GBP/USD Forecast: Pound Sterling could extend recovery on a soft US CPI print

- GBP/USD edges slightly higher after posting small gains on Monday and Tuesday.

- The technical outlook highlights sellers' hesitancy in the near term.

- May inflation data from the US and the Fed policy announcements could drive the pair's action later.

GBP/USD edged higher and closed the second consecutive day in positive territory on Tuesday. Despite the US Dollar's resilience, the pair managed to hold its ground as the sharp decline seen in EUR/GBP showed that Pound Sterling captured capital outflows out of the Euro.

GBP/USD continues to stretch higher and trades at around 1.2750 as market attention shifts to key macroeconomic events from the US.

Annual inflation in the US, as measured by the change in the Consumer price Index (CPI), is forecast to hold steady at 3.4% in May. On a monthly basis, the CPI is expected to increase 0.1%, while the core CPI, which excludes volatile food and energy prices, is seen rising 0.3%.

Investors are likely to react to the monthly core CPI print because it's not distorted by the base effect. If this data comes in below the market expectation, the initial reaction could trigger a US Dollar (USD) selloff and help GBP/USD push higher, at least until the Federal Reserve (Fed) announces monetary policy decisions later in the American session.

The Fed is widely anticipated to hold the policy rate steady at 5.25%-5.5% following the June policy meeting. Alongside the policy statement, the Fed will also release the revised Summary of Economic Projections (SEP), the so-called dot plot. Investors could react to the interest rate projections in the SEP. If the publication shows that policymakers expect a single rate cut this year, the US Treasury bond yields could surge higher and provide a boost to the USD. On the flip side, if the dot plot points to two 25 basis points rate cuts this year, investors could price in a September rate cut and hurt the USD. According to the CME FedWatch Tool, markets still see a nearly 50% probability of a no change in policy rate in September.

GBP/USD Technical Analysis

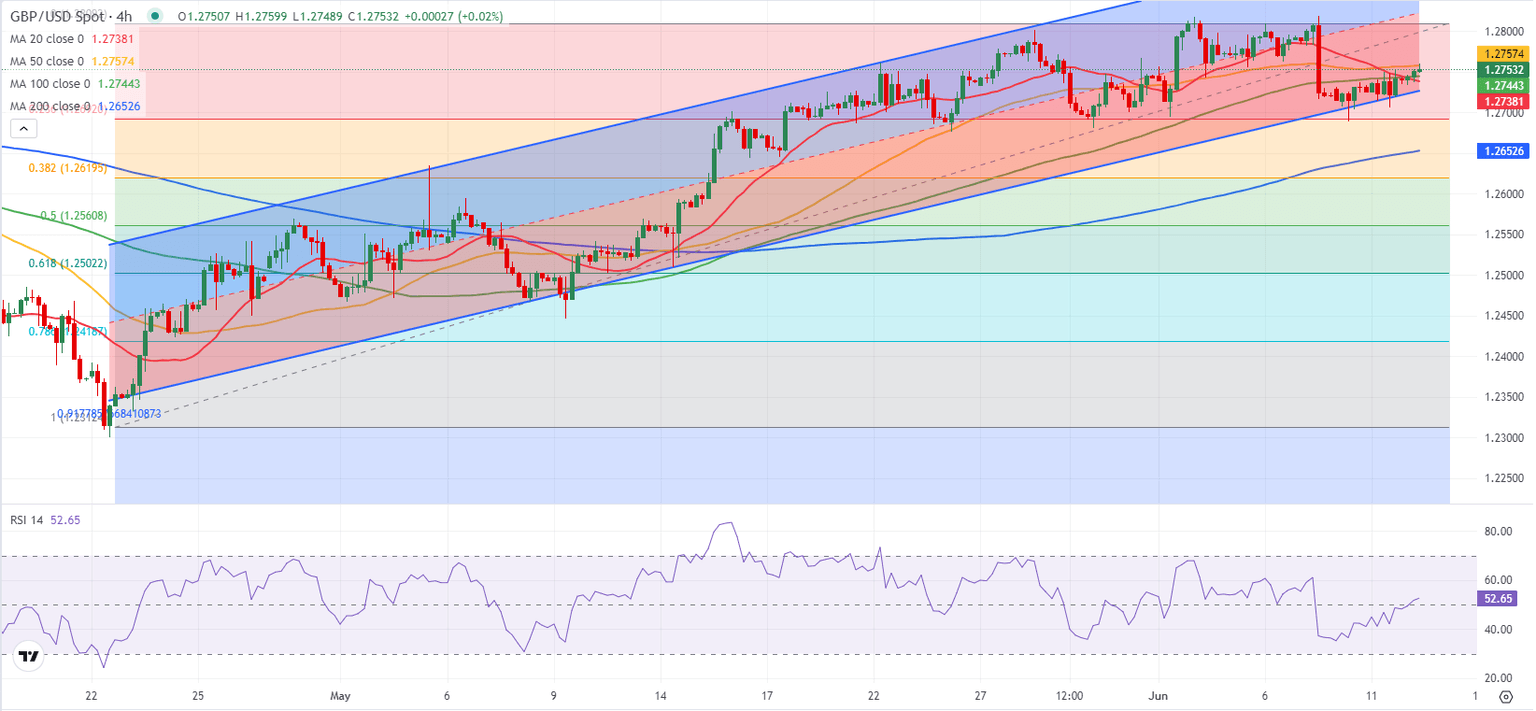

The Relative Strength Index (RSI) indicator on the 4-hour chart rose above 50, reflecting the sellers' hesitancy. On the upside, 1.2800 (mid-point of the ascending channel, psychological level, static level) aligns as next resistance before 1.2880 (static level from March).

The lower limit of the ascending channel forms first support at 1.2730 before 1.2700 (psychological level, static level) and 1.2650 (200-period Simple Moving Average on the 4-hour chart).

Economic Indicator

FOMC Minutes

FOMC stands for The Federal Open Market Committee that organizes 8 meetings in a year and reviews economic and financial conditions, determines the appropriate stance of monetary policy and assesses the risks to its long-run goals of price stability and sustainable economic growth. FOMC Minutes are released by the Board of Governors of the Federal Reserve and are a clear guide to the future US interest rate policy.

Read more.Last release: Wed May 22, 2024 18:00

Frequency: Irregular

Actual: -

Consensus: -

Previous: -

Source: Federal Reserve

Minutes of the Federal Open Market Committee (FOMC) is usually published three weeks after the day of the policy decision. Investors look for clues regarding the policy outlook in this publication alongside the vote split. A bullish tone is likely to provide a boost to the greenback while a dovish stance is seen as USD-negative. It needs to be noted that the market reaction to FOMC Minutes could be delayed as news outlets don’t have access to the publication before the release, unlike the FOMC’s Policy Statement.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.