GBP/USD Forecast: Ready to rally after weathering the latest coronavirus news, Boris' reshuffling

- GBP/USD has been holding onto gains, weathering USD strength.

- Coronavirus headlines, Brexit speculation, and US data are among the factors moving

- Thursday's four-hour chart is showing an improving picture for the bulls.

When a currency pair refuses to succumb to detrimental developments – it is showing its strength. That is what pound/dollar is doing by holding its ground despite adverse news from China regarding the coronavirus outbreak.

The number of cases has leaped by around 15,000, an abrupt end to a trend of deceleration in the spread of the disease. Moreover, the number of deaths also jumped by 240 and the economic damage is felt as far as Barcelona – the Mobile World Congress hosting 100,000 visitors has been canceled.

While the US dollar is gaining ground against most currencies, sterling seems unencumbered. It seems as GBP/USD is already pricing in adverse developments, including recent Brexit-related headlines. The EU and the UK have been digging into their positions regarding future relations, with Brussels demanding that UK sticks to EU rules in return for easy market access, rejecting London's demand for flexibility.

Prime Minister Boris Johnson has been showing flexibility in changing his government. In a reshuffle, he sacked prominent ministers such as Andrea Leadsom, Esther McVey, and Julian Smith – all being supportive to the PM. Markets are interested in Sajid Javid, the Chancellor of the Exchequer, who is set to remain in his post. The announcement about changes in the cabinet is ongoing at the time of writing.

In the US, Consumer Price Index figures for January are set to show a slowdown in core inflation – from 2.3% to 2.2% yearly.

See CPI Preview: Inflation’s academic exercise

Jerome Powell, Chairman of the Federal Reserve, said that he will act "aggressively" with Quantitative Easing (QE) in case of a downturn. The Fed has clarified that only a sustained rise in prices – unrealistic at this point – would trigger rate hikes.

Overall, GBP/USD seems to hold its ground despite various developments that should have pushed it lower, showing its strength.

GBP/USD Technical Analysis

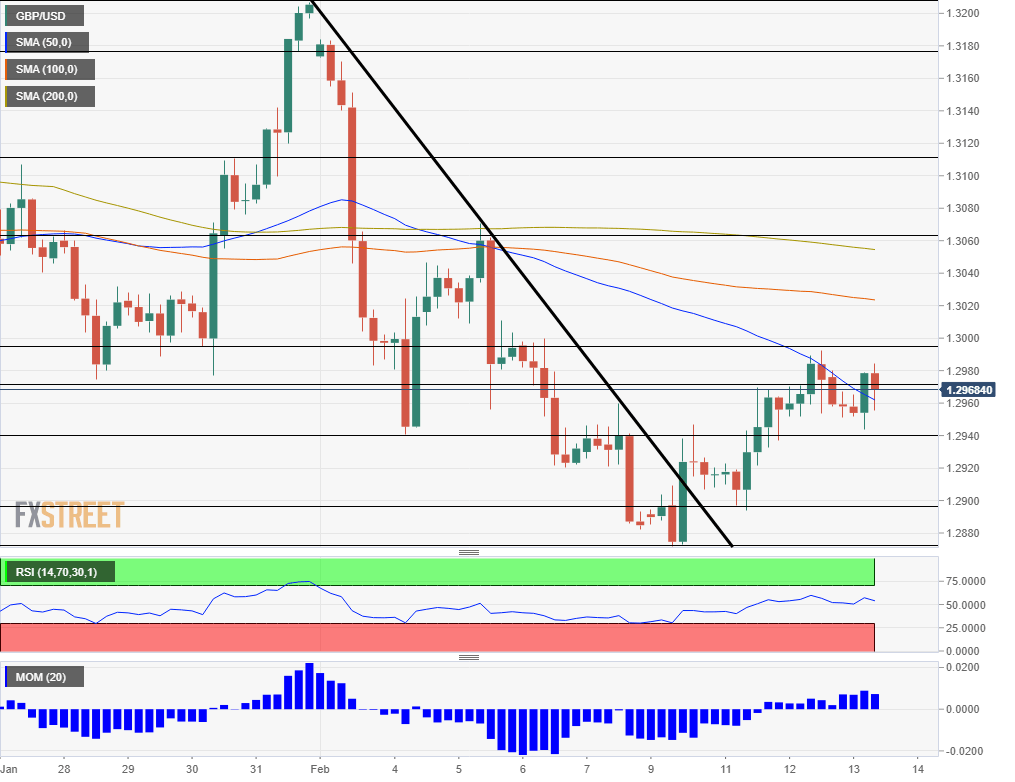

Pound/dollar has surpassed the 50 Simple Moving Average on the four-hour chart and enjoys upside momentum. While it trades below the 100 and 200 SMAs, the picture is improving.

Resistance awaits at 1.2990, which worked capped GBP/USD on Wednesday. Next, 1.3060 was a high point last week and 1.3110 was a temporary cap on the way up in late January.

Support awaits at 1.2940, a temporary support line last week, followed by 1.29, the round level that worked as support earlier this week and also in October. The 2020 low of 1.2875 is the next level to watch.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.