GBP/USD Forecast: Pound Sterling needs to overcome 1.2360 to push higher

- GBP/USD has regained its traction following Wednesday's pullback.

- 1.2360 aligns as key resistance for the pair.

- Investors will pay close attention to comments from Fed officials.

Following a decline toward 1.2300, GBP/USD has gathered bullish momentum and advanced to the 1.2350 area early Thursday. The pair faces strong resistance at 1.2360 and it needs to flip that level into support to continue to push higher.

The UK's FTSE 100 Index is up 0.5% after opening higher on Thursday and US stock index futures rise between 0.3% and 0.4% in the European session, suggesting that the market mood remains upbeat. If risk flows continue to dominate the markets in the second half of the day, the US Dollar (USD) is likely to stay on the back foot and help GBP/USD stretch higher.

However, comments from Fed officials could change the mood and provide support to the USD later in the session.

Citing Republican Representative Kevin Hern, Bloomberg reported late Wednesday that FOMC Chairman Jerome Powell told the Republican Study Committee that they anticipate one more rate hike this year. Despite this headline, the CME Group FedWatch Tool's probability that the Fed will leave its policy rate unchanged in May sits near 60%.

Richmond Fed President Thomas Barkin, Minneapolis Fed President Neel Kashkari and Fed Governor Christopher Waller will be speaking later in the day. In case they deliver hawkish comments and steer markets toward a 25 bps rate increase at the upcoming meeting, the USD could gather strength alongside rising Treasury bond yields and cause GBP/USD to stage a downward correction.

The US economic docket will feature the final revision to the fourth-quarter Gross Domestic Product (GDP) and the weekly Initial Jobless Claims.

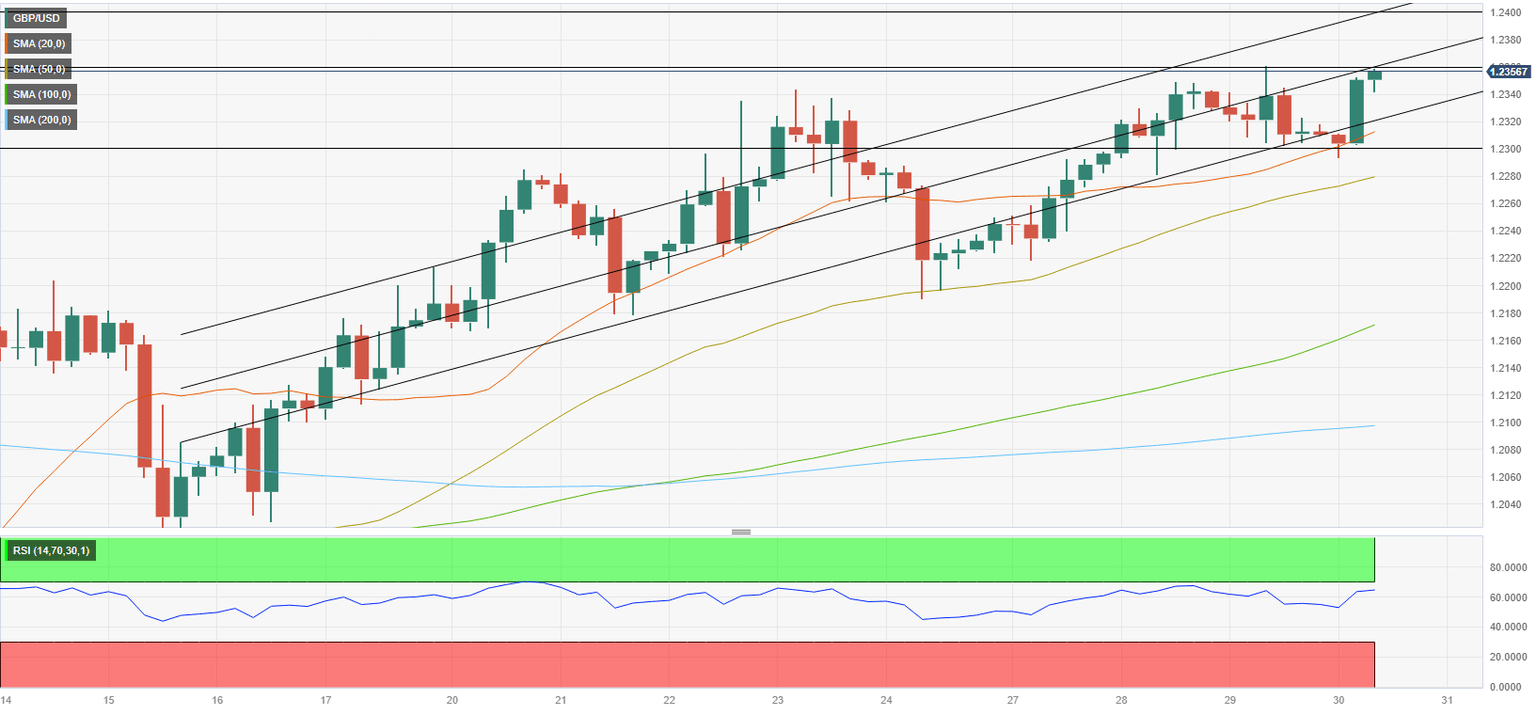

GBP/USD Technical Analysis

The mid-point of the ascending regression channel aligns as key resistance at 1.2360. If that level stays intact, GBP/USD could retreat toward 1.2320 (lower limit of the ascending channel, 20-period Simple Moving Average (SMA)). A four-hour close below that support could bring in additional sellers and cause the pair to fall to 1.2300 (psychological level) and 1.2280 (50-period SMA).

On the upside, additional gains toward 1.2400 (psychological level, upper-limit of the ascending channel) could be witnessed if buyers manage to keep GBP/USD afloat above 1.2360. Above 1.2400, 1.2450 (December 22 high) could be seen as the next bullish target.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.