GBP/USD Forecast: Pound Sterling needs to stabilize above 1.2140 to extend rebound

- GBP/USD has gone into a consolidation phase above 1.2100 on Monday.

- Near-term technical outlook suggests that the pair's bullish bias stays intact.

- Pound Sterling needs to confirm 1.2140 as support to continue to push higher.

GBP/USD has gone into a consolidation phase and retreated toward 1.2100 after having touched its highest level in more than two weeks at 1.2175 earlier in the day. Despite the latest pullback, the pair's near-term technical outlook points to a bullish bias.

Ahead of the weekend, the US Dollar came under heavy selling pressure and triggered a rally in GBP/USD. The pair gained more than 100 pips on Friday and erased the majority of its weekly losses.

The US Bureau of Labor Statistics (BLS) announced on Friday that Nonfarm Payrolls (NFP) rose by 223,000 in December, surpassing the market expectation of 200,000 by a wide margin. The US Dollar, however, failed to benefit from the upbeat NFP reading as the report also showed that annual wage inflation declined to 4.6% from 4.8% (revised from 5.1%) in November.

Moreover, the ISM's Services PMI survey revealed that price pressures in the service sector continued to ease while the overall economic activity contracted modestly in December, putting additional weight on the US Dollar's shoulders.

The probability of a 25 basis points Fed rate hike in early February climbed above 70% following these data releases, reflecting the return of dovish Fed bets.

The US economic docket will not be featuring any high-impact macroeconomic data releases on Monday. Later in the day, Atlanta Federal Reserve Bank President Raphael Bostic, who said on Friday that he was expecting the Fed to hold the peak rate well into 2024, will be delivering a speech.

Meanwhile, Wall Street's main indexes remain on track to open modestly higher with US stock index futures rising between 0.3% and 0.5% on the day. In case risk flows dominate the financial markets in the second half of the day, GBP/USD could gather bullish momentum and vice versa.

GBP/USD Technical Analysis

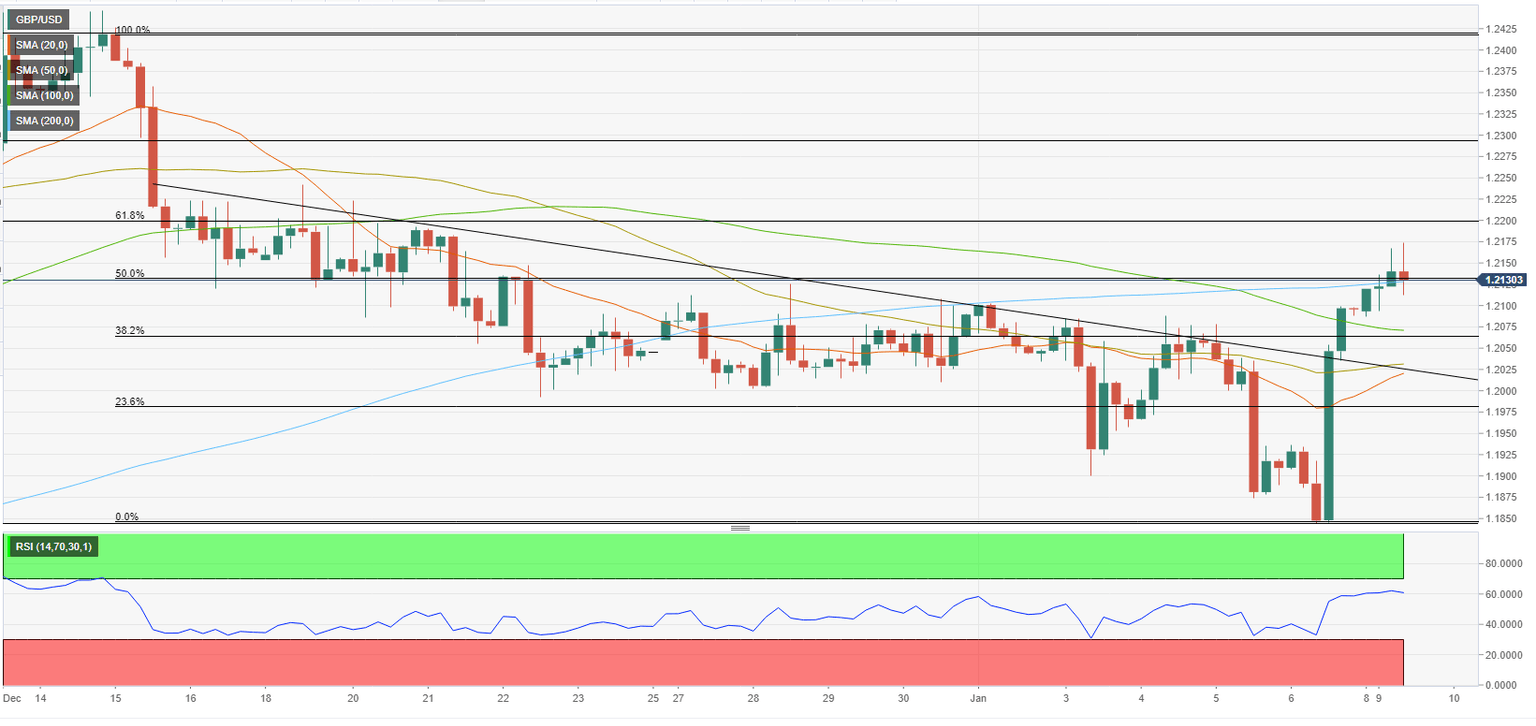

GBP/USD was last seen trading slightly below 1.2140, where the Fibonacci 50% retracement of the latest downtrend and the 200-period Simple Moving Average (SMA) on the four-hour chart are located. In case the pair rises above that level and confirms it as support, it could target 1.2175 (daily high) and 1.2200 (Fibonacci 61.8% retracement).

On the downside, 1.2100 (psychological level) aligns as interim support before 1.2070 (100-period SMA, Fibonacci 38.2% retracement) and 1.2030 (50-period SMA).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.