- GBP/USD has been attempting to recover from Wednesday's Fed-related dollar strength.

- The BOE's Super Thursday decision may see more appetite for tightening.

- Momentum on the four-hour chart has turned to the upside, a bullish signal.

Which central bank will print less of its currency earlier? That is the main question for GBP/USD traders as tensions rise toward the Bank of England's "Super Thursday" decision.

Cable has some distance to climb and recover from Wednesday's dollar surge. Federal Reserve Vice-Chair Richard Clarida said he supports announcing a taper already this year and sees risks to his inflation outlook as being to the upside. While he refrained from backing an outright reduction of the Fed's bond buys in 2021, moving forward with stating it is already a step toward tightening.

Clarida's comments were also backed up by Mary Daly of the San Francisco Fed – usually a dove – who even said that tapering could come as early as this year. The prospects of printing fewer dollars sent the greenback higher and stole the show from mixed economic data.

ADP's Nonfarm Payrolls report badly disappointed with an increase of only 330,000 private-sector jobs last month. On the other hand, the ISM Services Purchasing Managers' Index surprised with a sky-high score of 64.1 points – including a rise in the Employment component. The data serve as clues toward Friday's Nonfarm Payrolls.

More Inflation, the chip shortage and Delta are peaking, what it means for markets and the dollar

The focus now shifts to the pound and the BOE's triple release of its rate decision, meeting minutes and the quarterly Monetary Policy Report – which makes it a "Super Thursday" decision. Similar to the Fed, the "Old Lady" is set to leave its policy unchanged for now, but to include voices calling for tighter policy.

Monetary Policy Committee member Michael Saunders is projected to vote in favor of tapering the BOE's £895 billion bond-buying scheme and remain the sole dissenter. In that case, sterling has room to fall. However, if he is joined by Dave Ramsden or other members, the pound could climb on prospects of action coming sooner than later.

UK inflation hit 2.5% in June, exceeding the bank's target, while unemployment remains low. On the other hand, the government's furlough scheme is set to expire next month and price rises could provide temporary.

See BOE Preview: Five reasons the doves are set to win Super Thursday, GBP/USD may dip

Overall, the battle between central banks is critical to the next moves – and especially the voices of those members that do not toe the line.

GBP/USD Technical Analysis

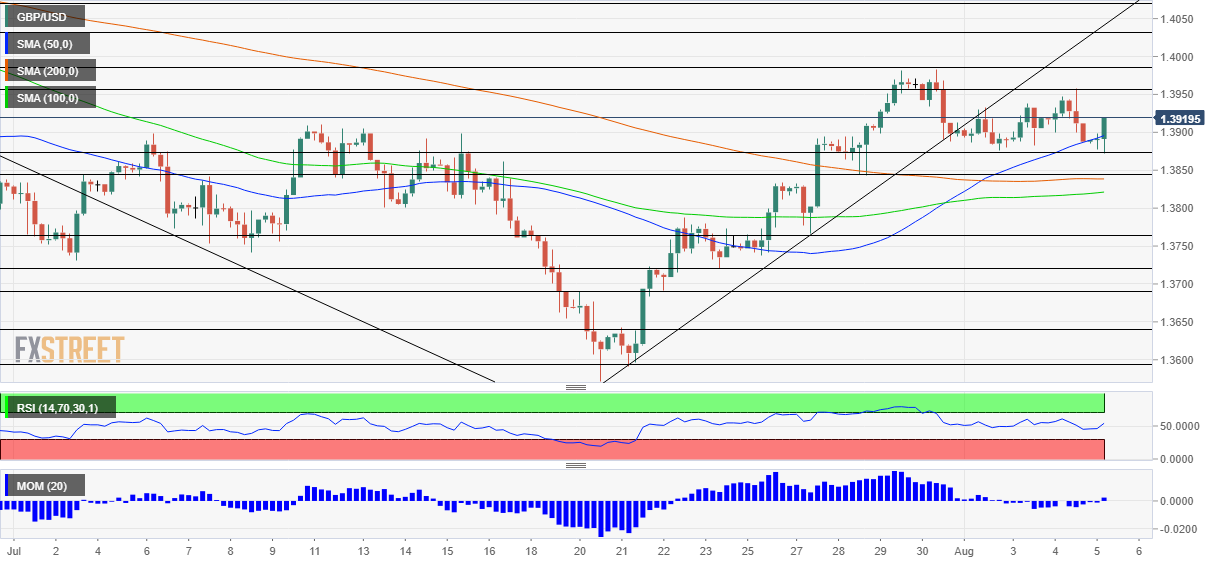

Momentum on the four-hour chart has turned positive, a bullish sign. Moreover, pound/dollar avoided falling off the 50 Simple Moving Average and trades above the 100 and 200 SMAs – another positive development.

Some resistance is at the daily high of 1.3925, followed by 1.2950, which was Wednesday's peak. Further above, 1.3980 was July's high point.

Support is at the daily low of 1.3870, followed by 1.3845 and 1.3760.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Gold trades near record-high, stays within a touching distance of $3,100

Gold clings to daily gains and trades near the record-high it set above $3,080 earlier in the day. Although the data from the US showed that core PCE inflation rose at a stronger pace than expected in February, it failed to boost the USD.

EUR/USD turns positive above 1.0800

The loss of momentum in the US Dollar allows some recovery in the risk-associated universe on Friday, encouraging EUR/USD to regain the 1.0800 barrier and beyond, or daily tops.

GBP/USD picks up pace and retests 1.2960

GBP/USD now capitalises on the Greenback's knee-jerk and advances to the area of daily peaks in the 1.2960-1.2970 band, helped at the same time by auspicious results from UK Retail Sales.

Donald Trump’s tariff policies set to increase market uncertainty and risk-off sentiment

US President Donald Trump’s tariff policies are expected to escalate market uncertainty and risk-off sentiment, with the Kobeissi Letter’s post on X this week cautioning that while markets may view the April 2 tariffs as the "end of uncertainty," it anticipates increased volatility.

US: Trump's 'Liberation day' – What to expect?

Trump has so far enacted tariff changes that have lifted the trade-weighted average tariff rate on all US imports by around 5.5-6.0%-points. While re-rerouting of trade will decrease the effectiveness of tariffs over time, the current level is already close to the highest since the second world war.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.