GBP/USD Forecast: Pound Sterling holds bullish despite pullback

- GBP/USD stays above 1.2800 in the European session on Tuesday.

- The technical outlook suggests that the bullish bias remains intact.

- Fed Chairman Powell's comments on policy outlook impact the US Dollar's valuation.

GBP/USD lost its traction after climbing to the 1.2850 area on Monday and erased its daily gains to close slightly above 1.2800. The pair stays in a consolidation phase early Tuesday as market focus shifts to Federal Reserve (Fed) Chairman Jerome Powell's congressional testimony. Meanwhile, the pair's technical outlook shows that the bullish bias remains unchanged despite the pullback seen late Monday.

British Pound PRICE Last 7 days

The table below shows the percentage change of British Pound (GBP) against listed major currencies last 7 days. British Pound was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.81% | -1.36% | -0.32% | -0.71% | -1.22% | -0.71% | -0.54% | |

| EUR | 0.81% | -0.56% | 0.52% | 0.09% | -0.42% | 0.07% | 0.27% | |

| GBP | 1.36% | 0.56% | 1.07% | 0.68% | 0.12% | 0.65% | 0.81% | |

| JPY | 0.32% | -0.52% | -1.07% | -0.41% | -0.90% | -0.43% | -0.26% | |

| CAD | 0.71% | -0.09% | -0.68% | 0.41% | -0.52% | -0.00% | 0.15% | |

| AUD | 1.22% | 0.42% | -0.12% | 0.90% | 0.52% | 0.50% | 0.67% | |

| NZD | 0.71% | -0.07% | -0.65% | 0.43% | 0.00% | -0.50% | 0.16% | |

| CHF | 0.54% | -0.27% | -0.81% | 0.26% | -0.15% | -0.67% | -0.16% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

The improving risk mood makes it difficult for the US Dollar to gather strength and helps GBP/USD hold its ground in the European session on Tuesday. At the time of press, US stock index futures were up between 0.15% and 0.4% on the day.

During the American trading hours, Fed Chairman Powell will present the Semi-Annual Monetary Policy Report and respond to questions before the Senate Banking Committee.

In his last public appearance at the ECB Forum on Central Banking earlier in the month, Powell noted that the disinflation trend was showing signs of resuming but repeated that they need to be more confident before reducing policy rates.

Following this event, the June jobs report from the US highlighted further loosening of conditions in the labor market. As a result, the probability of the Fed leaving the policy rate unchanged in September declined toward 20% from above-30% at the beginning of the month.

The current market positioning suggests that the USD has some more room on the downside in case Powell acknowledges weak jobs data and adopts an optimistic on the inflation outlook. On the other hand, the USD could gather strength against its peers if Powell pushes back against the market expectation for a September rate cut.

GBP/USD Technical Analysis

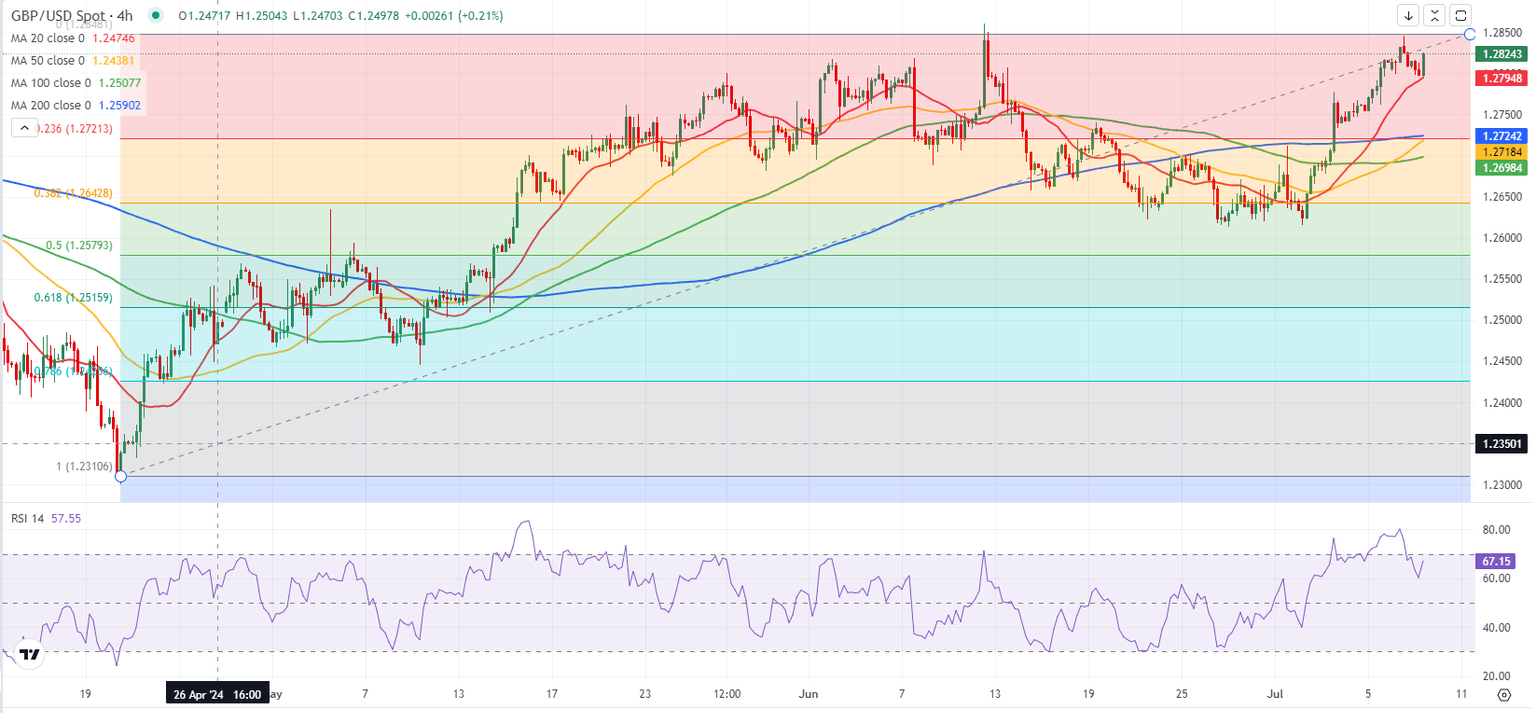

The Relative Strength Index (RSI) indicator on the 4-hour chart holds above 60 after retreating from 80 on Monday, suggesting that GBP/USD's bullish bias remains intact following a technical correction.

On the upside, 1.2850-1.2860 (static level, June 12 high) aligns as next resistance before 1.2900 (psychological level, static level).

Supports could be seen at 1.2800 (psychological level, static level), 1.2750 (static level) and 1.2710 (20-day Simple Moving Average).

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.