GBP/USD Forecast: Pound Sterling stabilizes above 1.2200 but looks vulnerable

- GBP/USD turned south on Thursday and erased all the weekly gains.

- The pair could gather recovery momentum in case 1.2200 support holds.

- Markets will pay close attention to action in US stock and bond markets later in the day.

GBP/USD lost more than 100 pips on Thursday and erased all the gains it recorded in the first half of the week. Early Friday, the pair staged a rebound and stabilized above 1.2200.

US Treasury bond yields surged higher on Thursday after the September inflation report and helped the US Dollar (USD) outperform its rivals.

Although the US Bureau of Labor Statistics announced that the annual Core Consumer Price Index (CPI) inflation, which excludes volatile food and energy prices, edged lower to 4.1% from 4.3% as forecast in September, underlying details of the report revived expectations for one more Federal Reserve rate increase later in the year. The so-called 'supercore inflation' increased 0.6% on a monthly basis, highlighting a lack of progress in the sticky part of inflation.

Pound Sterling price this week

The table below shows the percentage change of Pound Sterling (GBP) against listed major currencies this week. Pound Sterling was the weakest against the Swiss Franc.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.12% | 0.09% | 0.04% | 0.67% | 0.34% | 0.86% | -0.28% | |

| EUR | -0.14% | -0.04% | -0.08% | 0.53% | 0.21% | 0.75% | -0.40% | |

| GBP | -0.09% | 0.05% | -0.03% | 0.56% | 0.26% | 0.77% | -0.34% | |

| CAD | -0.04% | 0.08% | 0.04% | 0.63% | 0.29% | 0.82% | -0.31% | |

| AUD | -0.68% | -0.52% | -0.57% | -0.60% | -0.31% | 0.22% | -0.90% | |

| JPY | -0.34% | -0.21% | -0.24% | -0.28% | 0.28% | 0.49% | -0.60% | |

| NZD | -0.85% | -0.73% | -0.78% | -0.81% | -0.21% | -0.52% | -1.14% | |

| CHF | 0.25% | 0.38% | 0.33% | 0.30% | 0.89% | 0.58% | 1.10% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Early Friday, the 10-year US T-bond yield corrects lower after rising more than 3% on Thursday and makes it difficult for the USD to build on recent gains. Meanwhile, US stock index futures trade modestly higher.

If US yields continue to push lower in the second half of the day, the USD could stay on the back foot and allow GBP/USD to stretch higher ahead of the weekend. On the flip side, a cautious opening in Wall Street alongside recovering US yields could weigh on the pair.

GBP/USD Technical Analysis

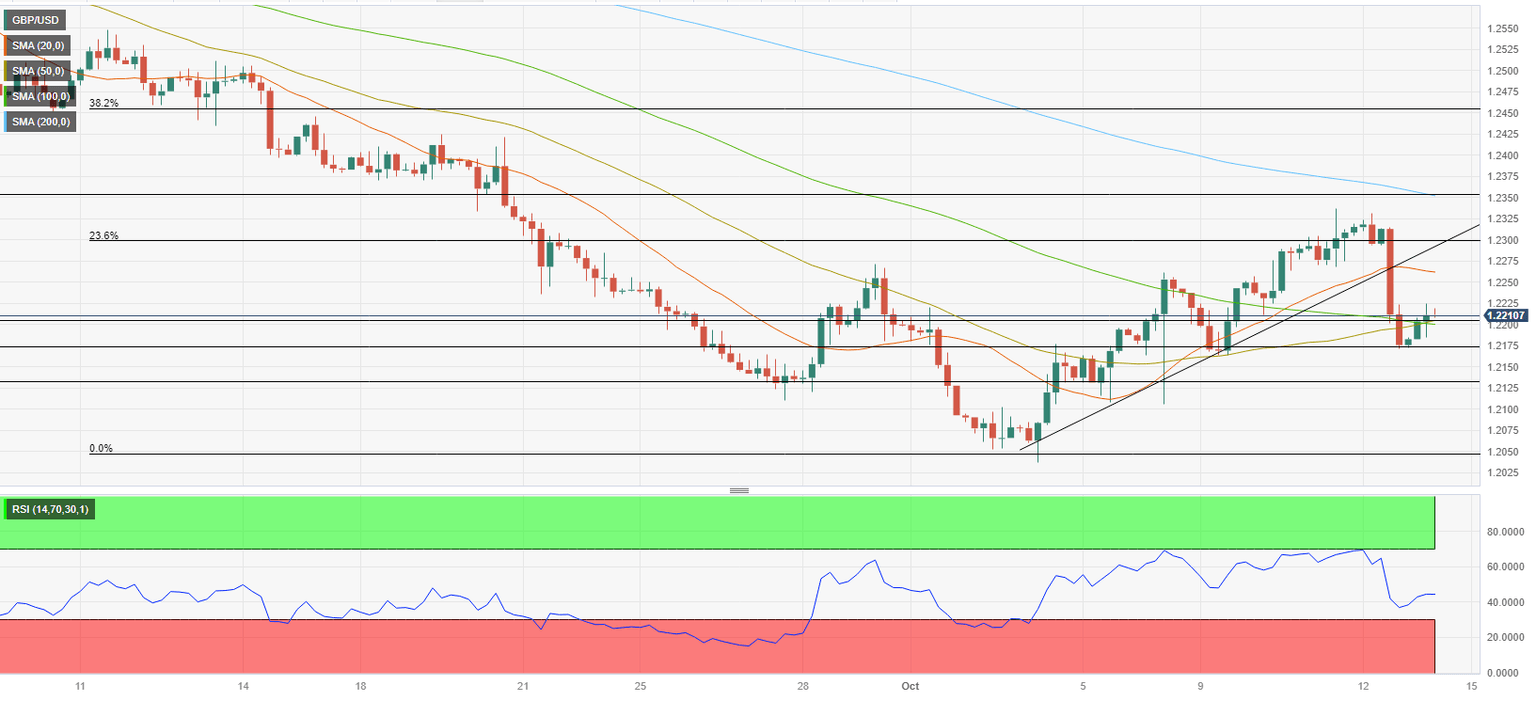

The Relative Strength Index (RSI) indicator on the four-hour chart declined to 40, pointing to a bearish tilt in the short term. 1.2200 (psychological level, static level, 100-period Simple Moving Average (SMA), 50-period SMA) aligns as a key pivot point for the pair.

Once 1.2200 is confirmed as support, GBP/USD could extend its recovery toward 1.2250 (20-period SMA) and 1.2300 (Fibonacci 23.6% retracement of the latest downtrend).

If GBP/USD fails to hold above 1.2200, sellers could show interest. On the downside, interim support seems to have formed at 1.2170 (static level) before 1.2130 (static level) and 1.2100 (psychological level, static level).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.