GBP/USD Forecast: Pound Sterling could push higher once 1.2750 is confirmed as support

- GBP/USD holds steady near 1.2750 after posting modest gains on Monday.

- The near-term technical outlook points to a build-up of bullish momentum.

- The risk perception could drive the pair's action in the absence of high-tier data releases.

After dipping below 1.2700, GBP/USD reversed its direction and closed the first trading day of the week in positive territory near 1.2750. The near-term technical outlook suggests that the pair could continue to edge higher once 1.2750 holds is confirmed as support.

Improving risk mood helped GBP/USD gain traction in the second half of the day on Monday. Growing optimism about the US government avoiding a shutdown after leaders of the House and Senate agreed on a $1.59 trillion spending deal late Sunday allowed US stocks to gather bullish momentum to start the week.

Pound Sterling price this week

The table below shows the percentage change of Pound Sterling (GBP) against listed major currencies this week. Pound Sterling was the strongest against the Australian Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.05% | -0.15% | 0.02% | 0.15% | -0.59% | -0.04% | -0.17% | |

| EUR | 0.05% | -0.10% | 0.07% | 0.22% | -0.53% | 0.01% | -0.12% | |

| GBP | 0.14% | 0.10% | 0.17% | 0.31% | -0.43% | 0.11% | -0.02% | |

| CAD | -0.01% | -0.06% | -0.16% | 0.15% | -0.58% | -0.06% | -0.18% | |

| AUD | -0.15% | -0.21% | -0.31% | -0.15% | -0.73% | -0.21% | -0.33% | |

| JPY | 0.54% | 0.52% | 0.41% | 0.60% | 0.74% | 0.54% | 0.39% | |

| NZD | 0.04% | -0.01% | -0.11% | 0.06% | 0.20% | -0.54% | -0.14% | |

| CHF | 0.17% | 0.12% | 0.02% | 0.19% | 0.33% | -0.41% | 0.13% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Meanwhile, US Treasury bond yields edged lower and the US Dollar (USD) struggled to attract buyers after the Federal Reserve Bank of New York reported that consumers' year-ahead inflation expectation dropped to its lowest level since January 2021 at 3%.

Nevertheless, the CME Group FedWatch Tool shows that the probability of a 25 basis points Federal Reserve rate cut in March stays around 60%, down from nearly 80% early last week. Investors might want to wait to confirm a further decline in core inflation figures before betting on a policy pivot.

The US economic calendar will not offer any macroeconomic data releases that could drive the USD's valuation in a noticeable way. Hence, market participants are likely to remain focused on the risk perception. The UK's FTSE 100 trades flat in the early session and US stock index futures are down between 0.3% and 0.4%.

GBP/USD Technical Analysis

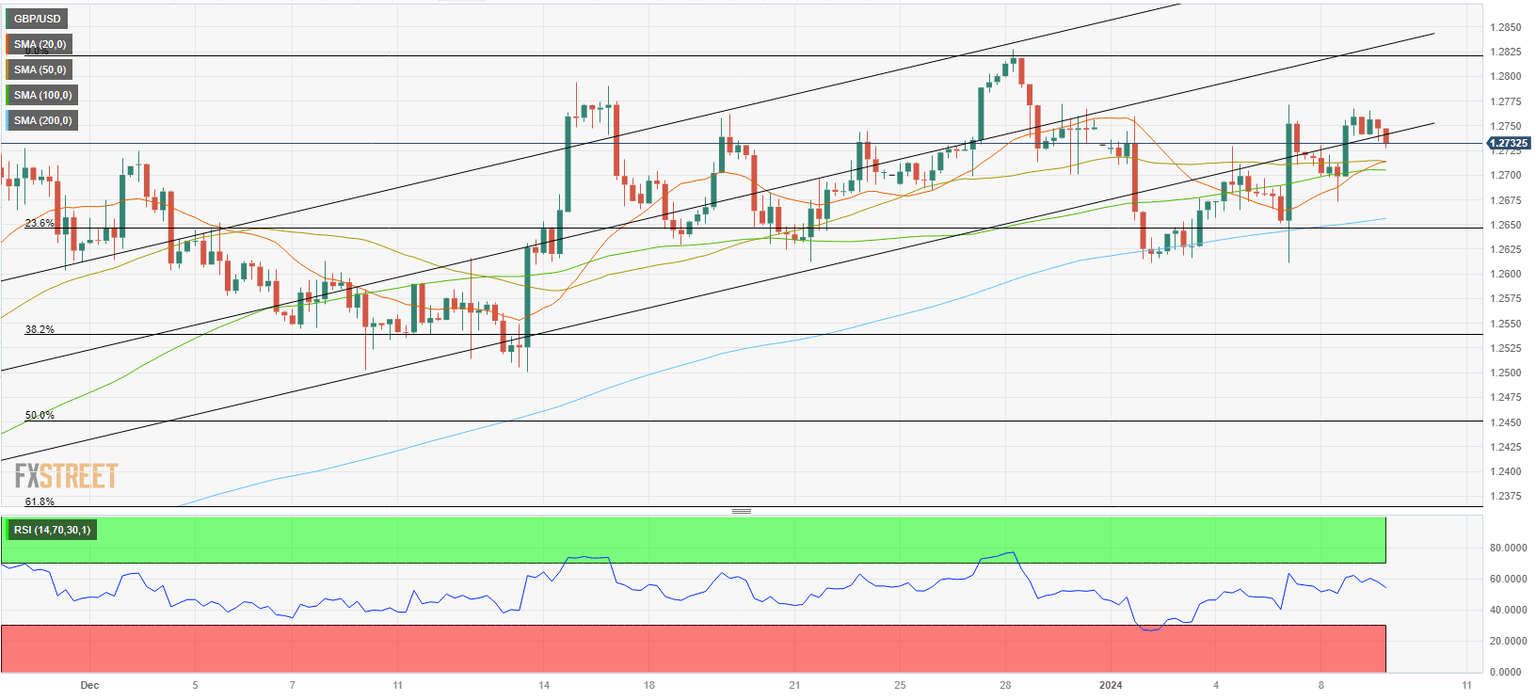

The lower limit of the ascending regression channel forms a pivot level at 1.2750. Once GBP/USD confirms that level as support, it could target 1.2800 (psychological level, static level) and 1.2820 (end-point of the latest uptrend).

If GBP/USD fails to stabilize above 1.2750, buyers could be discouraged. In this scenario, 1.2700 (100-period Simple Moving Average (SMA), psychological level) could be seen as next support before 1.2650 (Fibonacci 23.6% retracement, 200-period SMA).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.