GBP/USD Forecast: Pound Sterling needs a hawkish BoE to clear 1.2200

- GBP/USD started to retreat after facing resistance near 1.2200.

- The Bank of England is forecast to leave its policy rate unchanged at 5.25%.

- Governor Andrew Bailey will present the Monetary Policy Report at a press conference.

GBP/USD gathered bullish momentum and registered gains on Wednesday after dropping below 1.2100 earlier in the day. The pair continued to stretch higher toward 1.2200 on Thursday but lost its traction, with investors refraining from taking large positions ahead of the Bank of England's (BoE) monetary policy announcements.

The Federal Reserve held the policy rate steady at 5.25%-5.5% as widely expected on Wednesday. Fed Chairman Jerome Powell did not rule out another rate hike in December but failed to convince markets. The benchmark 10-year US Treasury bond yield fell nearly 4% on the day and the US Dollar (USD) weakened against its major rivals, allowing GBP/USD to turn north.

Pound Sterling price this week

The table below shows the percentage change of Pound Sterling (GBP) against listed major currencies this week. Pound Sterling was the strongest against the Japanese Yen.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.40% | -0.46% | -0.19% | -1.50% | 0.45% | -1.39% | 0.31% | |

| EUR | 0.40% | -0.09% | 0.21% | -1.10% | 0.83% | -0.99% | 0.69% | |

| GBP | 0.47% | 0.09% | 0.25% | -1.03% | 0.92% | -0.93% | 0.77% | |

| CAD | 0.20% | -0.21% | -0.29% | -1.32% | 0.62% | -1.21% | 0.48% | |

| AUD | 1.47% | 1.11% | 1.02% | 1.28% | 1.92% | 0.11% | 1.79% | |

| JPY | -0.45% | -0.84% | -0.84% | -0.67% | -1.95% | -1.84% | -0.15% | |

| NZD | 1.38% | 0.99% | 0.91% | 1.18% | -0.13% | 1.81% | 1.67% | |

| CHF | -0.31% | -0.69% | -0.77% | -0.49% | -1.80% | 0.14% | -1.70% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

The BoE is forecast to keep the key rate unchanged at 5.25% for the second consecutive meeting. Investors will scrutinize revised projections and the statement language to see whether the BoE has reached the end of the tightening cycle.

BoE Governor Andrew Bailey will hold a press conference to deliver the Monetary policy Report and respond to questions from the press. In case Bailey notes that they will keep the policy rate at 5.25% in the face of weakening economic outlook and softer inflation, Pound Sterling could come under selling pressure. On the other hand, if Bailey adopts a hawkish tone by citing heightened inflation risks amid the Middle East conflict, GBP/USD could regain its traction.

Previewing the BoE event, "forward guidance will likely be softened a bit, in light of the weaker economic outlook – signaling a pretty high bar for further hikes," said TD Securities analysts and added:

"A dovish hold by the BoE will weigh on the GBP especially versus peers where the growth-inflation outcomes don't look as meek."

GBP/USD Technical Analysis

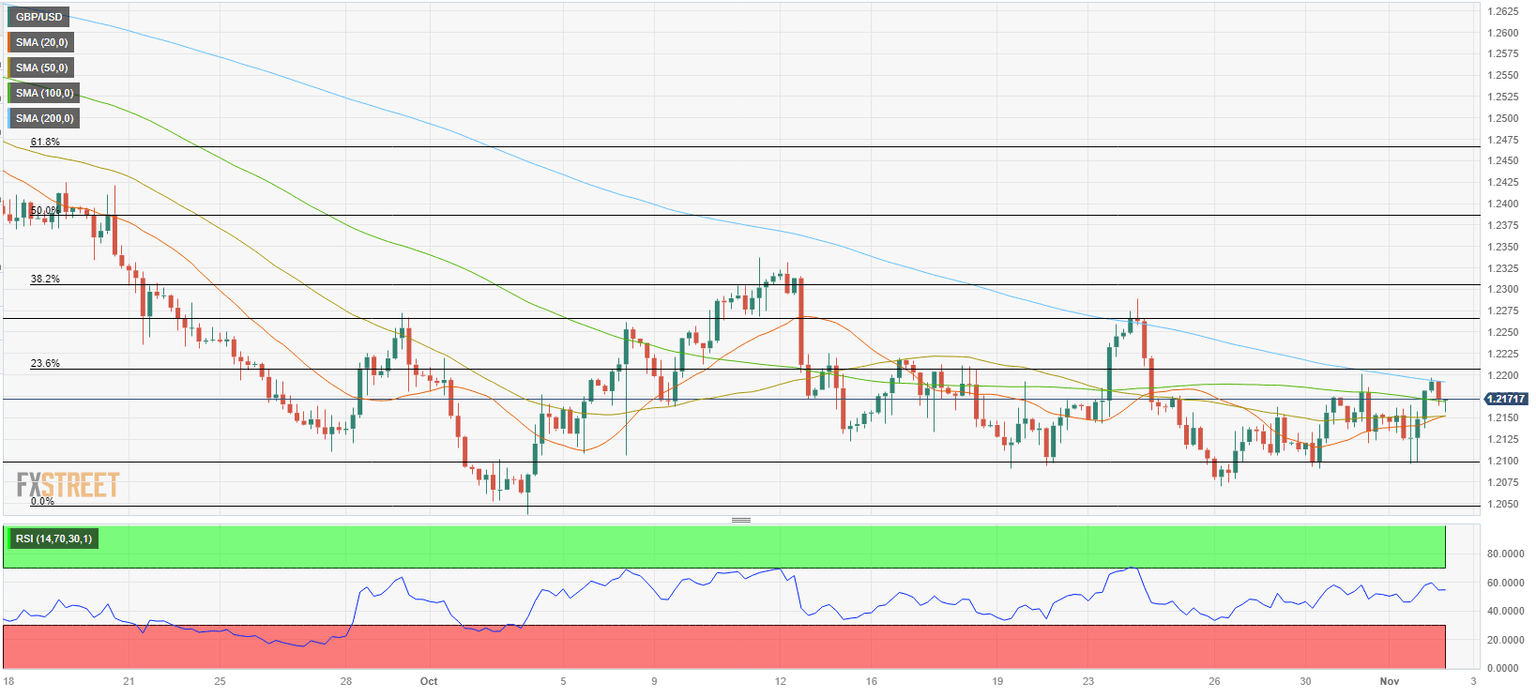

1.2200 (200-period Simple Moving Average (SMA) on the 4-hour chart, Fibonacci 23.6% retracement of the latest downtrend) aligns as key technical resistance for GBP/USD. A 4-hour close above that level could attract technical buyers and open the door for another leg higher toward 1.2260 (static level) and 1.2300 (Fibonacci 38.2% retracement).

On the downside, 1.2150 (50-period SMA, 20-period SMA) forms interim support before 1.2100 (static level, psychological level) and 1.2050 (end-point of the latest downtrend).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.