GBP/USD Forecast: Pound Sterling to face strong resistance at 1.2140

- GBP/USD has extended its rebound after having registered small gains on Tuesday.

- The pair's upside is likely to remain limited in case safe-haven flows return.

- The near-term technical outlook is yet to produce a signal of a reversal.

GBP/USD has gathered recovery momentum and advanced toward 1.2100 after having dropped below 1.2000 for the first time in a month on Tuesday. Market participants will keep a close eye on risk perception and Fedspeak in the absence of high-impact macroeconomic data releases.

The broad-based US Dollar strength caused GBP/USD to extend its slide during the first half of the day on Tuesday. Minneapolis Federal Reserve (Fed) President Neel Kashkari told CNBC that his terminal rate projection was still 5.4% following the upbeat January jobs report and didn't allow GBP/USD to gain traction.

Late Tuesday, FOMC Chairman Jerome Powell also acknowledged the strong labour market data and reiterated that they will probably need to do further rate hikes. On an optimistic tone, Powell said that he was expecting 2023 to be "a year of significant decline in inflation." This comment made it difficult for the US Dollar Index to preserve its bullish momentum and helped GBP/USD erase some of this week's losses.

Early Wednesday, the Pound Sterling holds its ground with UK's FTSE 100 Index rising more than 0.5% on the day. However, US Stock index futures are down around 0.3%, suggesting that markets could turn cautious in case Wall Street's main indexes fail to build on Tuesday's gains and open in negative territory. In that scenario, the US Dollar could regather its strength and limit GBP/USD's upside.

Later in the day, Atlanta Fed President Raphael Bostic, Fed Governor Christopher Waller and NY Fed President John Williams will be delivering speeches. Currently, the CME Group FedWatch Tool shows that markets are pricing in a 68% probability of the Fed opting for two more 25 basis points rate increase in March and May. Ahead of next week's inflation report, the market positioning is unlikely to change significantly but hawkish comments, similar to Kashkari's, are likely to support the US Dollar. On the other hand, the currency could have a hard time holding its ground if policymakers put a strong emphasis on disinflation.

GBP/USD Technical Analysis

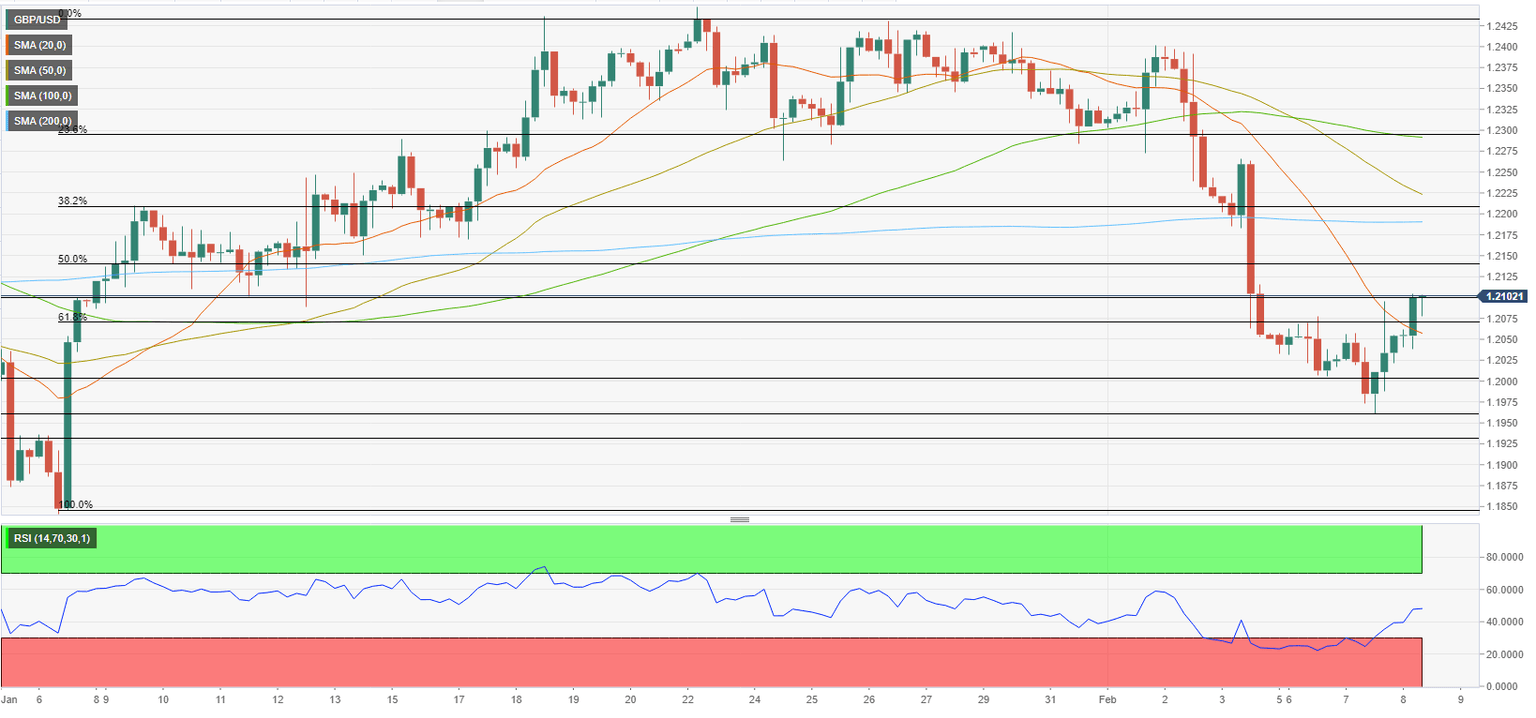

GBP/USD trades within a touching distance of 1.2100. The Relative Strength Index (RSI) indicator on the four-hour chart seems to have turned horizontal after having recovered to 50, suggesting that this area could mark the end of the upward correction.

If GBP/USD rises above that level and starts using it as support, it could attract bulls and stretch higher toward 1.2140 (Fibonacci 50% retracement of the latest uptrend) and 1.2180 (200-period Simple Moving Average (SMA) on the four-hour chart).

On the downside, 1.2070 (Fibonacci 61.8% retracement of the latest uptrend) aligns as first support before 1.2050 (20-period SMA) and 1.2000 (psychological level, static level).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.