GBP/USD Forecast: Pound Sterling gathers bullish momentum after UK data, Fed is next

- GBP/USD trades in positive territory above 1.3200 on Wednesday.

- Annual core CPI rose at a stronger pace than expected in August.

- The Fed is widely expected to lower the policy rate after the September meeting.

GBP/USD gained traction in the European session on Wednesday and climbed above 1.3200 after closing in negative territory on Tuesday. The pair's technical outlook points to a buildup of bullish momentum as market focus shifts to the Federal Reserve's monetary policy announcements.

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.18% | -0.42% | -0.48% | -0.08% | -0.36% | -0.60% | -0.49% | |

| EUR | 0.18% | -0.25% | -0.30% | 0.10% | -0.17% | -0.43% | -0.31% | |

| GBP | 0.42% | 0.25% | -0.04% | 0.34% | 0.08% | -0.19% | -0.04% | |

| JPY | 0.48% | 0.30% | 0.04% | 0.39% | 0.12% | -0.11% | 0.02% | |

| CAD | 0.08% | -0.10% | -0.34% | -0.39% | -0.28% | -0.53% | -0.38% | |

| AUD | 0.36% | 0.17% | -0.08% | -0.12% | 0.28% | -0.23% | -0.11% | |

| NZD | 0.60% | 0.43% | 0.19% | 0.11% | 0.53% | 0.23% | 0.12% | |

| CHF | 0.49% | 0.31% | 0.04% | -0.02% | 0.38% | 0.11% | -0.12% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

The UK's Office for National Statistics reported early Wednesday that annual inflation, as measured by the change in the Consumer Price Index (CPI), held steady at 2.2% in August, as expected. The core CPI, which excludes volatile food and energy prices, rose 3.6% on a yearly basis, up from the 3.3% increase recorded in July and above analysts' estimate of 3.5%. With the immediate reaction, Pound Sterling gathered strength against its rivals.

The Fed is set to lower the policy rate following the September meeting. However, markets are split on the size of the rate cut. According to the CME FedWatch Tool, there is a 61% probability of a 50 basis points (bps) rate cut and a 39% chance of a 25 bps cut.

If the Fed opts for a 50 bps cut, the immediate reaction could cause the USD to come under strong selling pressure and open the door for another leg higher in GBP/USD. On the flip side, the USD could hold its ground if the Fed goes for a 25 bps rate reduction and trigger a downward correction in the pair.

Investors will also scrutinize the details of the revised Summary of Economic Projections (SEP), the so-called dot-plot. In case the dot-plot shows at least another 75 bps rate reduction is projected by the end of the year, the USD could fail to benefit from a 25 bps rate cut.

GBP/USD Technical Analysis

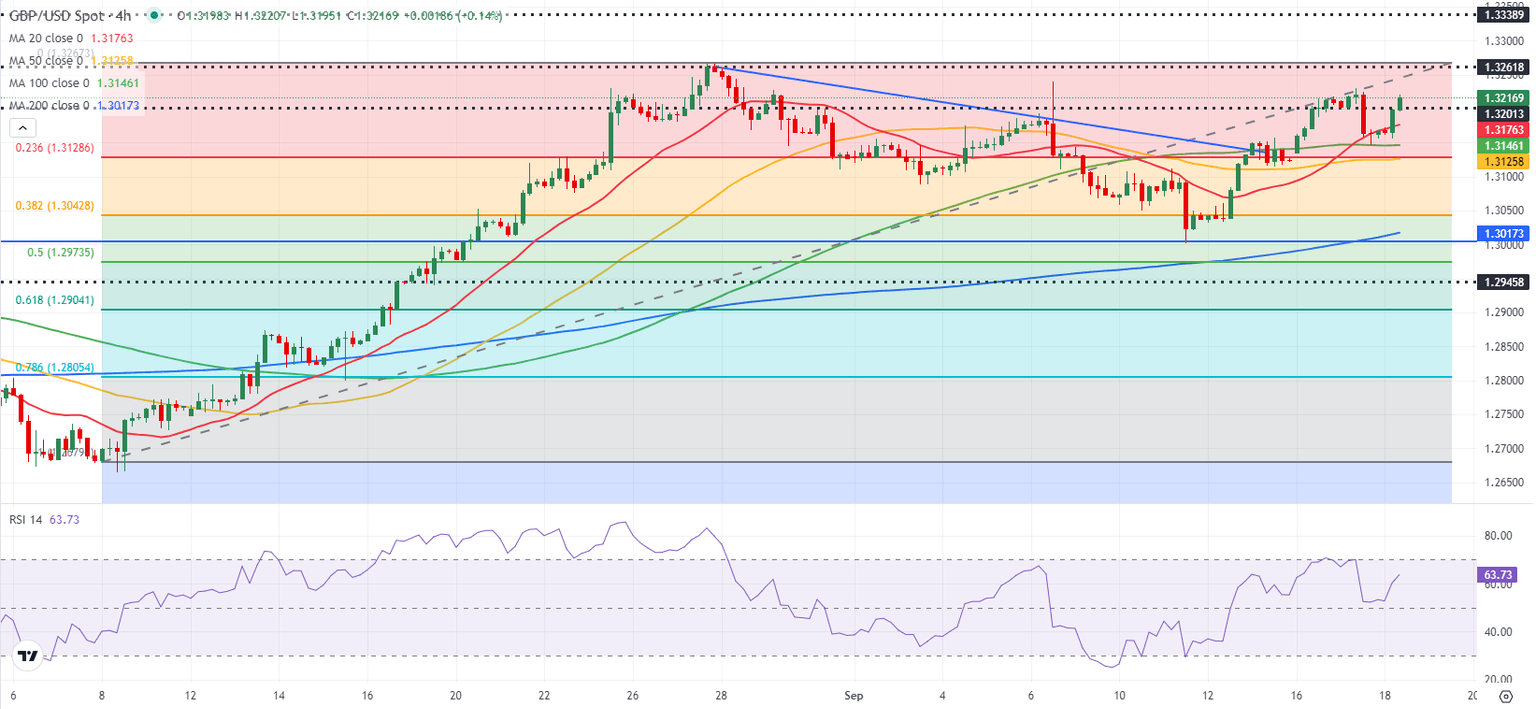

The Relative Strength Index (RSI) indicator on the 4-hour chart rose above 60 after falling toward 50 on Tuesday, reflecting a bullish tilt in the near-term outlook. GBP/USD could face interim resistance at 1.3260 (end-point of the latest uptrend) before 1.3300 (static level) and 1.3340 (static level).

On the downside, 1.3200 (static level) aligns as first support ahead of 1.3150-1.3140 (100-period SMA, Fibonacci 38.2% retracement of the latest uptrend) and 1.3100 (static level).

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.