GBP/USD Forecast: Pound Sterling to have a hard time attracting buyers post-BOE

- GBP/USD has been struggling to stage a rebound following Thursday's sharp decline.

- Pound Sterling is likely to stay on the back foot following BOE's policy announcements.

- The near-term technical outlook points to a bearish shift.

GBP/USD has gone into a consolidation phase below 1.2200 early Friday after having lost more than 200 pips on Thursday. Following the Bank of England's (BOE) policy announcements, the pair could find it difficult to gain traction even if the US Dollar come under renewed selling pressure.

As expected, the BOE raised its policy rate by 50 basis points (bps) to 3.5% following the December policy meeting. Two members of the Monetary Policy Committee (MPC), Silvana Tenreyro and Swati Dhingra, however, voted to keep the policy rate unchanged at 3%. The policy statement further revealed that the BOE expects the new fiscal plan to lower the 2023 Consumer Price Forecast for the second quarter by about 0.75%.

The BOE's latest policy decisions suggest that the bank could look to take its foot off the tightening pedal relatively soon amid heightened optimism about inflation having peaked and the gloomy growth outlook.

Coupled with the BOE's dovish tone, the risk-averse market environment forced GBP/USD to extend its slide on Thursday. Early Friday, US stock index futures trade modestly lower on the day. Even if risk flows return and cause the US Dollar to weaken against its rivals in the second half of the day, the Pound Sterling could have a hard time capturing some of the capital outflows.

The data from the UK revealed that S&P Global Manufacturing and Services PMIs both recovered modestly in early December but failed to help Pound Sterling limit its losses.

S&P Global Manufacturing and Services PMI data will be featured in the US economic docket but they are unlikely to impact GBP/USD's action in a meaningful way ahead of the weekend.

GBP/USD Technical Analysis

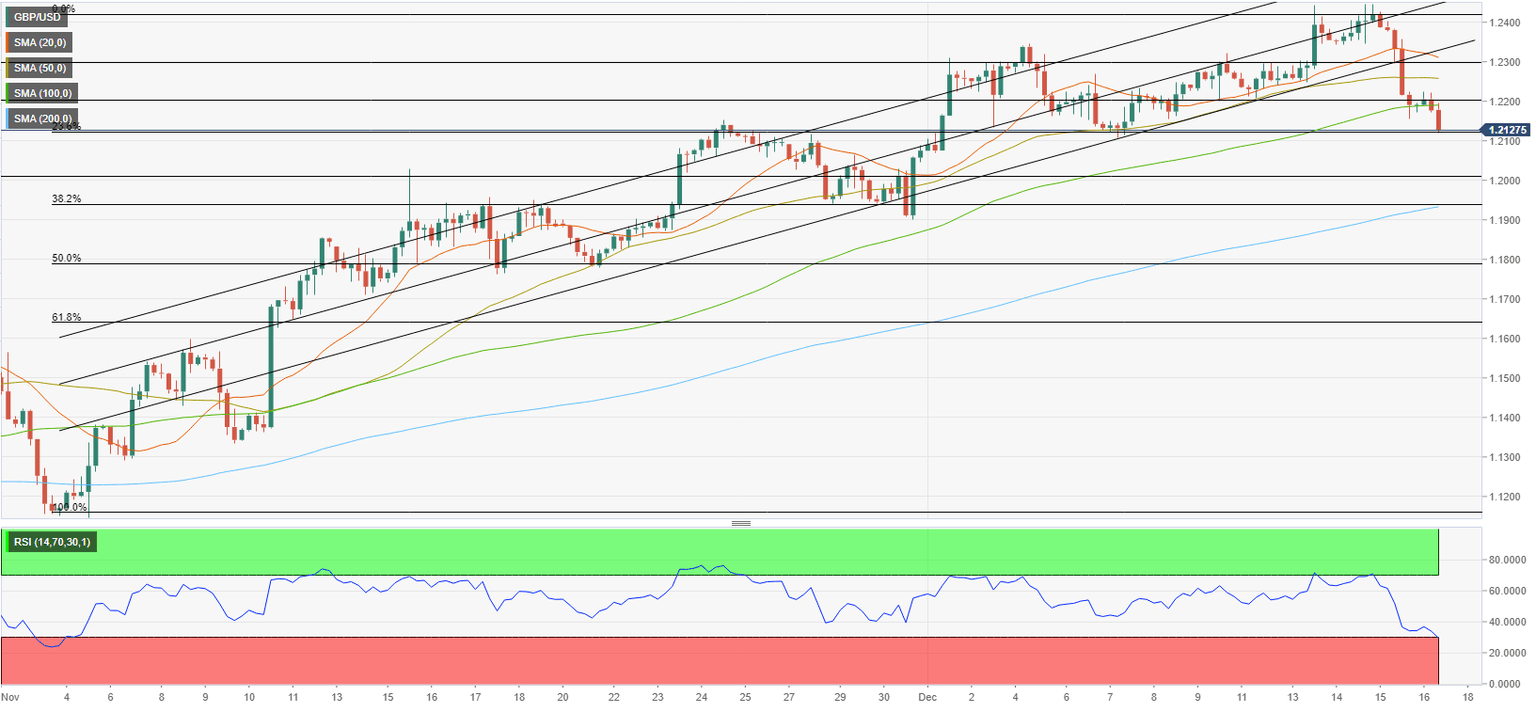

GBP/USD broke below the ascending trend line and dropped below the 100-period Simple Moving Average for the first time since the beginning of that same uptrend, pointing to a bearish tilt in the near-term technical outlook. Although the Relative Strength Index (RSI) indicator on the four-hour chart stays near 30 and suggests that there could be a technical correction before the next leg lower, sellers are likely to dominate the pair's action unless it reclaims 1.2200.

On the downside, 1.2100 (Fibonacci 23.6 retracement of the uptrend, 200-day SMA) aligns as key support level. If GBP/USD falls below that level and confirms it as resistance, additional losses toward 1.2000 (psychological level, static level) and 1.1930 (Fibonacci 38.2% retracement, 200-period SMA) could be witnessed.

1.2200 (100-period SMA) forms initial resistance before 1.2260 (50-period SMA) and 1.2300 (former support, psychological level).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.