GBP/USD Forecast: Pound Sterling tests key support

- GBP/USD has extended its slide to fresh multi-week lows on Friday.

- The risk-averse market atmosphere doesn't allow the pair to stage a rebound.

- The pair trades near a key short-term support level.

GBP/USD has stretched lower and touched its lowest level since early January below 1.1950 after having closed below 1.2000 on Thursday. The pair is trading near the key support that seems to have formed at 1.1930 and the technical outlook suggests that there could be a short-term rebound if that level holds.

The broad-based US Dollar (USD) strength weighed heavily on GBP/USD in the second half of the week. Hawkish comments from Fed policymakers and the latest macroeconomic data releases revived expectations that the Fed could opt to do additional rate hikes even after May. In turn, the benchmark 10-year US Treasury bond yield advanced to its highest level in nearly three months above 3.9% and provided a boost to the USD.

The Core Producer Price Index in the US declined slightly to 5.4% in January from 5.5% in December and beat the market forecast of 4.9%. Additionally, the weekly Initial Jobless Claims came in below 200K for the fifth straight week, confirming tight labor market conditions.

According to the CME Group FedWatch Tool, markets are pricing in a nearly 60% probability that the Fed will at least rise its policy rate three more times by 25 basis points, compared to only 40% a week ago.

Meanwhile, the UK's Office for National Statistics reported on Friday that Retail Sales increased by 0.5% on a monthly basis in January. Although this reading came in better than the market expectation for a decrease of 0.3%, December's print of -1% got revised lower to -1.2%, not allowing the Pound Sterling to benefit from that data.

The US economic docket will not offer any macroeconomic data releases that could impact the US Dollar's performance in a significant way. Hence, market participants will pay close attention to risk perception. US stock index futures are down between 0.5% and 0.9% in the European session. Another bout of flight to safety should help the USD end the week on a firm footing while an improvement in risk mood should have the opposite effect.

GBP/USD Technical Analysis

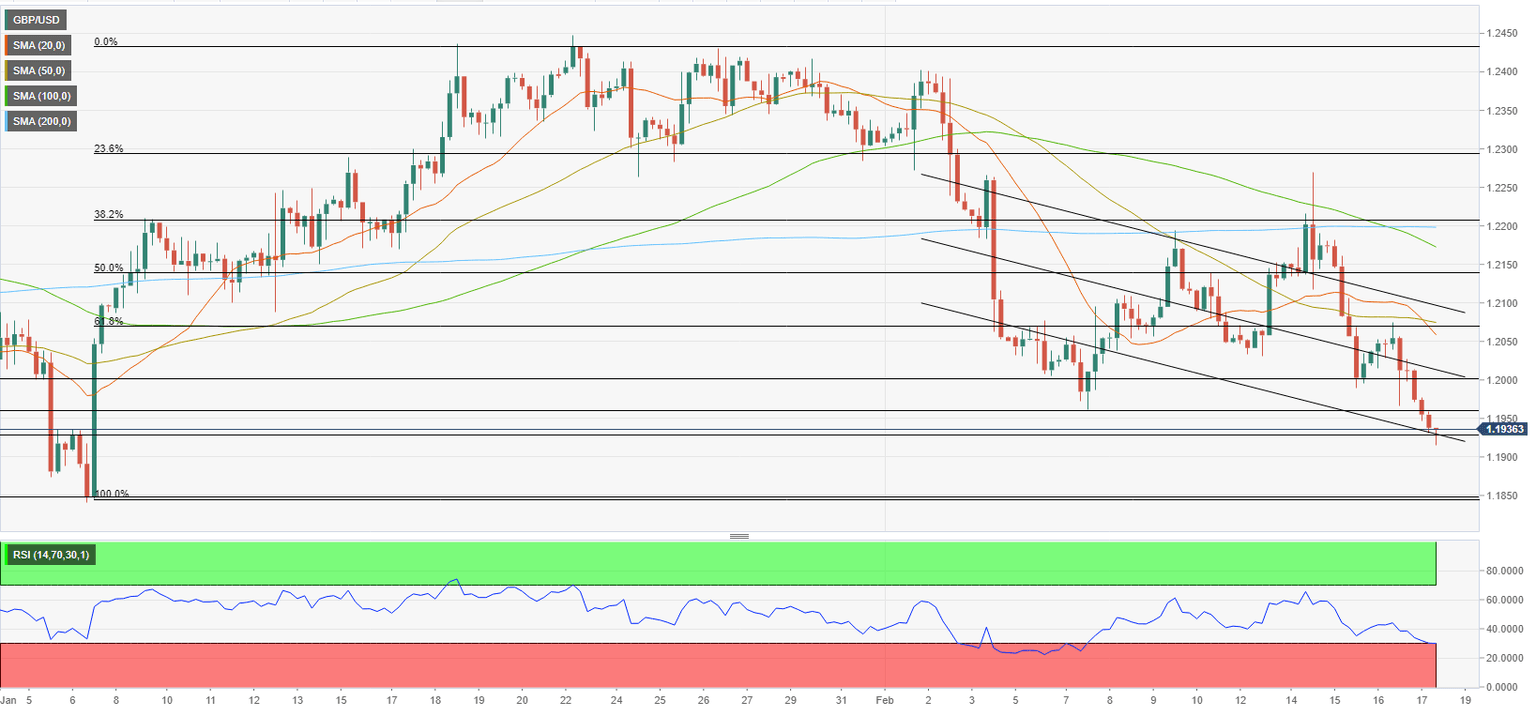

The Relative Strength Index (RSI) indicator on the four-hour chart is about to drop below 30 to show oversold conditions. GBP/USD also trades near the lower limit of the descending regression channel coming from early February at 1.1930.

In case that level holds, GBP/USD could recover toward 1.1960 (former support, static level) and 1.2000 (psychological level, static level). If the pair manages to reclaim that level, additional buyers could come in and open the door for a leg higher toward 1.2060/70 (50-period Simple Moving Average, Fibonacci 50% retracement of the latest uptrend).

On the downside, GBP/USD could stretch lower toward 1.1900 (psychological level) and 1.1850 (static level) once 1.1930 support fails.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.