GBP/USD Forecast: Sterling bulls fully dependent on dollar weakness, critical US CPI eyed

- GBP/USD has benefited from pre-US inflation dollar weakness.

- UK jobless claims missed estimated, falling less than expected.

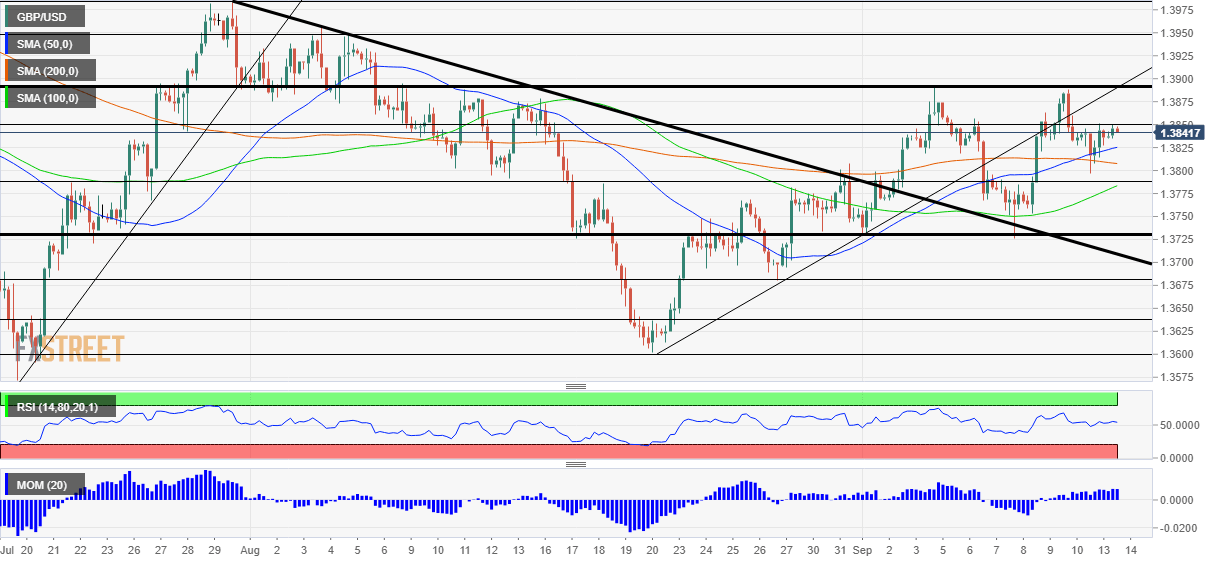

- Tuesday's four-hour chart shows a well-defined range, with bulls in the lead.

Benefiting from the misery of others has its limits – GBP/USD has resumed its falls in response to unconvincing UK labor figures. The Claimant Count Change – aka jobless claims – dropped by only 58,600 in August, weaker than over 70,000 expected. That shows Britain's recovery is slowing down.

Figures for July were more upbeat, showing a drop in the Unemployment Rate from 4.7% to 4.6%, as expected. Excluding bonuses, wage growth remained elevated at 8.3% YoY, marginally above 8.2% projected. Nevertheless, the more recent figures carry more weight.

Moreover, millions of Brits are still on furlough schemes which are on course to be phased out. Slower growth and weaker government support mean higher uncertainty and potentially a delay in the Bank of England's path of rate hikes. Wednesday's UK inflation report will provide further data, but parallel figures on the other side of the pond are more important on Tuesday.

The headline US Consumer Price Index (CPI) is projected to drop from the highs, but remain at 5.3%. Investors will likely focus on Core CPI – which the Federal Reserve also watches closely – and that is predicted to decline from 4.3% to 4.2% YoY. The Fed's target is 2%.

Jerome Powell, Chair of the Federal Reserve, signaled the bank is unlikely to taper the bank's bond-buying scheme in next week's meeting. Nevertheless, persistently fast price rises may erode his argument that prices rises are transitory and open the door to reducing stimulus in the following meeting. Tapering remains critical to traders.

US Inflation Preview: CPI critical for taper, three scenarios for the dollar

On Monday, markets recovered from last week's declines, and the better mood weighed on the safe-haven dollar. On Tuesday, it is all about CPI.

Apart from Britain's jobs data and US inflation, Brexit headlines refuse to disappear. Chief UK Negotiator David Frost insisted that the EU "must move" on the Northern Irish protocol. He threatened a unilateral suspension of trade arrangements. The issue adds to pressure on the pound.

GBP/USD Technical Analysis

Pound/dollar is confined to a clear range in September – support is at the double-bottom 1.3725 and robust resistance is at 1.3895, a quadruple top, which held cable down since mid-August. Momentum on the four-hour chart is to the upside and the currency pair trades above the 50 and 200 Simple Moving Averages.

Above 1.3895, the next levels to watch are 1.3950, 1.3985 and 1.4010.

Support awaits at 1.3785, followed by 1.3725 mentioned earlier, and then by 1.3675.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.