to sharpen minds. Both sides would prefer smooth trade in the post-Brexit world and may save the most painful compromises to the last minute.

2) Vaccine readiness

Johnson and his colleagues have been at the receiving end of immense – and mostly justified – criticism about their handling of the pandemic. From the lack of Personal Protective Equipment (PPE) in the spring through the PM's U-turn on a second nationwide lockdown.

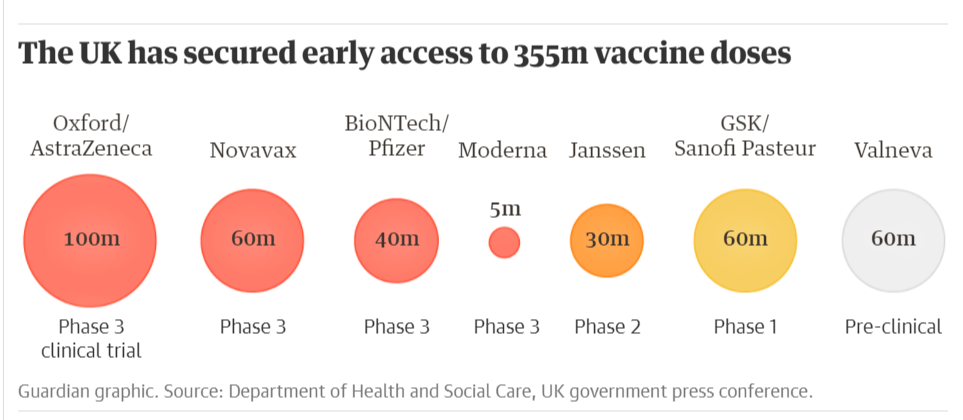

However, there is at least one thing the UK got right – its vaccine strategy. Officials set up a task force handling immunization and this group successfully secured deals worth 355 million vaccine doses from seven companies that are at different stages of trials.

Source: The Guardian

Most immunization treatments require two doses and some of the material will likely be lost in processes or due to extremely cold storing conditions. Nevertheless, the total UK population is just under 67 million people and two jabs for each person amounts to 134 million shots in the arm.

The total of 355 million doses, including 200 million doses within Phase 3 trials, puts the UK on a sound footing to exit the crisis faster than its peers.

3) Bailey ready to buy bonds

When the Bank of England first announced its Asset Purchase Facility program in 2009, it sent the pound down. Buying bonds using money created out of thin air devalued the currency – following a pattern that happened all over the world. While the same logic still applies for the US dollar, the pandemic changed that reaction function for the pound and also the euro.

Each time the "Old Lady" announced it would buy more bonds – in March, June, and November – sterling jumped. Why?

These moves by the BOE were quickly followed by announcements of additional fiscal stimulus by the government. In the latest iteration, the treasury waited for the bank to extend its furlough scheme, putting more money in the pockets of those unable to work due to the pandemic. In turn, that means a stronger economy – and a more robust currency.

Critics may say that such moves amount to monetary financing or Modern Monetary Theory (MMT) that would create inflation down the road. Nevertheless, in the era of the pandemic and after years of nearly non-existent inflation, investors favor the promise of near-term growth over any long-term fears.

The US is hesitating about additional fiscal stimulus and central bank orthodoxy in Europe is still limiting such bold moves. That leaves room for sterling to shine.

Conclusion

With the US elections in the rear-view mirror and looking toward year-end, GBP/USD has room to rally. The mix of an end to the Brexit saga, the UK's vaccine preparedness, and its generous central bank all set up the pound for upside success.

See What you need to know about the dollar in the post-vaccine announcement world

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD struggles to hold above 1.0400 as mood sours

EUR/USD stays on the back foot and trades near 1.0400 following the earlier recovery attempt. The holiday mood kicked in, keeping action limited across the FX board, while a cautious risk mood helped the US Dollar hold its ground and forced the pair to stretch lower.

GBP/USD approaches 1.2500 on renewed USD strength

GBP/USD loses its traction and trades near 1.2500 in the second half of the day on Monday. The US Dollar (USD) benefits from safe-haven flows and weighs on the pair as trading conditions remain thin heading into the Christmas holiday.

Gold hovers around $2,610 in quiet pre-holiday trading

Gold struggles to build on Friday's gains and trades modestly lower on the day near $2,620. The benchmark 10-year US Treasury bond yield edges slightly higher above 4.5%, making it difficult for XAU/USD to gather bullish momentum.

Bitcoin fails to recover as Metaplanet buys the dip

Bitcoin hovers around $95,000 on Monday after losing the progress made during Friday’s relief rally. The largest cryptocurrency hit a new all-time high at $108,353 on Tuesday but this was followed by a steep correction after the US Fed signaled fewer interest-rate cuts than previously anticipated for 2025.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.