GBP/USD Forecast: Pound Sterling could extend uptrend on a weak US GDP reading

- GBP/USD climbed to fresh weekly high near 1.3000 on Thursday.

- Board-based US Dollar weakness fuels the pair's rally.

- US BEA will release the first estimate of Q2 GDP growth.

GBP/USD gathered bullish momentum and advanced to a weekly high near 1.3000 during the European trading hours on Thursday. The risk-positive market atmosphere provides an additional boost to the pair ahead of the Gross Domestic Product (GDP) data releases from the US.

The US Dollar (USD) stays under persistent selling pressure as markets see a strong chance that the Federal Reserve may have reached its terminal rate with a 25 basis points rate hike on Wednesday.

FOMC Chairman Jerome Powell's hesitancy to confirm the need for additional rate increases and his acknowledgement of policy being restrictive in the post-meeting press conference triggered a USD selloff late Wednesday. In the European session, S&P 500 Futures and Nasdaq Futures are up 0.6% and 1.2%, respectively, highlighting the upbeat market mood.

The US Bureau of Economic Analysis (BEA) is forecast to report an annualized Gross Domestic Product (GDP) expansion of 1.8% in the second quarter. A noticeably weaker-than-forecast GDP growth, at or below 1.5%, could force the USD to weaken further, allowing GBP/USD to extend its weekly rally. On the other hand, a reading near 2% could help the USD to stage a rebound and cap the pair's upside. Nevertheless, the pair is likely to hold its ground if risk flows dominate the financial markets in the American session.

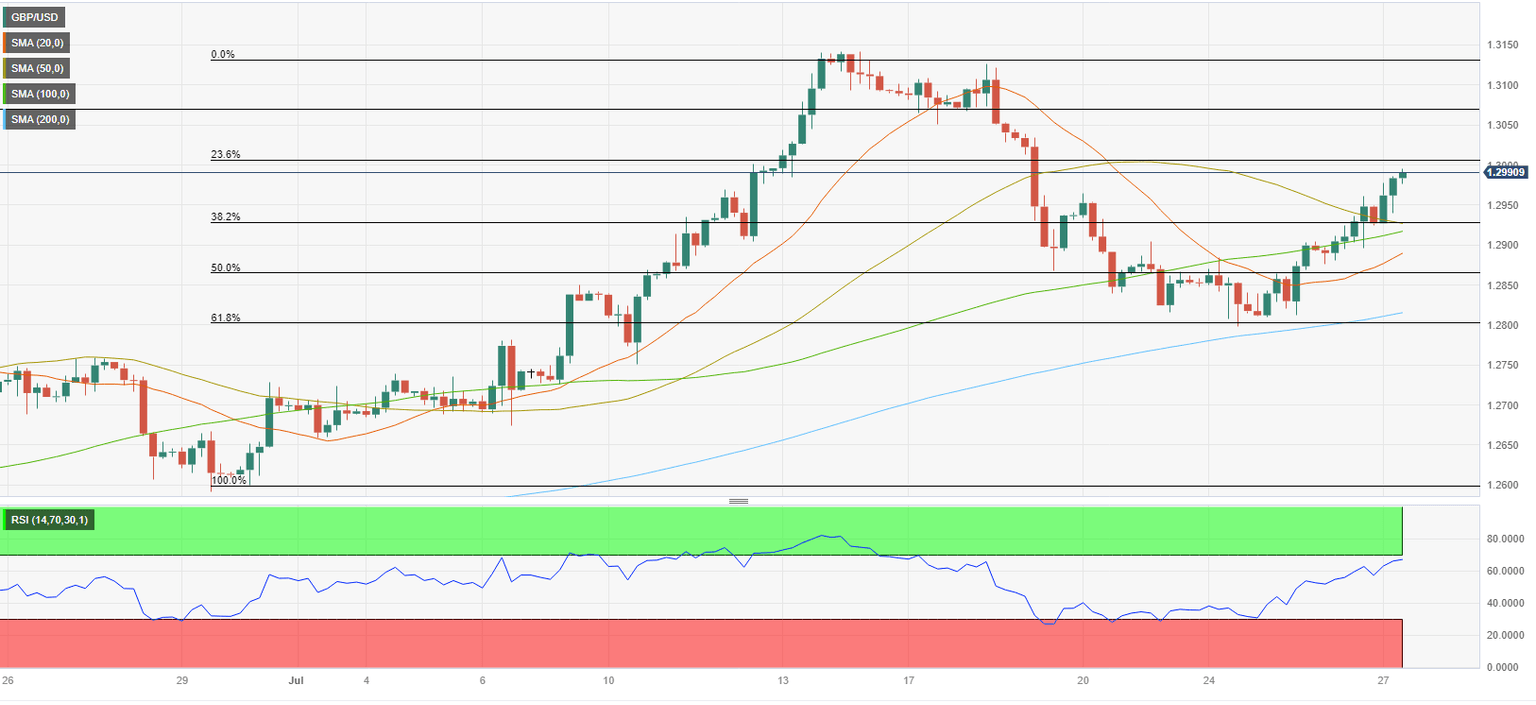

GBP/USD Technical Analysis

GBP/USD faces stiff resistance at 1.3000 (Fibonacci 23.6% retracement of the latest uptrend). In case the pair rises above that level and starts using it as support, it could target 1.3070 (static level) and 1.3100 (psychological level) next.

On the downside, 1.2930 (Fibonacci 38.2% retracement, 50-period SMA, 100-period SMA) aligns as first support before 1.2900 (psychological level) and 1.2870 (Fibonacci 50% retracement).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.