GBP/USD Forecast: Pound Sterling fails to benefit from hot inflation data

- GBP/USD stays on the back foot despite strong CPI readings for May.

- Technical outlook points to a bearish tilt in the short term.

- FOMC Chairman Jerome Powell's two-day congressional testimony starts on Wednesday.

Following a spike above 1.2800 with the knee-jerk reaction to UK May inflation data, GBP/USD reversed its direction and declined toward 1.2700 during the European trading hours on Wednesday. The pair's technical outlook highlights a bearish shift in the short-term outlook as investors gear up for FOMC Chairman Jerome Powell's two-day congressional testimony.

The Consumer Price Index (CPI) rose 8.7% on a yearly basis in May, the UK's Office for National Statistics (ONS) reported on Wednesday. This reading matched April's increase and surpassed the market expectation of 8.4%. The Core CPI, which excludes volatile food and energy prices, increased 7.1% in the same period, accelerating from 6.8% in April. Meanwhile, underlying details of the report showed that producer inflation, as measured by the change in the Producer Price Index (PPI), fell 1.5% on a monthly basis in May.

Combined with last week's strong wage inflation reading, hot CPI figures from the UK virtually confirmed a hawkish Bank of England (BoE) message on Thursday. In this context, the negative reaction in Pound Sterling could be a product of 'buy the rumour sell the fact' market action.

Later Wednesday, market participants will pay close attention to comments from FOMC Chairman Jerome Powell on the first day of his semi-annual congressional testimony.

Markets are still seeing a nearly 20% probability of the Federal Reserve (Fed) leaving its policy rate unchanged in July. If Powell confirms a return to rate hikes next month, the USD could gather some strength and weigh on GBP/USD. Investors are, however, more curious about the terminal rate and whether the Fed is willing to raise rates at least twice more this year.

In the meantime, the risk perception could also influence GBP/USD's movements in the second half of the day. Since the beginning of the week, the risk-averse market atmosphere helped the USD hold its ground against its rivals. Hence, an extended slide in Wall Street's main indexes during Powell's speech could make it difficult for the pair to regain its traction.

GBP/USD Technical Analysis

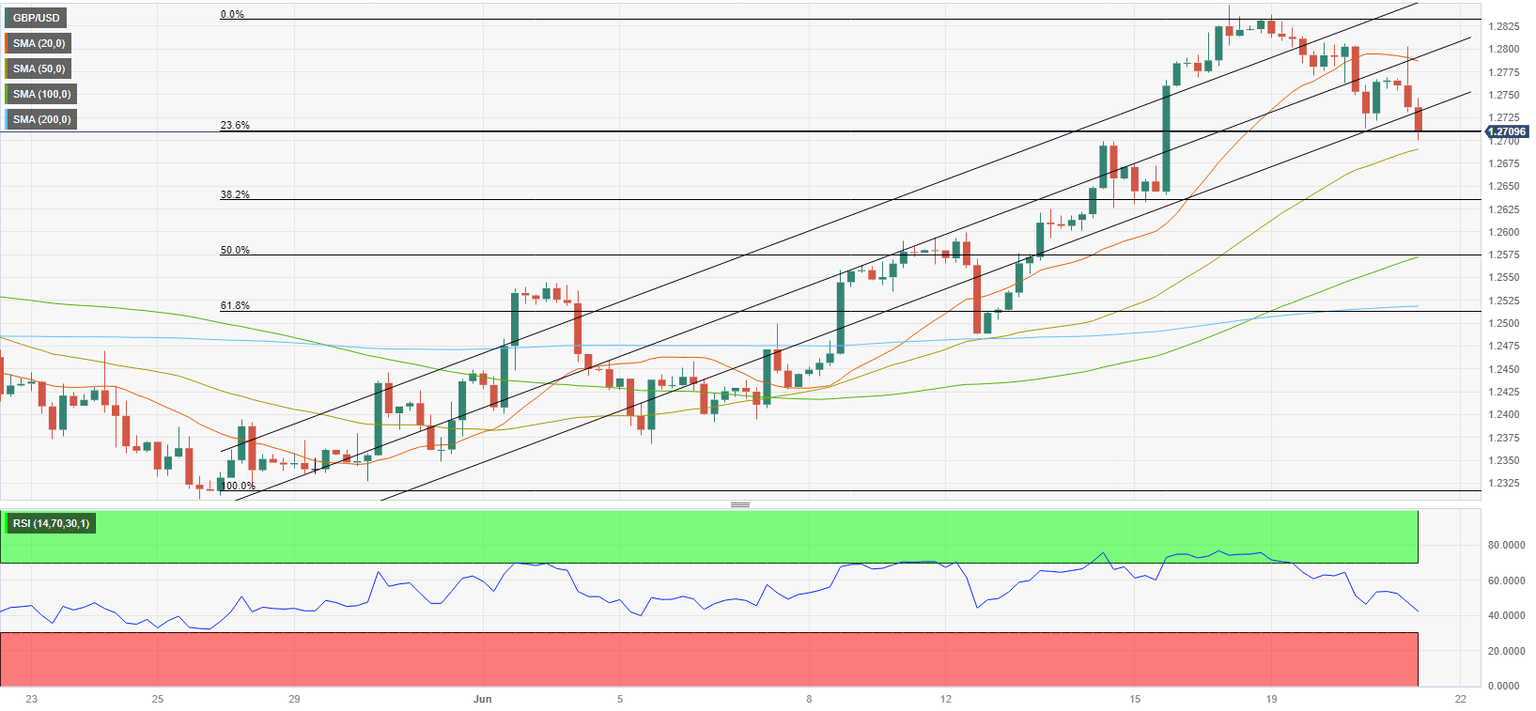

GBP/USD broke below the ascending regression channel and the Relative Strength Index (RSI) indicator on the four-hour chart fell below 50, reflecting a buildup of bearish momentum.

On the downside, 1.2700 (Fibonacci 23.6% retracement of the latest uptrend, psychological level), aligns as key support. If GBP/USD falls below that level and starts using it as resistance, it could extend its slide toward 1.2640 (Fibonacci 38.2% retracement) and 1.2600 (psychological level, static level).

Looking up, the first hurdle is located at 1.2750 (lower-limit of the ascending channel) ahead of 1.2800 (psychological level, static level, mid-point of the ascending channel) and 1.2850 (14-month high set on Friday).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.