GBP/USD Forecast: Pound Sterling trades near key level as markets await PMIs

- GBP/USD stabilized near 1.2700 following Tuesday's volatile action.

- 1.2700 aligns as a near-term pivot level for the pair.

- PMI surveys from the UK and the US will be looked upon for fresh catalysts.

After rising toward 1.2750 early Tuesday, GBP/USD made a sharp U-turn and lost nearly 100 pips during the American trading hours. The improving risk mood toward the end of the day, however, helped the pair erase a large portion of its daily losses. Early Wednesday, GBP/USD holds steady at around 1.2700.

S&P Global/CIPS Composite PMI in the UK is forecast to tick up to 52.2 in January's flash estimate from 52.1 in December. In case this reading comes in below 50 and show a contraction in the private sector's business activity, the initial reaction could revive expectations for an early Bank of England policy pivot and weigh on Pound Sterling.

Later in the day, S&P Global will release PMI surveys' outcomes for the US as well. The Services PMI is expected to hold above 50 in early January. A stronger-than-expected Services PMI reading in the US could provide a boost to the USD and weigh on GBP/USD.

Investors, however, could opt to wait to see the fourth-quarter US Gross Domestic Product (GDP) on Thursday before taking large positions.

Meanwhile, US stock index futures were last seen rising between 0.2% and 0.6%. In case risk flows dominate the action following a bullish opening in Wall Street, the USD could have a hard time attracting investors.

GBP/USD Technical Analysis

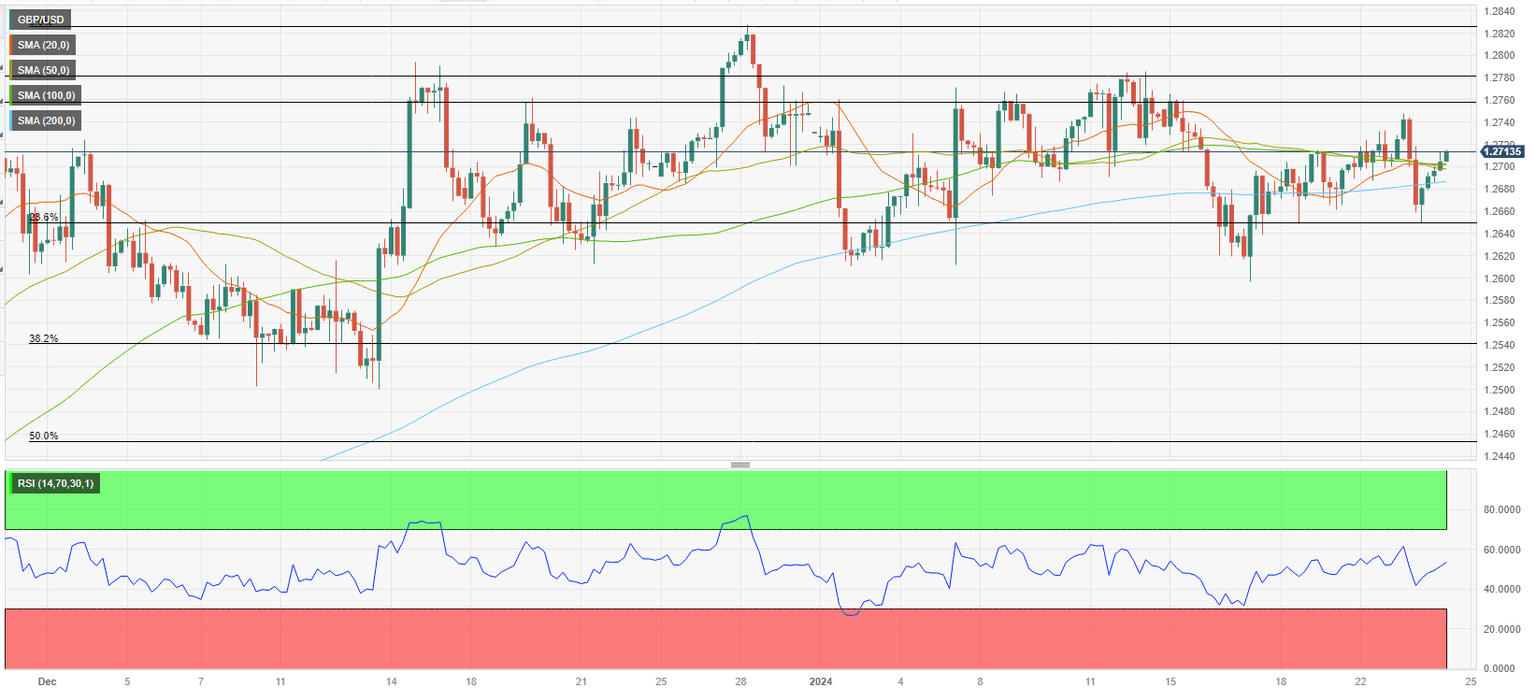

GBP/USD trades near 1.2700, where the 20-, 50-, and 100-period Simple Moving Averages (SMA) on the 4-hour chart are located. In case this level stays intact as support, 1.2760 (static level) could be seen as next resistance before 1.2780 (static level) and 1.2820 (end-point of the latest uptrend).

Below 1.2700, immediate support aligns at 1.2680 (200-period SMA) before 1.2650 (50-day SMA, Fibonacci 23.6% retracement of the latest uptrend).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.