GBP/USD Forecast: Pressure mounts amid fundamental jitters weighing on pound

GBP/USD Current price: 1.3927

- Tensions around the Northern Ireland Protocol keep hitting the pound.

- The UK will publish May Retail Sales on Friday, foreseen up by 1.6% MoM.

- GBP/USD has room to extend its decline in the near-term.

The GBP/USD pair traded as low as 1.3895 in the aftermath of a hawkish US Federal Reserve, now heading into the Asian opening trading at around 1.3900. The UK did not release macroeconomic figures that could add to the pound’s behaviour. Still, tensions surrounding the Northern Ireland Protocol undermine sterling´s demand.

Meanwhile, the UK reported that new coronavirus cases in the country are doubling every 11 days amid the rapid spread of the Delta variant. The country already delayed lifting lockdown measures and is speeding up immunization. This Friday, the UK will publish May Retail Sales, seen up by 1.6% MoM, and Consumer Inflation expectations, previously at 2.7%.

GBP/USD short-term technical outlook

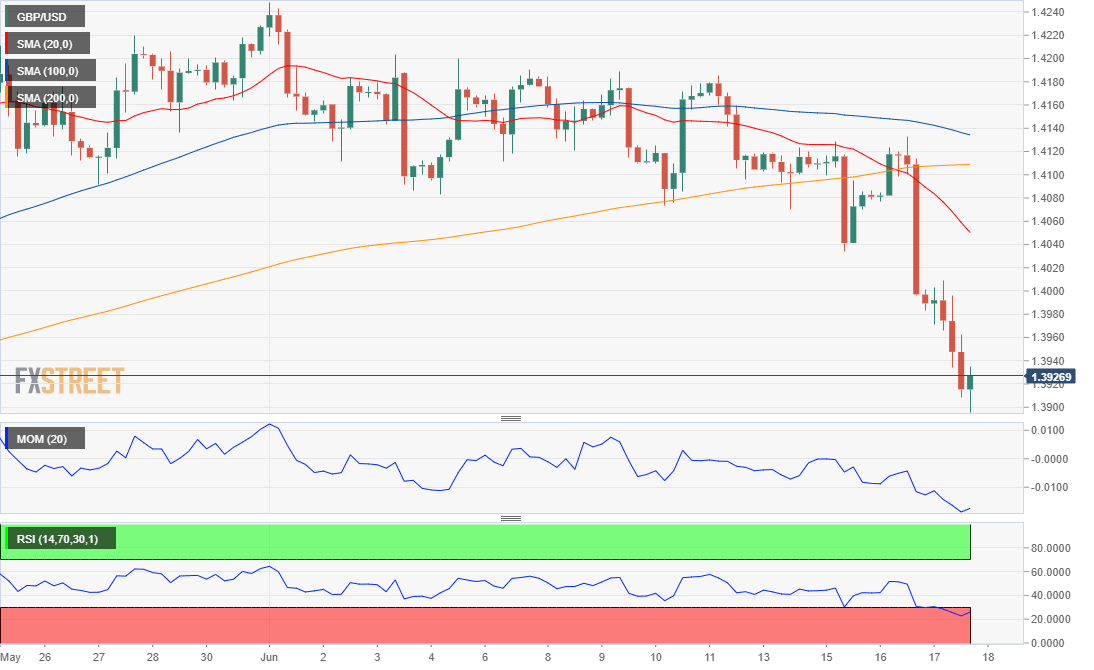

The GBP/USD pair bounced from the mentioned low, currently trading in the 1.3920 price zone. The risk is skewed to the downside, according to the 4-hour chart, as the pair is far below a bearish 20 SMA, which extended its slump below the longer ones. Technical indicators correct extreme oversold readings but remain well into negative territory, indicating absent buying interest.

Support levels: 1.3895 1.3860 1.3820

Resistance levels: 1.3940 1.3985 1.4030

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.