While the economic fundamentals support Sterling firmly anchored above $1.3000 against the US Dollar, the political uncertainty weighs heavily on GBP/USD currency pair. The data-intensive week ahead should set the clear signal about pair’s further direction with the bias being bearish ahead of CPI, PPI, labor market data and retail sales reports next week.

Closing the week around $1.3200 level, Sterling has erased about half of loses stemming from the ultra-dovish rate outlook from the Bank of England during the second week of November. Economic fundamentals are running positive with both manufacturing output and GDP estimate from UK’s NIESR support GBP/USD, while politics including Brexit negotiations remain the key risk for the currency pair.

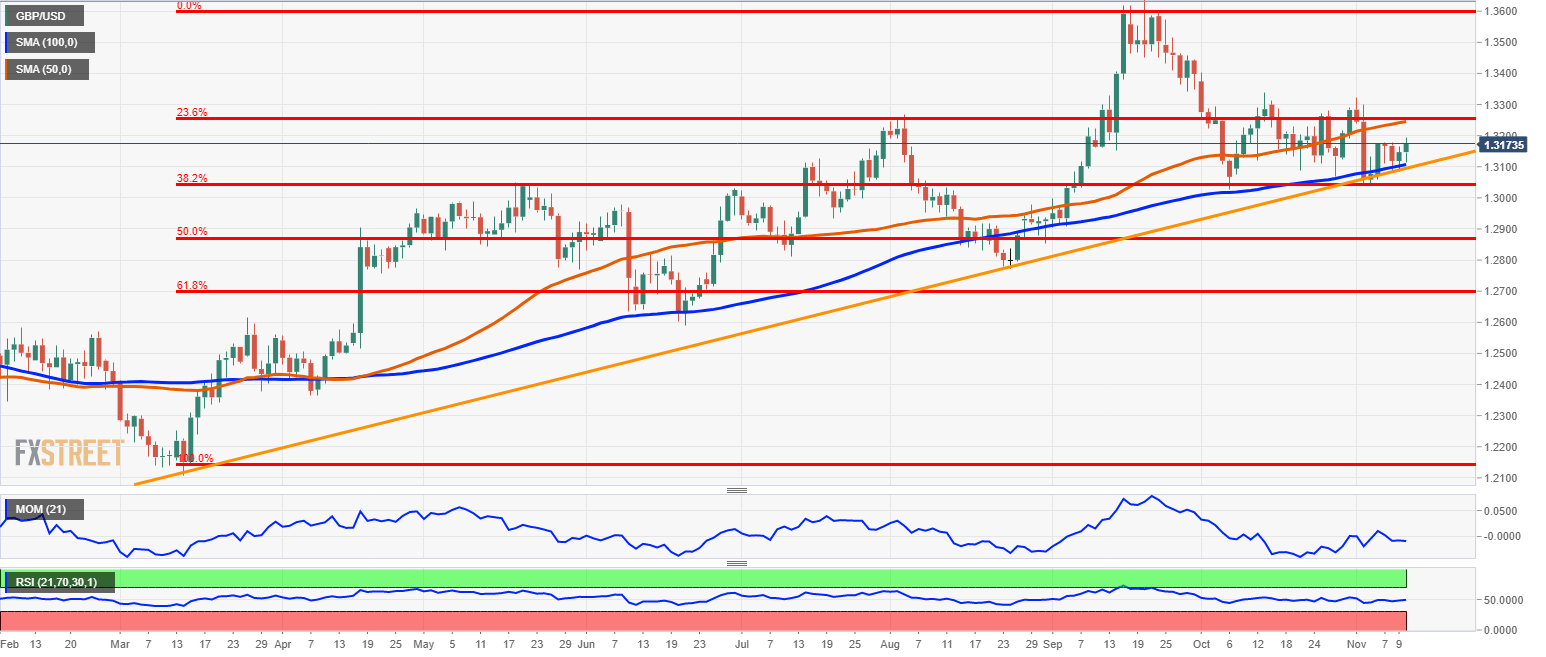

Technically is Sterling heavy, stuck to key support levels. Sterling is holding on tight to support line of its uptrend starting in mid-March and also trades above key Fibonacci support of $1.3040. While above the Fibonacci retracement line, Sterling is still technically supported.

Key data in week ahead

As fundamentals are key drivers for GBP/USD, next week will be of particular interest for the markets.

On Tuesday set of inflation indices including CPI, PPI, and home prices are scheduled, with markets expecting CPI to rise 0.2% m/m while rising 3.1% over the year in October. Inflation, the Bank of England’s biggest fear, is expected to accelerate further from September, but possibly peaking as the effect of Sterling’s past depreciation feeding into prices starts to dissipate.

On Wednesday, the Office for National Statistics released labor market report with unemployment expected to dwell at the 40-year low of 4.3% while closely watched wage growth is seen decelerating further and rise only by 2.0% over the year.

Thursday’s retail sales report should see sales unchanged in October from the previous month after falling 0.8% m/m in September. On Thursday, policymakers from the Bank of England including Governor Carney and Deputy Governor Broadbent, chief economist Haldane and long-time rate dove Cunliffe speaking in Liverpool.

Politics

No formal announcement was made about the ongoing Brexit negotiations during the second week of November, so the chances of striking a deal before December EU summit are 50%/50%. All we know is that EU is giving the UK two weeks to finalize the Brexit bill proposal before the EU summit in December and that can be scary.

The Recent political scandal with the UK Prime Minister Theresa May losing control of her government while dismissing second government minister in last two weeks weighs on Sterling. Nevertheless, the relationship between UK internal politics and FX market is rather unclear.

Last week’s summary

The only important economic indicator during the second week of November surprised on the upside as the UK manufacturing output increased 0.7% over the month and 2.7% over the year in September.

Adding to the picture was the GDP estimate from NIESR that sees GDP rising 0.5% in three months ending in October, up from 0.4% in September. Unlike European Commission’s forecast, NIESR said it sees the pattern of demand in the UK economy to rebalance towards international trade in response to strengthening global growth.

Long-term economic forecast for the UK is less rosy with European Commission cutting the growth rate outlook for the UK in 2018 and 2019 while raising the outlook for rest of Europe.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

AUD/USD struggles near multi-month low; remains below 0.6500 after Aussie jobs report

AUD/USD hangs near its lowest level since August 6 and remains below the 0.6500 psychological mark following the release of rather unimpressive Australian employment details. RBA Governor Michele Bullock said this Thursday that interest rates were restrictive enough and will not rise any further.

USD/JPY stands firm near multi-month top, above mid-155.00s

USD/JPY holds steady near its highest level since July 24, above mid-155.00s during the Asian session on Thursday and seems poised to prolong its appreciating move. The continuation of the Trump trade lifts the USD to a fresh YTD high.

Gold price remains vulnerable near its lowest level since September 19

Gold price enters a bearish consolidation following a four-day decline to a nearly two-month low amid oversold conditions on hourly charts. Any meaningful recovery, however, seems elusive amid the recent USD bullish run to a fresh YTD low, bolstered by expectations for US President-elect Donald Trump's expansionary policies and elevated US bond yields.

Dogecoin Price Forecast: Miners offload $240M as DOGE approaches risk zone

Since Donald Trump’s victory on November 5, Dogecoin has emerged as the best performing asset among the top 10 ranked cryptocurrencies. On November 12, DOGE reached a new milestone price propelled by Trump’s statement confirming Elon Musk’s involvement in the incoming administration.

Trump vs CPI

US CPI for October was exactly in line with expectations. The headline rate of CPI rose to 2.6% YoY from 2.4% YoY in September. The core rate remained steady at 3.3%. The detail of the report shows that the shelter index rose by 0.4% on the month, which accounted for 50% of the increase in all items on a monthly basis.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.