GBP/USD Forecast: Sellers could take action if 1.2000 fails

- GBP/USD has recovered modestly after having declined toward 1.2000.

- The technical outlook suggests that buyers remain uninterested.

- The bearish pressure could strengthen if 1.2000 support fails.

GBP/USD has managed to erase a small portion of its daily losses after having tested 1.2000 earlier in the day on Wednesday. The pair's near-term technical outlook shows that the bearish bias stays intact and additional losses could be witnessed in case 1.2000 turns into resistance.

On Tuesday, the sharp increase witnessed in the US Treasury bond yields helped the US Dollar hold its ground against its major rivals in the second half of the day and forced GBP/USD to edge lower. Early Wednesday, US stock index futures trade modestly higher on the day. If Wall Street's main indexes gain traction after the opening bell, the US Dollar could lose interest and help GBP/USD stage a rebound and vice versa.

There won't be any macroeconomic data releases from the UK. Later in the session, November Pending Home Sales and the Federal Reserve Bank of Richmond's Manufacturing Index for December will be featured in the US economic docket.

Markets expect Pending Home Sales to rise by 0.6% on a monthly basis following a 4.6% contraction recorded in October. Although the market reaction to this US data is unlikely to be significant given thin trading conditions ahead of the New Year holiday, a big decline is likely to remind investors of the worsening conditions in the housing market and weigh on the US Dollar.

GBP/USD Technical Analysis

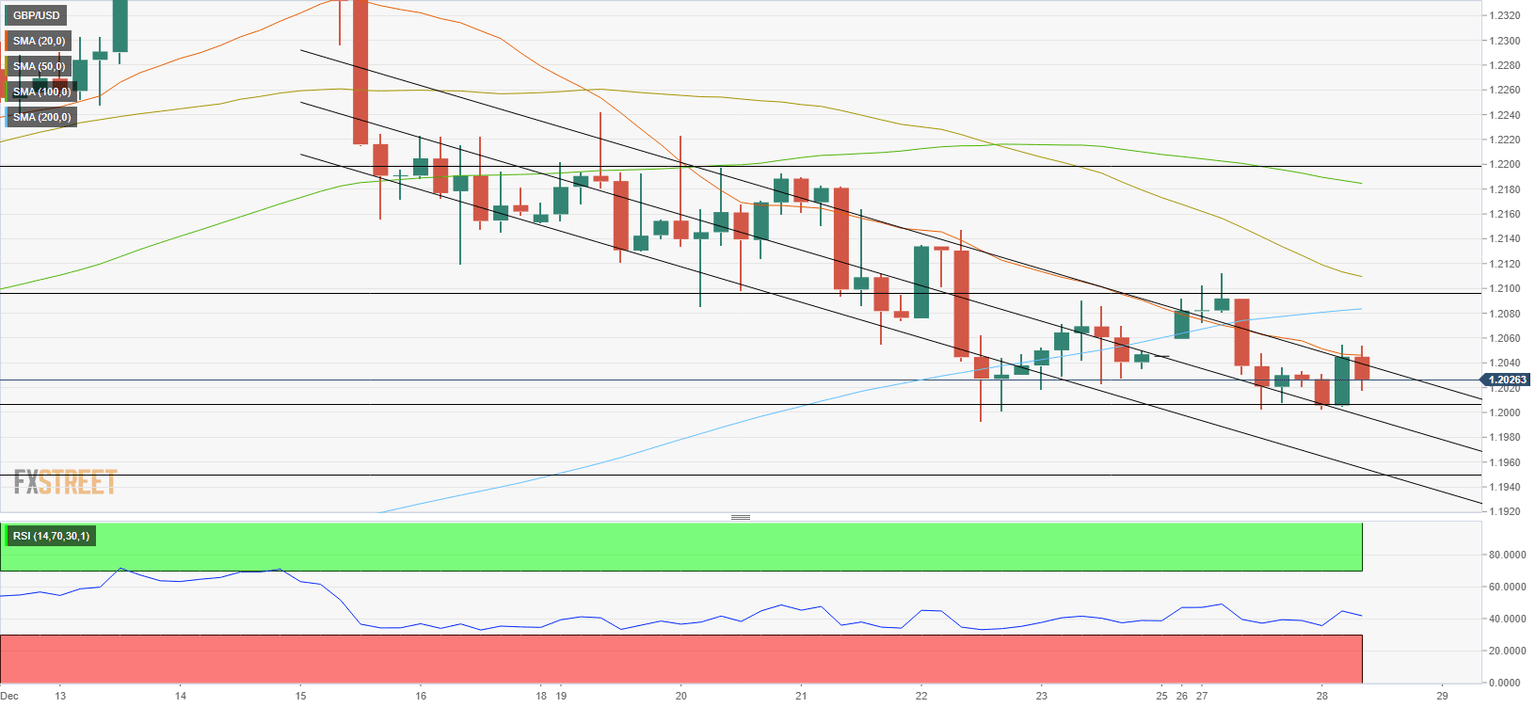

GBP/USD continues to trade within a descending regression channel and the Relative Strength Index (RSI) indicator on the four-hour chart stays near 40, confirming the bearish bias.

On the downside, 1.2000 (static level, psychological level) aligns as key support. If GBP/USD drops below that level and starts using it as resistance, it could extend its slide toward 1.1950 (static level) and 1.1900 (static level, psychological level).

1.2040 (upper limit of the descending channel) forms initial resistance before 1.2080 (200-period SMA) and 1.2100 (static level, psychological level).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.