GBP/USD Forecast: Pound Sterling could extend slide after soft UK inflation

- GBP/USD trades in negative territory below 1.2600 early Wednesday.

- Annual CPI inflation in the UK held steady at 4% in January.

- Improving risk mood helps the pair limit its losses for now.

After closing in negative territory on Tuesday, GBP/USD continued to push lower in the European session on Wednesday and touched its lowest level in over a week below 1.2550. The near-term technical outlook suggests that the pair has more room on the downside before turning technically overbought.

January Consumer Price Index (CPI) readings from the US triggered a US Dollar rally in the American trading hours on Tuesday and caused GBP/USD to decline sharply. On a monthly basis, the CPI and the Core CPI, which excludes volatile food and energy prices, rose 0.3% and 0.4%, respectively. Both of these reading came in above analysts' estimates and provided a boost to the USD.

Early Wednesday, the UK's Office for National Statistics (ONS) reported that the annual CPI inflation and core CPI inflation held steady at 4% and 5.1%, respectively. Monthly CPI declined 0.6% in January, while the monthly Retail Price Index fell 0.3%. Although these prints are not weak enough for Bank of England policymakers to reconsider the timing of a policy pivot, they still make it difficult for Pound Sterling to stage a rebound.

In the meantime, the UK's FTSE 100 Index opened higher on Wednesday and US stock index futures turned positive on the day after spending the Asian session moving sideways. In case risk flows start to dominate the action in financial markets in the second half of the day, the USD could lose some interest and help GBP/USD find a foot hold.

Later in the day, BoE Governor Andrew Bailey will be testifying before the Lords Economic Affairs Committee. In case Bailey acknowledges the latest inflation data as welcoming news, GBP/USD could struggle to gain traction. On the other hand, Pound Sterling could find demand if Bailey adopts a cautious tone regarding a policy pivot, citing underlying strength in inflation despite January's encouraging prints.

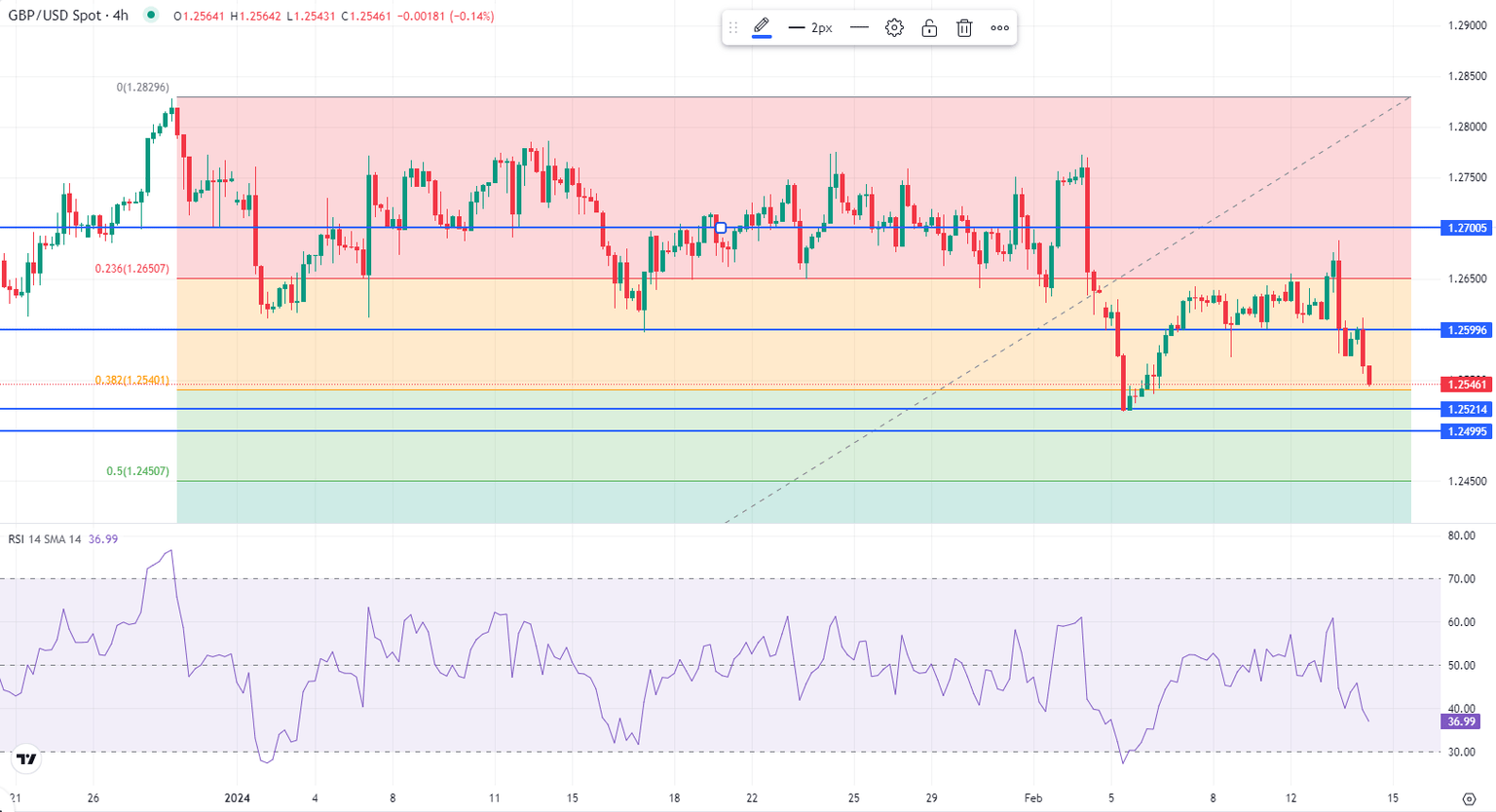

GBP/USD Technical Analysis

The Relative Strength Index (RSI) indicator on the 4-hour chart declined below 40, highlighting a buildup of bearish momentum. On the downside, 1.2520 (February 5 low) aligns as interim support before 1.2500 (psychological level, static level) and 1.2450 (Fibonacci 50% retracement of the latest uptrend).

Looking north, 1.2600 (former support, static level) could be seen as first resistance before 1.2650 (Fibonacci 23.6% retracement) and 1.2700 (static level).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.