GBP/USD Forecast: Sellers eye a drop below 1.3400

- GBP/USD has started to edge lower toward the lower limit of trading range.

- Renewed dollar strength is weighing on the pair ahead of the New Year holiday.

- UK PM Johnson will reportedly assess Omicron data next Monday.

GBP/USD has reversed its direction after climbing to its highest level in more than a month at 1.3463 on Tuesday. The pair is closing in on key 1.3400 support and additional losses could be witnessed if buyers fail to defend that level.

The negative shift witnessed in market sentiment seems to be weighing on GBP/USD early Wednesday by providing a boost to the safe-haven greenback. The number of new Coronavirus cases globally is rising at an unprecedented pace and investors grow increasingly concerned about the potential negative impact on the economic activity.

Scotland, Wales and Northern Ireland have already announced additional restrictions focusing on indoor gatherings but several news outlets reported that British Prime Minister Boris Johnson will assess the latest data next Monday. On Tuesday, the UK reported nearly 130,000 new cases.

There won't be any high-tier macroeconomic data releases in the remainder of the week and investors could opt to stay away from risk assets heading into the New Year.

GBP/USD Technical Analysis

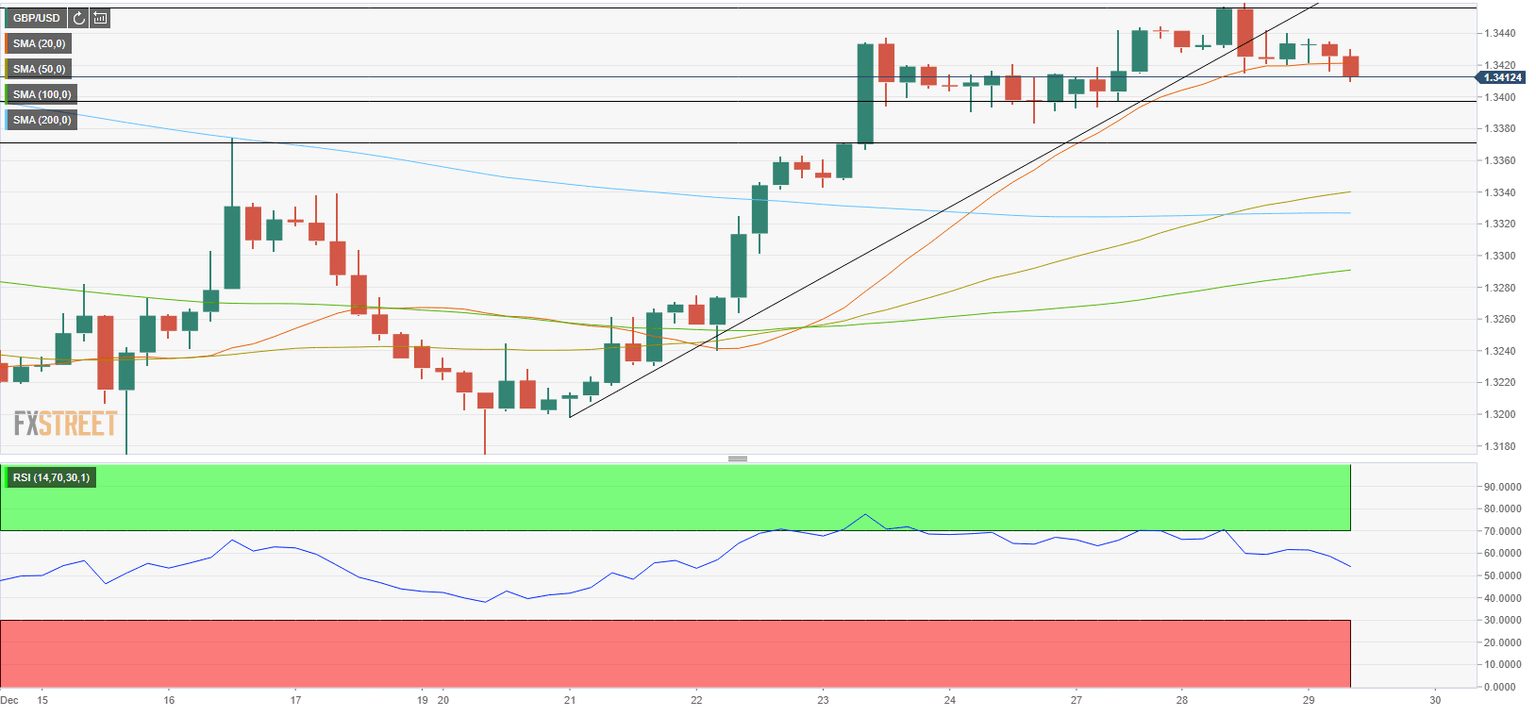

With the sharp decline witnessed late Tuesday, GBP/USD broke below the ascending trend line coming from December 21. Additionally, the Relative Strength Index (RSI) indicator on the four-hour chart returned to 50, confirming the view that the pair has lost its bullish momentum.

On the downside, the lower-limit of the weekly trading range is forming key support at 1.3400. In case this level turns into resistance, additional losses toward 1.3370 (former resistance) could be witnessed before 1.3330 (200-period SMA).

The 20-period SMA acts as interim resistance at 1.3420 before 1.3460 (static level) and 1.3500 (psychological level).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.